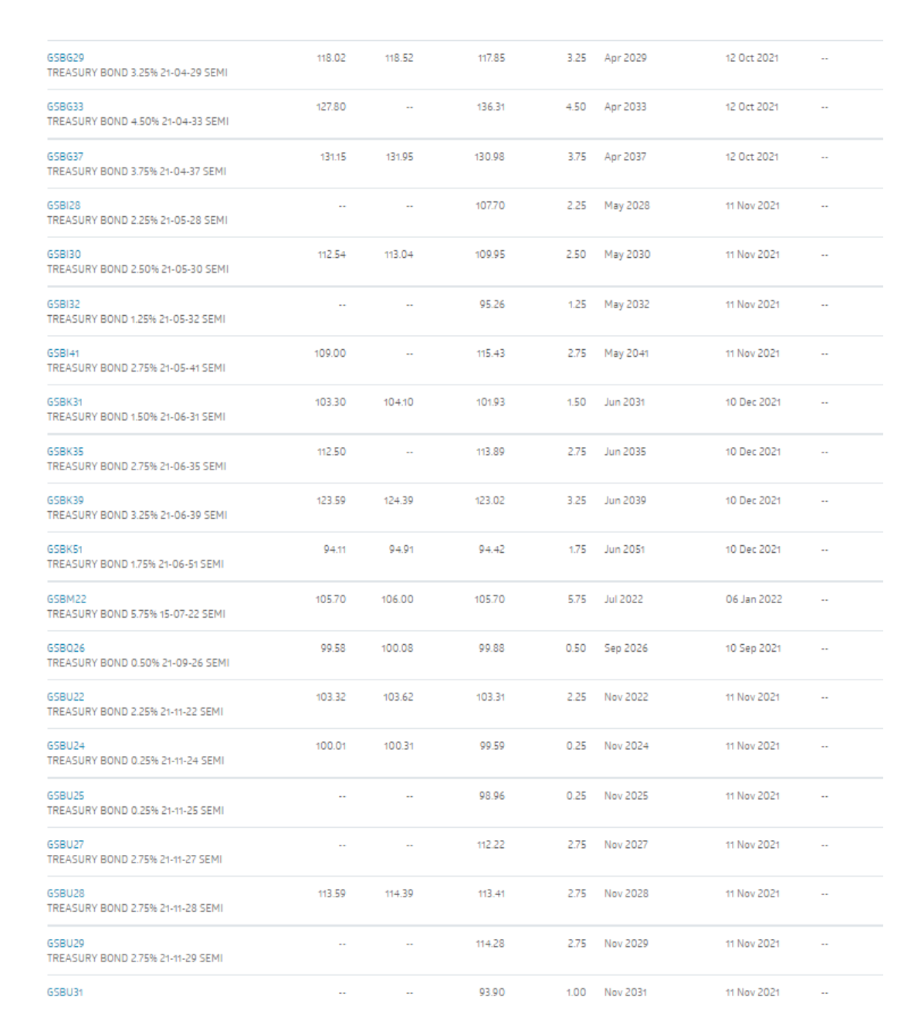

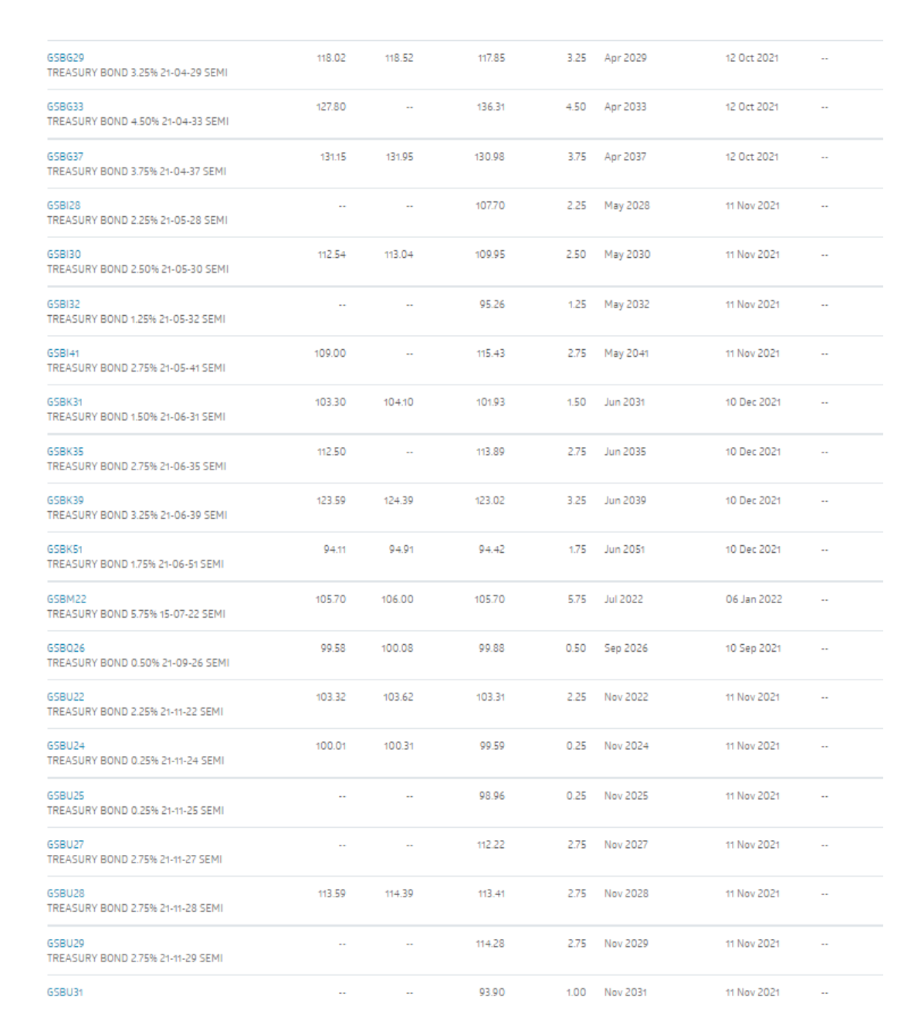

Question A1 (Yield-to-Maturity, YTM therefore). Lets look at the bond GSBG29 at bottom of screenshot-1/3. Its bid, ask, and last traded prices are $118.02, $118.52 and $117.85 for every $100 par respectively. These prices are cash price that youve learnt in the lec- ture/textbook 2. Recall cash price is sum of clean price and accrued interest.

