Question

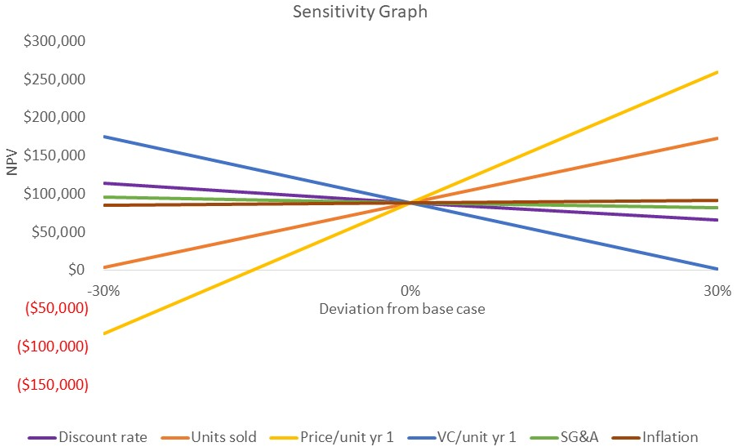

QUESTION (a) You have the following information related to a project. (i) Interpret the information. (ii) List two follow-up actions you would take related to

QUESTION (a) You have the following information related to a project.

(i) Interpret the information. (ii) List two follow-up actions you would take related to this project.

(b) ABC Ltd runs a chain of grocery stores (supermarkets) in Australia. Its capital structure consists of debt (20%), preferred shares (10%) and ordinary shares(70%). The yield to maturity on the companny's debt is 9%. The company's preferred shares each pay a $10 dividend and currently trade for $100. The company's ordinary shares have an expected return (based on CAPM) of 15%. ABC Ltd is subject to a 30% tax rate.

(i) What is ABC's after-tax WACC?

(ii) ABC is analysing a project involving expansion into Indonesia. Should the company use its WACC as the discount rate for this project? Explain.

Sensitivity Graph Sensitivity GraphStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started