Question:

a) Write Appropriate Journal Entries

b) Prepare General Ledger (T-accounts)

c) Prepare Adjusted Trial Balance with debit and credit

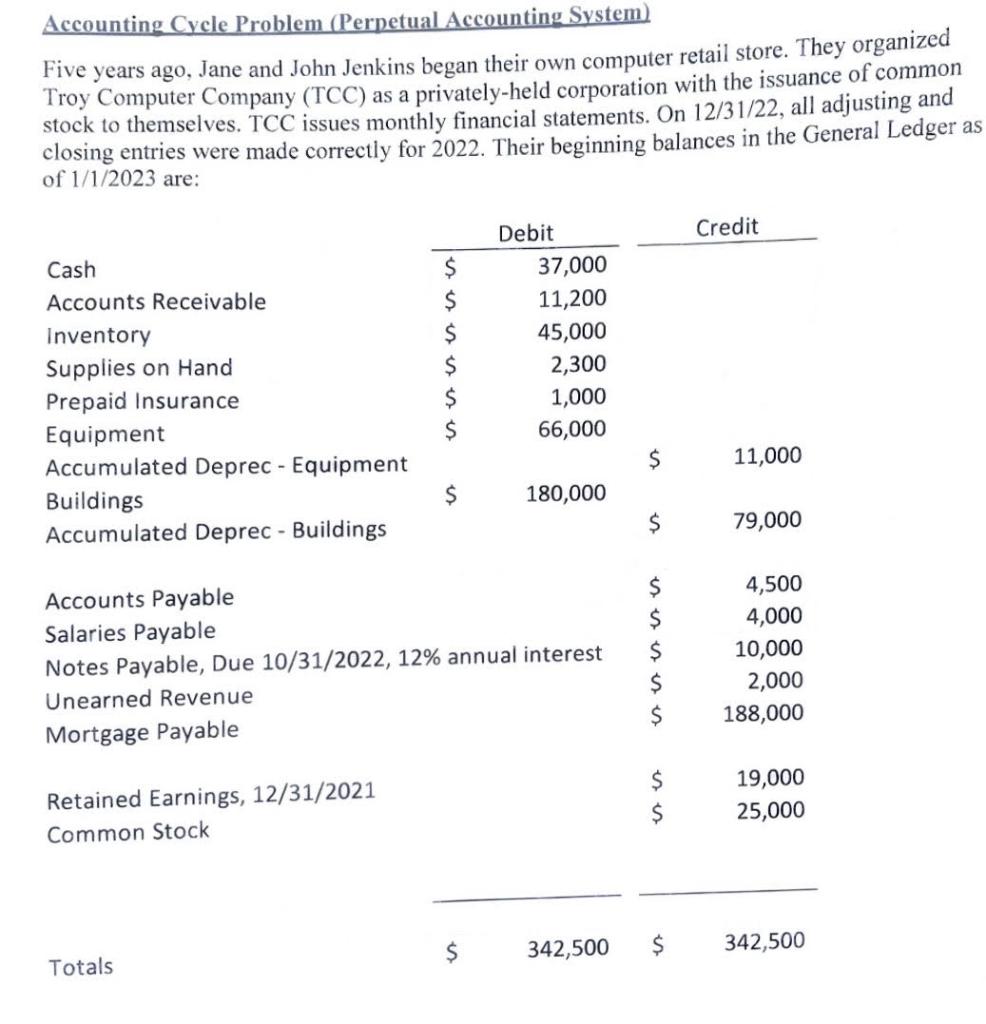

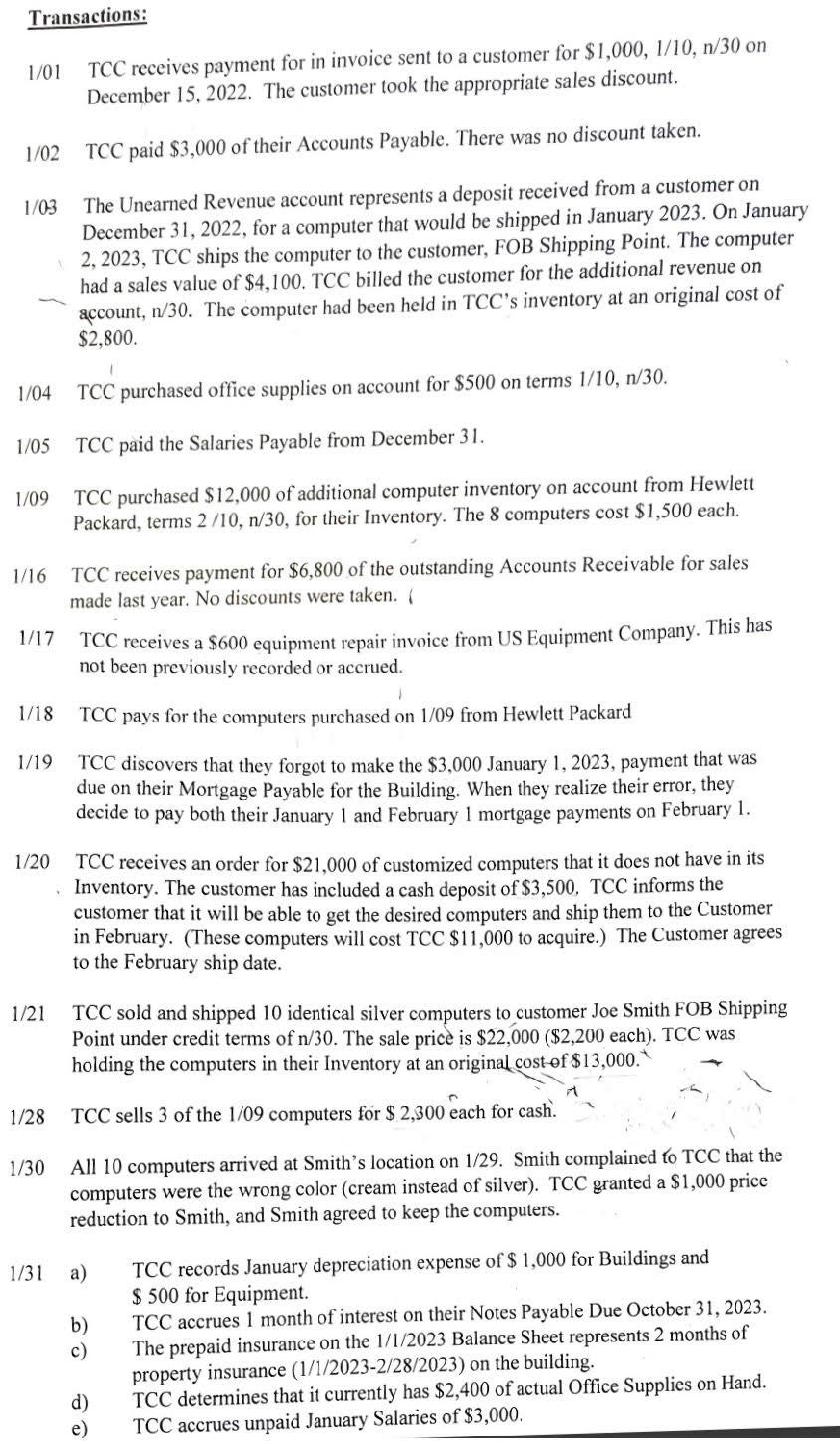

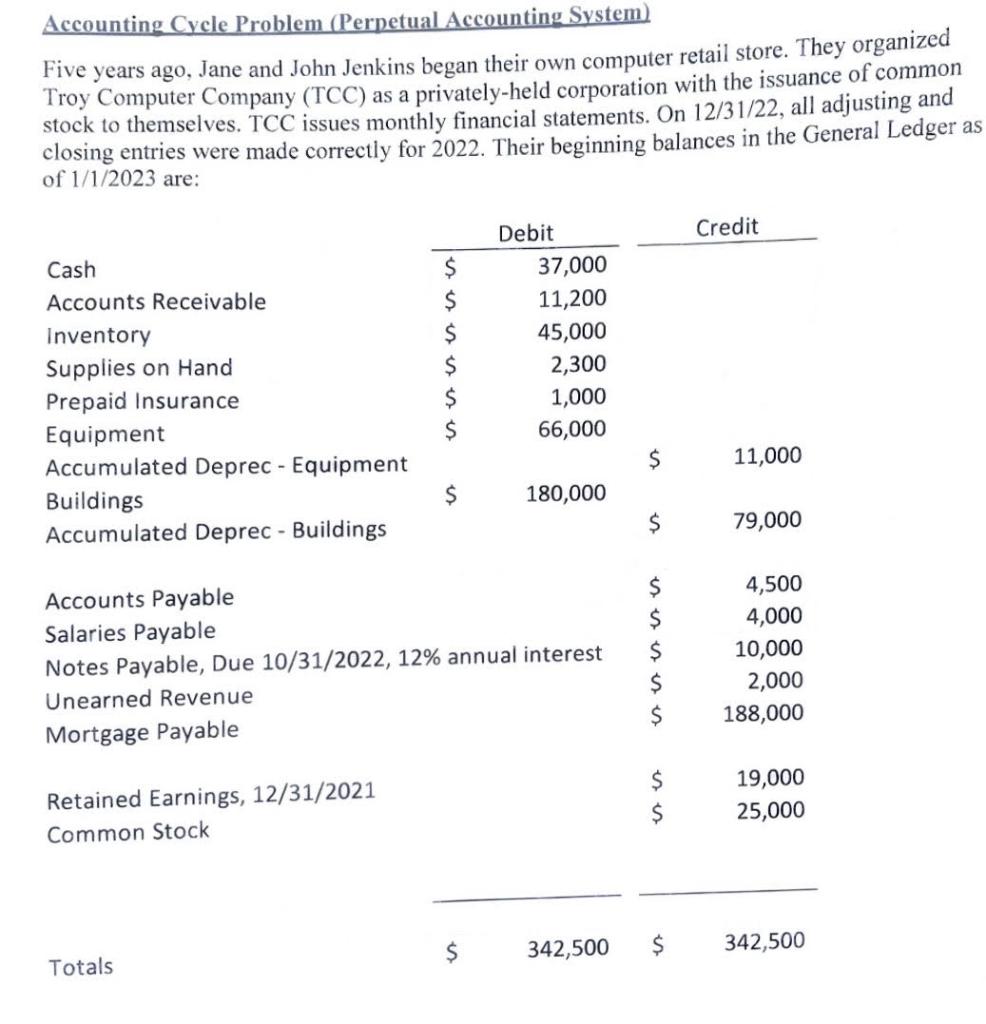

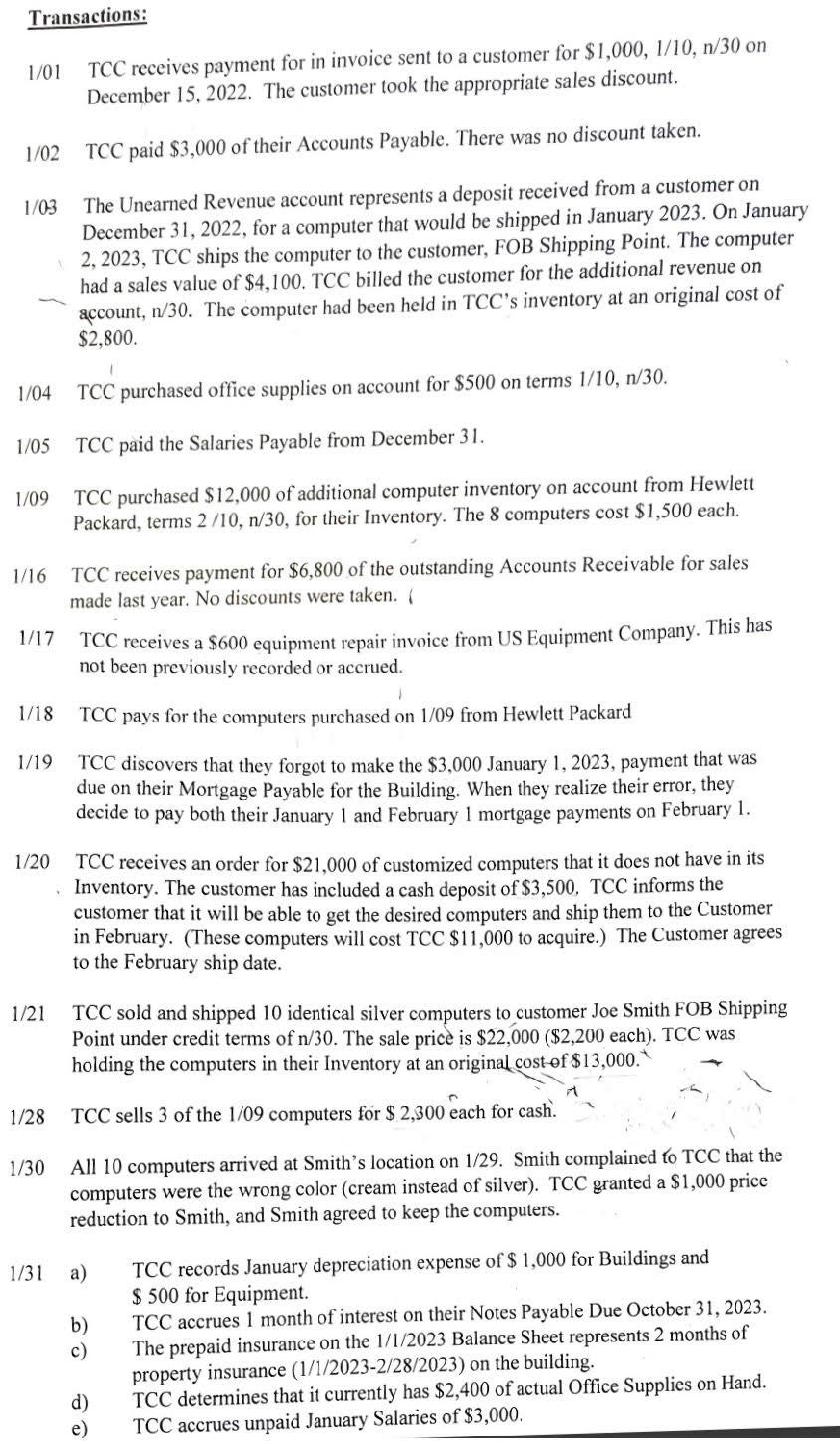

Accounting Cycle Problem (Perpetual Accounting System) Five years ago, Jane and John Jenkins began their own computer retail store. They organized Troy Computer Company (TCC) as a privately-held corporation with the issuance of common stock to themselves. TCC issues monthly financial statements. On 12/31/22, all adjusting and Transactions: 1/01 TCC receives payment for in invoice sent to a customer for $1,000,1/10,n/30 on December 15,2022 . The customer took the appropriate sales discount. 1/02 TCC paid $3,000 of their Accounts Payable. There was no discount taken. 1/03 The Unearned Revenue account represents a deposit received from a customer on December 31, 2022, for a computer that would be shipped in January 2023. On January 2, 2023, TCC ships the computer to the customer, FOB Shipping Point. The computer had a sales value of $4,100. TCC billed the customer for the additional revenue on account, n/30. The computer had been held in TCC's inventory at an original cost of $2,800. 1/04 TCC purchased office supplies on account for $500 on terms 1/10,n/30. 