Answered step by step

Verified Expert Solution

Question

1 Approved Answer

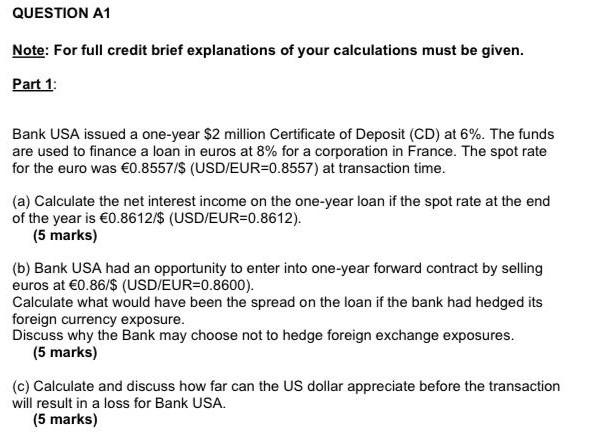

QUESTION A1 Note: For full credit brief explanations of your calculations must be given. Part 1: Bank USA issued a one-year $2 million Certificate of

QUESTION A1 Note: For full credit brief explanations of your calculations must be given. Part 1: Bank USA issued a one-year $2 million Certificate of Deposit (CD) at 6%. The funds are used to finance a loan in euros at 8% for a corporation in France. The spot rate for the euro was 0.8557/$ (USD/EUR=0.8557) at transaction time. (a) Calculate the net interest income on the one-year loan if the spot rate at the end of the year is 0.8612/$ (USD/EUR=0.8612). (5 marks) (b) Bank USA had an opportunity to enter into one-year forward contract by selling euros at 0.86/$ (USD/EUR=0.8600). Calculate what would have been the spread on the loan if the bank had hedged its foreign currency exposure. Discuss why the Bank may choose not to hedge foreign exchange exposures. (5 marks) (c) Calculate and discuss how far can the US dollar appreciate before the transaction will result in a loss for Bank USA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started