Answered step by step

Verified Expert Solution

Question

1 Approved Answer

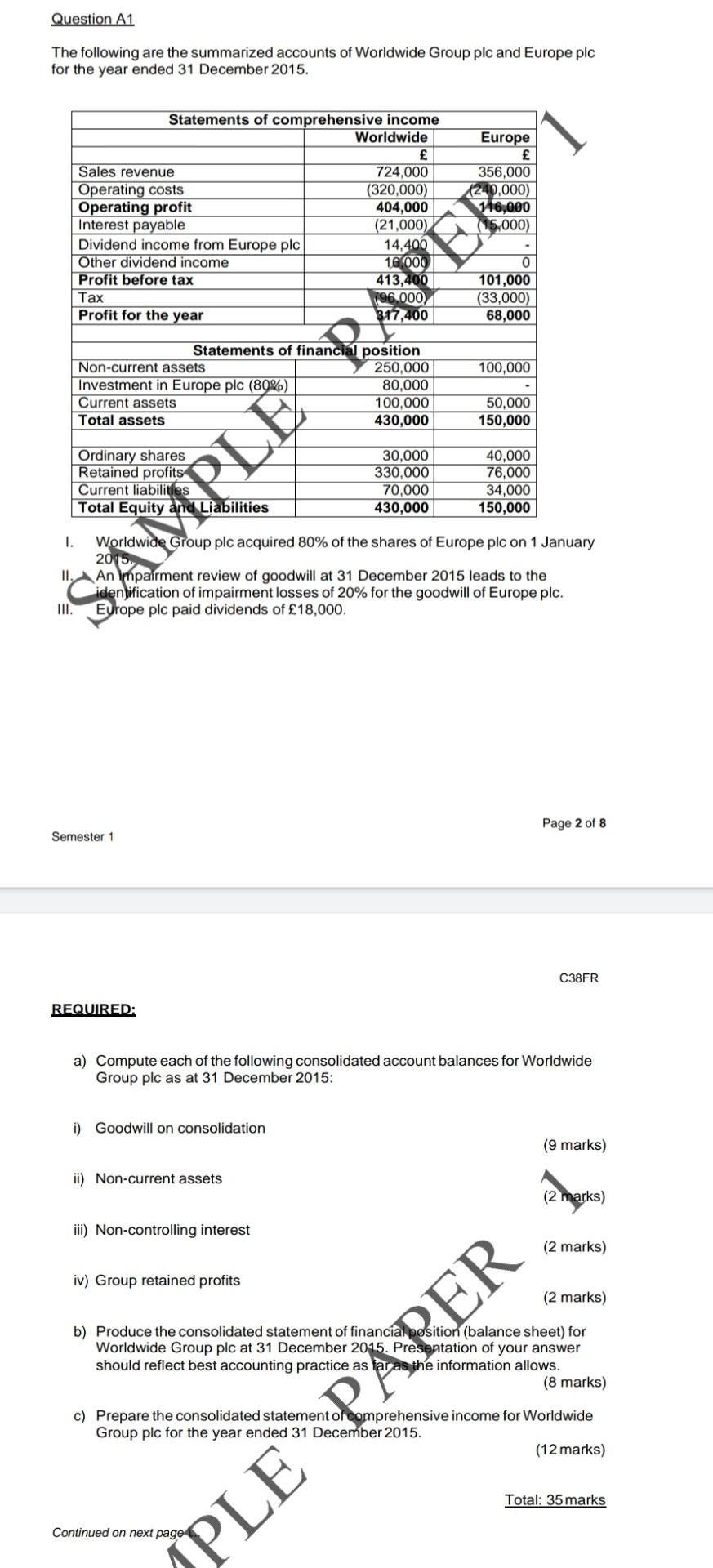

Question A1 The following are the summarized accounts of Worldwide Group plc and Europe plc for the year ended 31 December 2015. Europe Statements of

Question A1 The following are the summarized accounts of Worldwide Group plc and Europe plc for the year ended 31 December 2015. Europe Statements of comprehensive income Worldwide Sales revenue 724,000 Operating costs (320,000) Operating profit 404,000 Interest payable (21,000) Dividend income from Europe plc Other dividend income Profit before tax Tax Profit for the year 101,000 (33,000) 68,000 100,000 Statements of financial position Non-current assets 250,000 Investment in Europe plc (80%) 80,000 Current assets 100,000 Total assets 430,000 50,000 150,000 Ordinary shares Retained profits Current liabilities 30,000 330,000 70,000 430,000 40,000 76,000 34,000 150,000 jabilities 1. Worldwide Group plc acquired 80% of the shares of Europe plc on 1 January II. AMPLE PAPER An Impairment review of goodwill at 31 December 2015 leads to the identification of impairment losses of 20% for the goodwill of Europe plc. Europe plc paid dividends of 18,000. III. Page 2 of 8 Semester 1 C38FR REQUIRED: a) Compute each of the following consolidated account balances for Worldwide Group plc as at 31 December 2015: i) Goodwill on consolidation (9 marks) ii) Non-current assets (2 marks) B iii) Non-controlling interest (2 marks) iv) Group retained profits (2 marks) b) Produce the consolidated statement of financial position (balance sheet) for Worldwide Group plc at 31 December 2015. Presentation of your answer should reflect best accounting practice as far as the information allows. (8 marks) c) Prepare the consolidated statement of comprehensive income for Worldwide Group plc for the year ended 31 December 2015. (12 marks) Total: 35 marks Continued on next page PLE PARER Question A1 The following are the summarized accounts of Worldwide Group plc and Europe plc for the year ended 31 December 2015. Europe Statements of comprehensive income Worldwide Sales revenue 724,000 Operating costs (320,000) Operating profit 404,000 Interest payable (21,000) Dividend income from Europe plc Other dividend income Profit before tax Tax Profit for the year 101,000 (33,000) 68,000 100,000 Statements of financial position Non-current assets 250,000 Investment in Europe plc (80%) 80,000 Current assets 100,000 Total assets 430,000 50,000 150,000 Ordinary shares Retained profits Current liabilities 30,000 330,000 70,000 430,000 40,000 76,000 34,000 150,000 jabilities 1. Worldwide Group plc acquired 80% of the shares of Europe plc on 1 January II. AMPLE PAPER An Impairment review of goodwill at 31 December 2015 leads to the identification of impairment losses of 20% for the goodwill of Europe plc. Europe plc paid dividends of 18,000. III. Page 2 of 8 Semester 1 C38FR REQUIRED: a) Compute each of the following consolidated account balances for Worldwide Group plc as at 31 December 2015: i) Goodwill on consolidation (9 marks) ii) Non-current assets (2 marks) B iii) Non-controlling interest (2 marks) iv) Group retained profits (2 marks) b) Produce the consolidated statement of financial position (balance sheet) for Worldwide Group plc at 31 December 2015. Presentation of your answer should reflect best accounting practice as far as the information allows. (8 marks) c) Prepare the consolidated statement of comprehensive income for Worldwide Group plc for the year ended 31 December 2015. (12 marks) Total: 35 marks Continued on next page PLE PARER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started