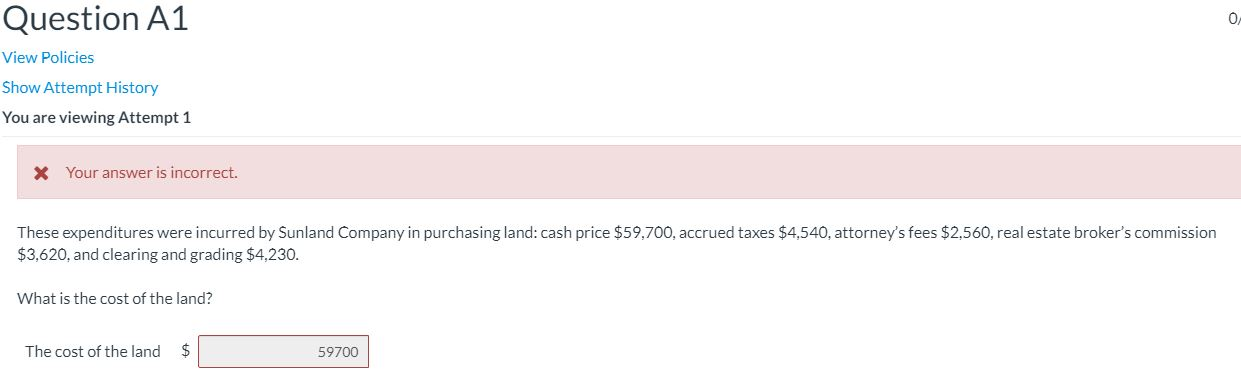

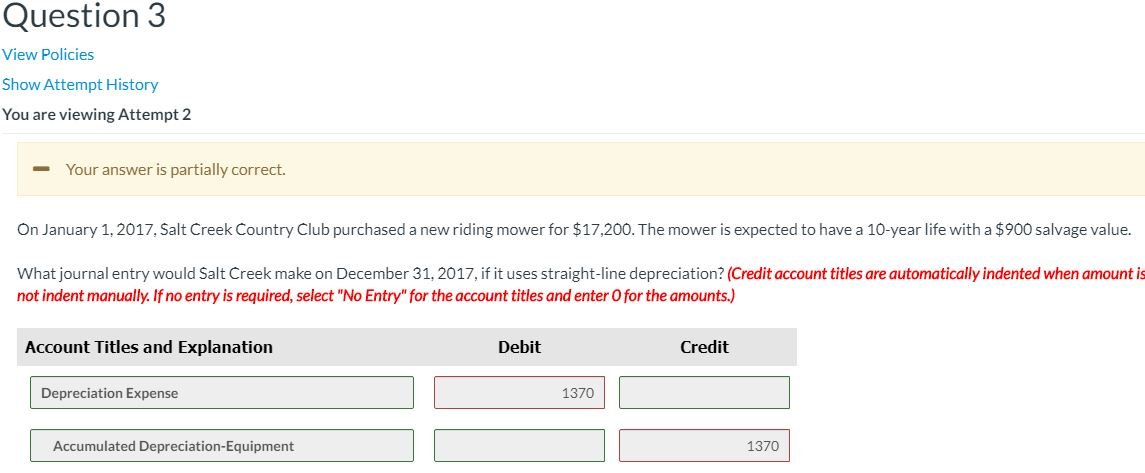

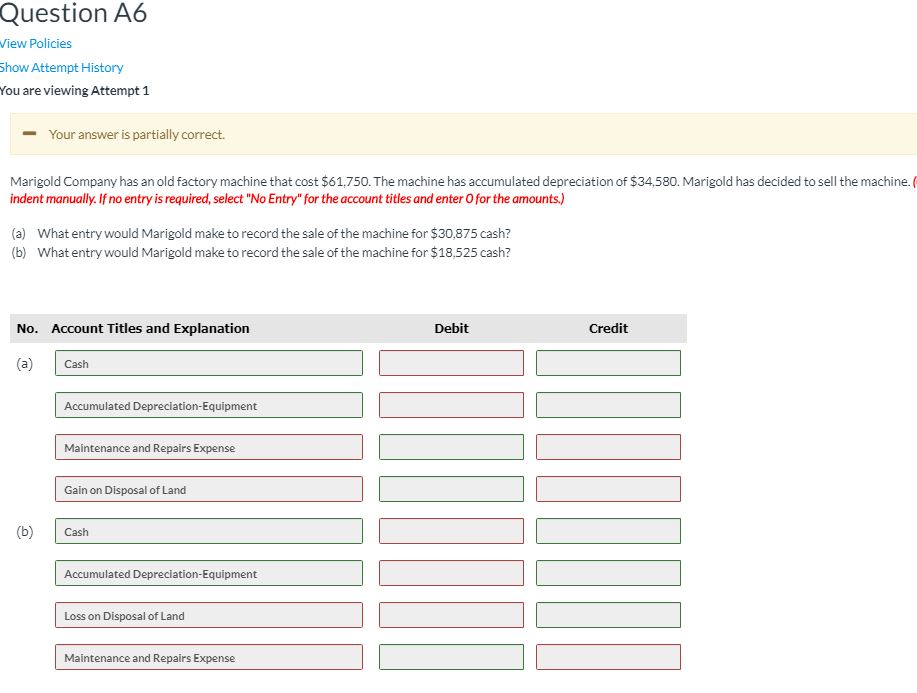

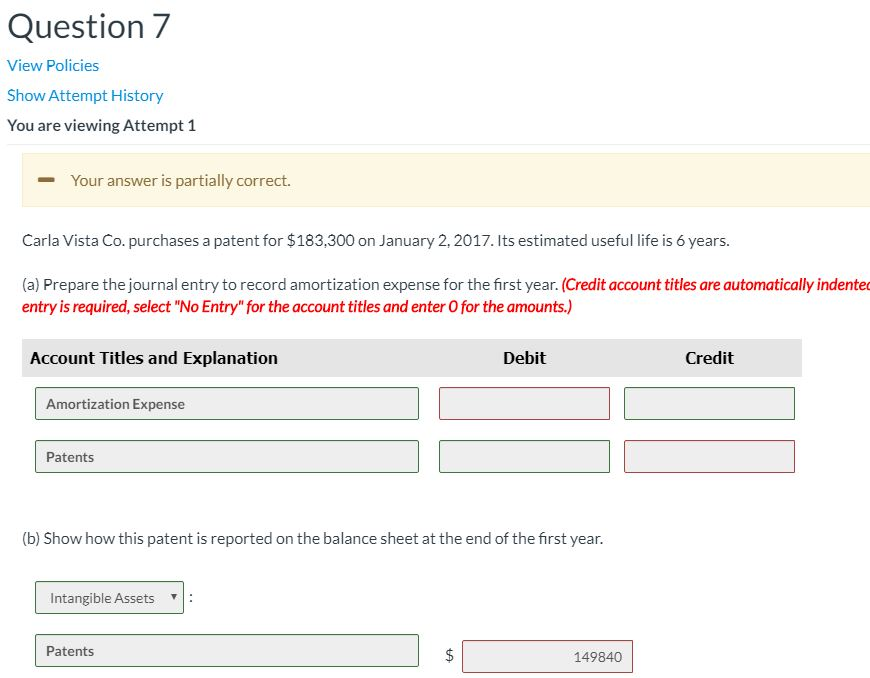

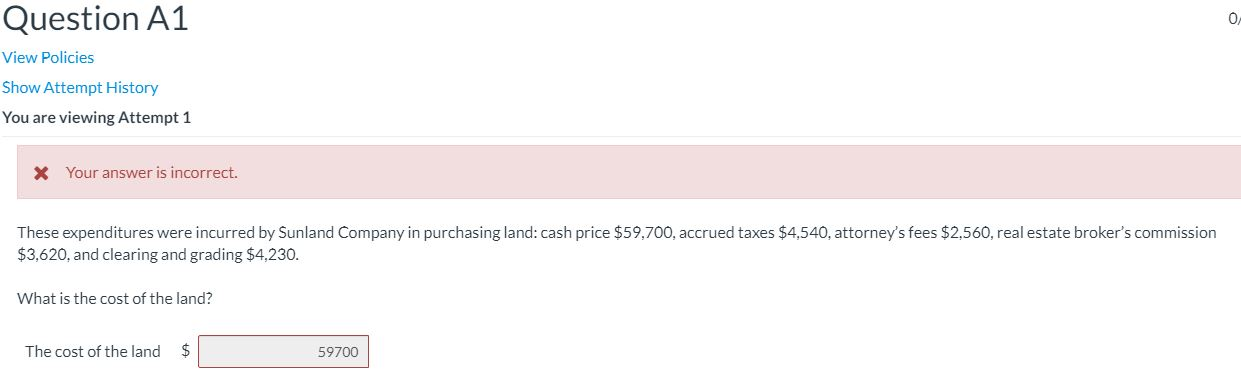

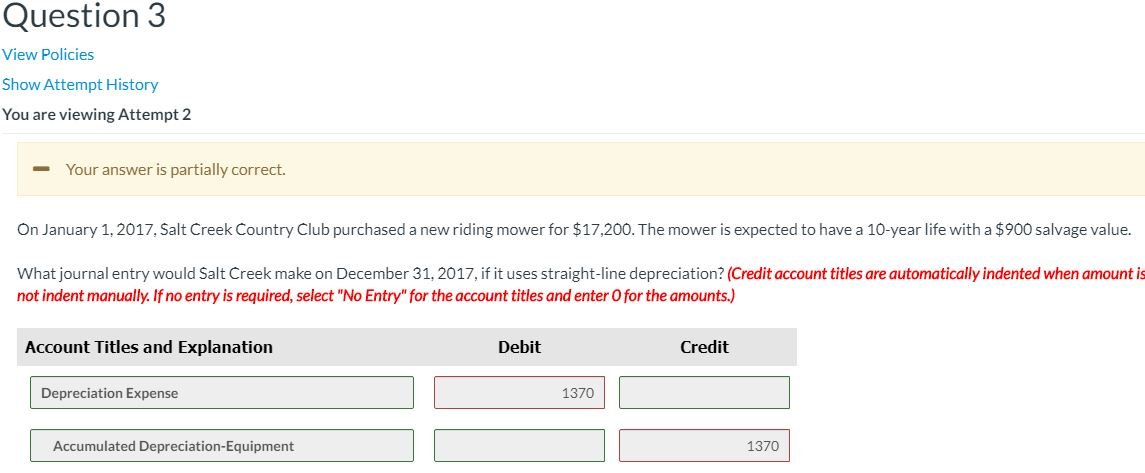

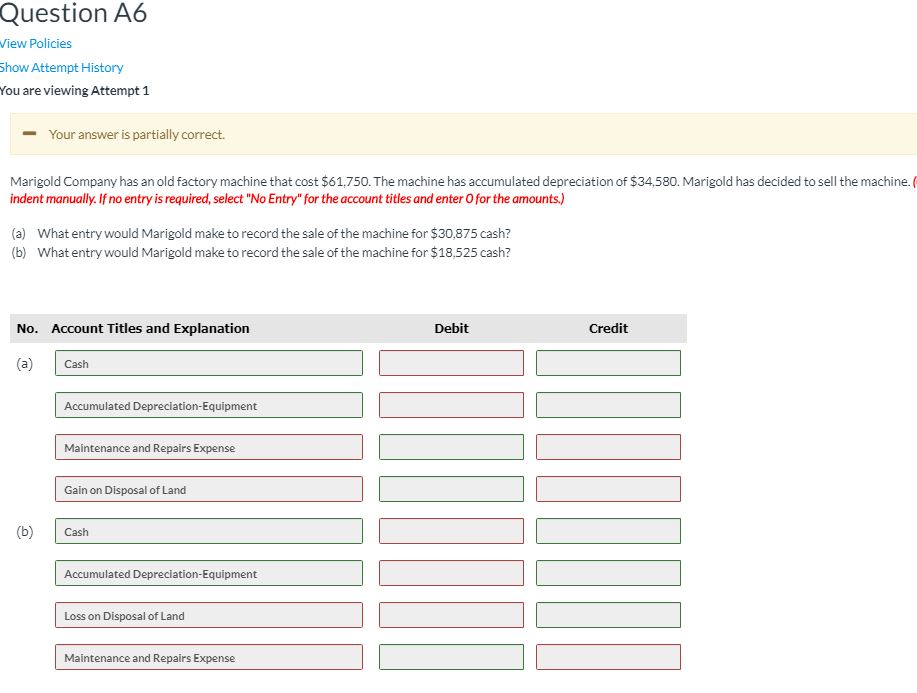

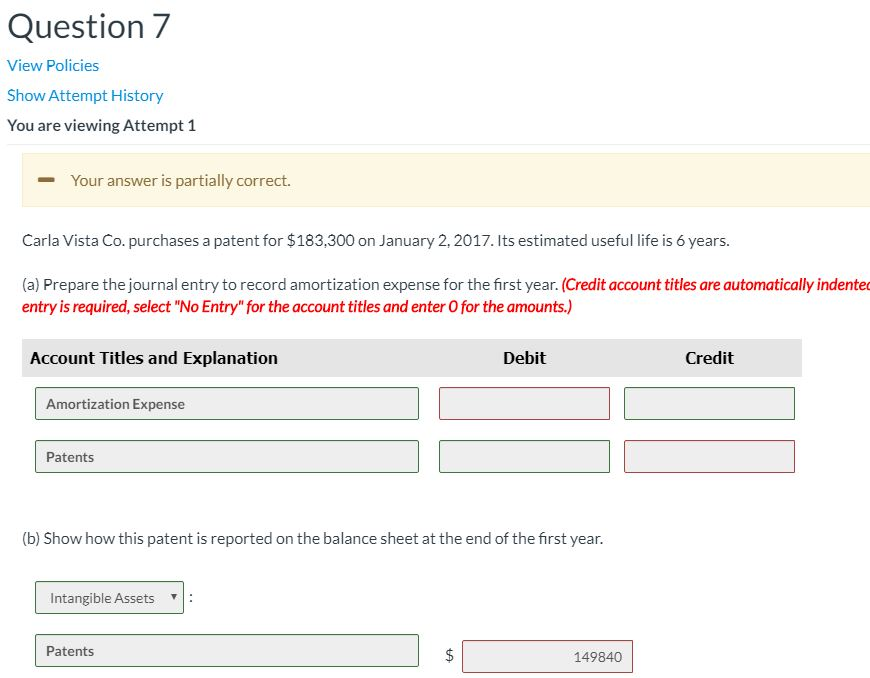

Question A1 View Policies Show Attempt History You are viewing Attempt 1 X Your answer is incorrect. These expenditures were incurred by Sunland Company in purchasing land: cash price $59,700, accrued taxes $4,540, attorney's fees $2,560, real estate broker's commission $3,620, and clearing and grading $4,230. What is the cost of the land? The cost of the land $ 59700 Question 3 View Policies Show Attempt History You are viewing Attempt 2 - Your answer is partially correct. On January 1, 2017, Salt Creek Country Club purchased a new riding mower for $17,200. The mower is expected to have a 10-year life with a $900 salvage value. What journal entry would Salt Creek make on December 31, 2017, if it uses straight-line depreciation? (Credit account titles are automatically indented when amount is not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Depreciation Expense 1370 Accumulated Depreciation Equipment 1370 Question A6 Wiew Policies Show Attempt History You are viewing Attempt 1 - Your answer is partially correct. Marigold Company has an old factory machine that cost $61.750. The machine has accumulated depreciation of $34,580. Marigold has decided to sell the machine. indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) What entry would Marigold make to record the sale of the machine for $30,875 cash? (b) What entry would Marigold make to record the sale of the machine for $18,525 cash? No. Account Titles and Explanation Debit Credit I Cash Accumulated Depreciation-Equipment Maintenance and Repairs Expense Gain on Disposal of Land (6) Cash Accumulated Depreciation-Equipment Loss on Disposal of Land Maintenance and Repairs Expense Question 7 View Policies Show Attempt History You are viewing Attempt 1 - Your answer is partially correct. Carla Vista Co. purchases a patent for $183,300 on January 2, 2017. Its estimated useful life is 6 years. (a) Prepare the journal entry to record amortization expense for the first year. (Credit account titles are automatically indented entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Amortization Expense Patents (b) Show how this patent is reported on the balance sheet at the end of the first year. Intangible Assets Patents 149840