1/05 TCC paid the Salaries Payable from December 31 . 1/09 TCC purchased $12,000 of additional computer inventory on account from Hewlett Packard, terms 2/10,n/30, for their Inventory. The 8 computers cost $1,500 each. 1/16 TCC receives payment for $6,800 of the outstanding Accounts Receivable for sales made last year. No discounts were taken. 1/17 TCC receives a $600 equipment repair invoice from US Equipment Company. This has not been previously recorded or accrued. 1/18 TCC pays for the computers purchased on 1/09 from Hewlett Packard 1/19 TCC discovers that they forgot to make the $3,000 January 1, 2023, payment that was due on their Mortgage Payable for the Building. When they realize their error, they decide to pay both their January 1 and February 1 mortgage payments on February 1. 1/20 TCC receives an order for $21,000 of customized computers that it does not have in its Inventory. The customer has included a cash deposit of $3,500, TCC informs the customer that it will be able to get the desired computers and ship them to the Customer in February. (These computers will cost TCC $11,000 to acquire.) The Customer agrees to the February ship date. 1/21 TCC sold and shipped 10 identical silver computers to customer Joe Smith FOB Shipping Point under credit terms of n/30. The sale price is $22,000($2,200 each). TCC was holding the computers in their Inventory at an original cost f$13,000.' 