Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question! A summary of a government district's first year transactions follows (all dollar amounts in millions): (CLO 3 & 4) (10 marks) 1- The district

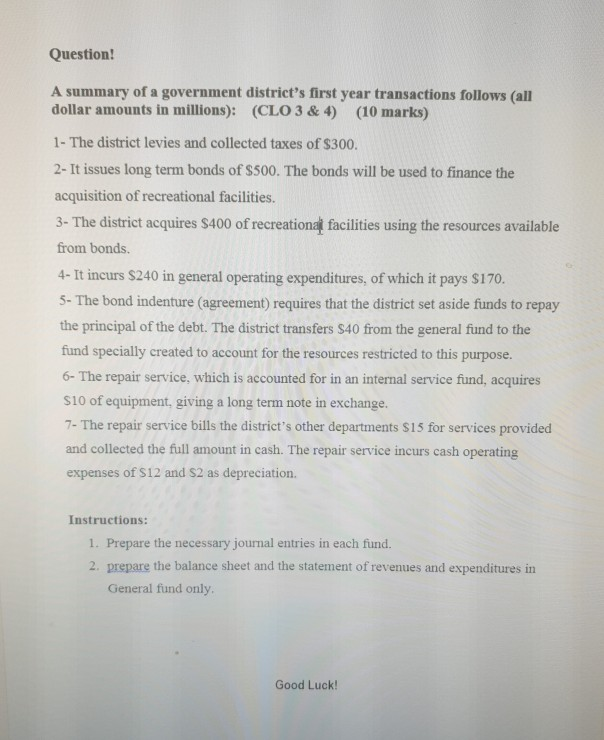

Question! A summary of a government district's first year transactions follows (all dollar amounts in millions): (CLO 3 & 4) (10 marks) 1- The district levies and collected taxes of $300. 2- It issues long term bonds of $500. The bonds will be used to finance the acquisition of recreational facilities. 3- The district acquires $400 of recreational facilities using the resources available from bonds. 4- It incurs $240 in general operating expenditures, of which it pays $170. 5- The bond indenture (agreement) requires that the district set aside funds to repay the principal of the debt. The district transfers S40 from the general fund to the fund specially created to account for the resources restricted to this purpose. 6- The repair service, which is accounted for in an internal service fund, acquires $10 of equipment, giving a long term note in exchange. 7- The repair service bills the district's other departments S15 for services provided and collected the full amount in cash. The repair service incurs cash operating expenses of $12 and $2 as depreciation. Instructions: 1. Prepare the necessary journal entries in each fund. 2. prepare the balance sheet and the statement of revenues and expenditures in General fund only Good Luck! Question! A summary of a government district's first year transactions follows (all dollar amounts in millions): (CLO 3 & 4) (10 marks) 1- The district levies and collected taxes of $300. 2- It issues long term bonds of $500. The bonds will be used to finance the acquisition of recreational facilities. 3- The district acquires $400 of recreational facilities using the resources available from bonds. 4- It incurs $240 in general operating expenditures, of which it pays $170. 5- The bond indenture (agreement) requires that the district set aside funds to repay the principal of the debt. The district transfers S40 from the general fund to the fund specially created to account for the resources restricted to this purpose. 6- The repair service, which is accounted for in an internal service fund, acquires $10 of equipment, giving a long term note in exchange. 7- The repair service bills the district's other departments S15 for services provided and collected the full amount in cash. The repair service incurs cash operating expenses of $12 and $2 as depreciation. Instructions: 1. Prepare the necessary journal entries in each fund. 2. prepare the balance sheet and the statement of revenues and expenditures in General fund only Good Luck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started