1/28 TCC sells 3 of the 1/09 computers for $2,300 each for cash. 1/30 All 10 computers arrived at Smith's location on 1/29. Smith complained to TCC that the computers were the wrong color (cream instead of silver). TCC granted a $1,000 price reduction to Smith, and Smith agreed to keep the computers. 1/31 a) TCC records January depreciation expense of $1,000 for Buildings and b) TCC accrues 1 month of interest on their Notes Payable Due October 31, 2023. c) The prepaid insurance on the 1/1/2023 Balance Sheet represents 2 months of property insurance (1/1/20232/28/2023) on the building. d) TCC determines that it currently has $2,400 of actual Office Supplies on Hand. e) TCC accrues unpaid January Salaries of $3,000. Accounting Cycle Problem (Perpetual Accounting System) Five years ago, Jane and John Jenkins began their own computer retail store. They organized Troy Computer Company (TCC) as a privately-held corporation with the issuance of common stock to themselves. TCC issues monthly financial statements. On 12/31/22, all adjusting and Transactions: 1/01 TCC receives payment for in invoice sent to a customer for $1,000,1/10,n/30 on December 15,2022 . The customer took the appropriate sales discount. 1/02 TCC paid $3,000 of their Accounts Payable. There was no discount taken. 1/03 The Unearned Revenue account represents a deposit received from a customer on December 31, 2022, for a computer that would be shipped in January 2023. On January 2, 2023, TCC ships the computer to the customer, FOB Shipping Point. The computer had a sales value of $4,100. TCC billed the customer for the additional revenue on account, n/30. The computer had been held in TCC's inventory at an original cost of $2,800. 1/04 TCC purchased office supplies on account for $500 on terms 1/10,n/30. 1/05 TCC paid the Salaries Payable from December 31 . 1/09 TCC purchased $12,000 of additional computer inventory on account from Hewlett Packard, terms 2/10,n/30, for their Inventory. The 8 computers cost $1,500 each. 1/16 TCC receives payment for $6,800 of the outstanding Accounts Receivable for sales made last year. No discounts were taken. 1/17 TCC receives a $600 equipment repair invoice from US Equipment Company. This has not been previously recorded or accrued. 1/18 TCC pays for the computers purchased on 1/09 from Hewlett Packard 1/19 TCC discovers that they forgot to make the $3,000 January 1, 2023, payment that was due on their Mortgage Payable for the Building. When they realize their error, they decide to pay both their January 1 and February 1 mortgage payments on February 1. 1/20 TCC receives an order for $21,000 of customized computers that it does not have in its Inventory. The customer has included a cash deposit of $3,500, TCC informs the customer that it will be able to get the desired computers and ship them to the Customer in February. (These computers will cost TCC $11,000 to acquire.) The Customer agrees to the February ship date. 1/21 TCC sold and shipped 10 identical silver computers to customer Joe Smith FOB Shipping Point under credit terms of n/30. The sale price is $22,000($2,200 each). TCC was holding the computers in their Inventory at an original cost f$13,000.' 1/28 TCC sells 3 of the 1/09 computers for $2,300 each for cash. 1/30 All 10 computers arrived at Smith's location on 1/29. Smith complained to TCC that the computers were the wrong color (cream instead of silver). TCC granted a $1,000 price reduction to Smith, and Smith agreed to keep the computers. 1/31 a) TCC records January depreciation expense of $1,000 for Buildings and b) TCC accrues 1 month of interest on their Notes Payable Due October 31, 2023. c) The prepaid insurance on the 1/1/2023 Balance Sheet represents 2 months of property insurance (1/1/20232/28/2023) on the building. d) TCC determines that it currently has $2,400 of actual Office Supplies on Hand. e) TCC accrues unpaid January Salaries of $3,000