We treat these data as end of day data. Your task is to calculate the yield-to-maturity on 20th July 2021 for bond GSBG29. The date 20th July 2021 here is identified as settlement date. You might want to choose semi-annul compounding as interest rate measurement, which matches the coupon payment frequency. Your calculation involves setting up all future cash flows, discounting these cash flows with YTM, making the sum of these discounted cash flows equal to its market price 3. To infer the yield you need Excel goal seek .

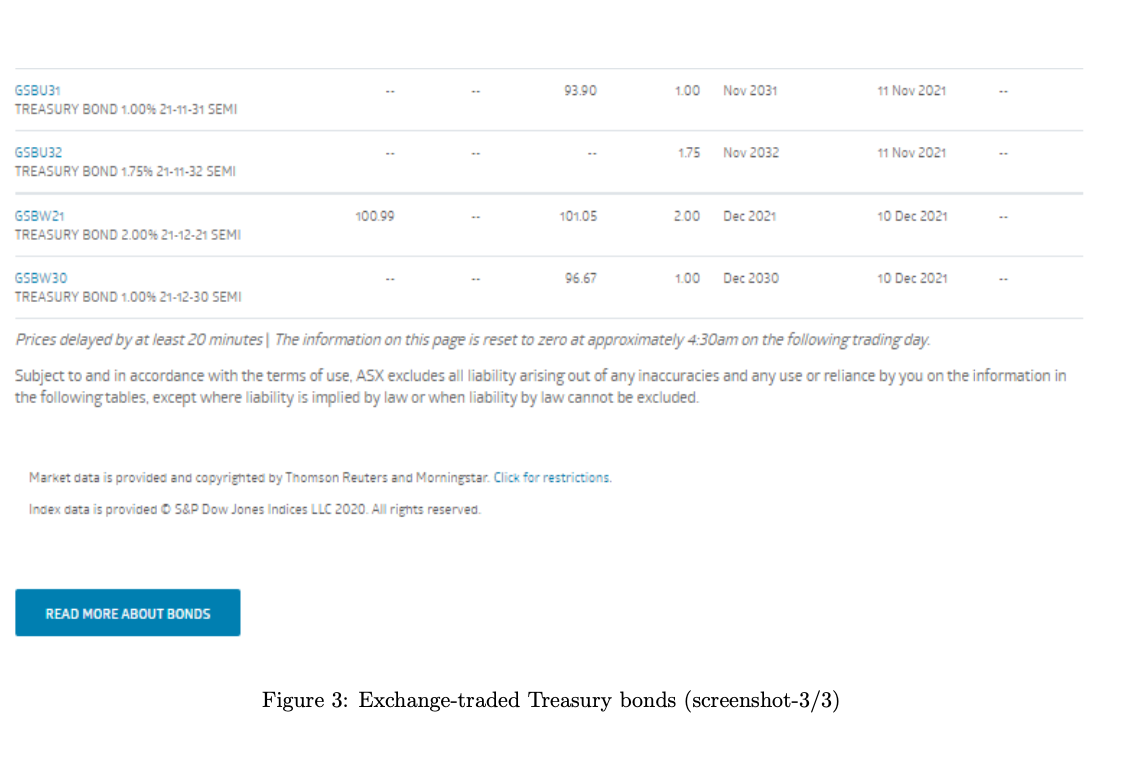

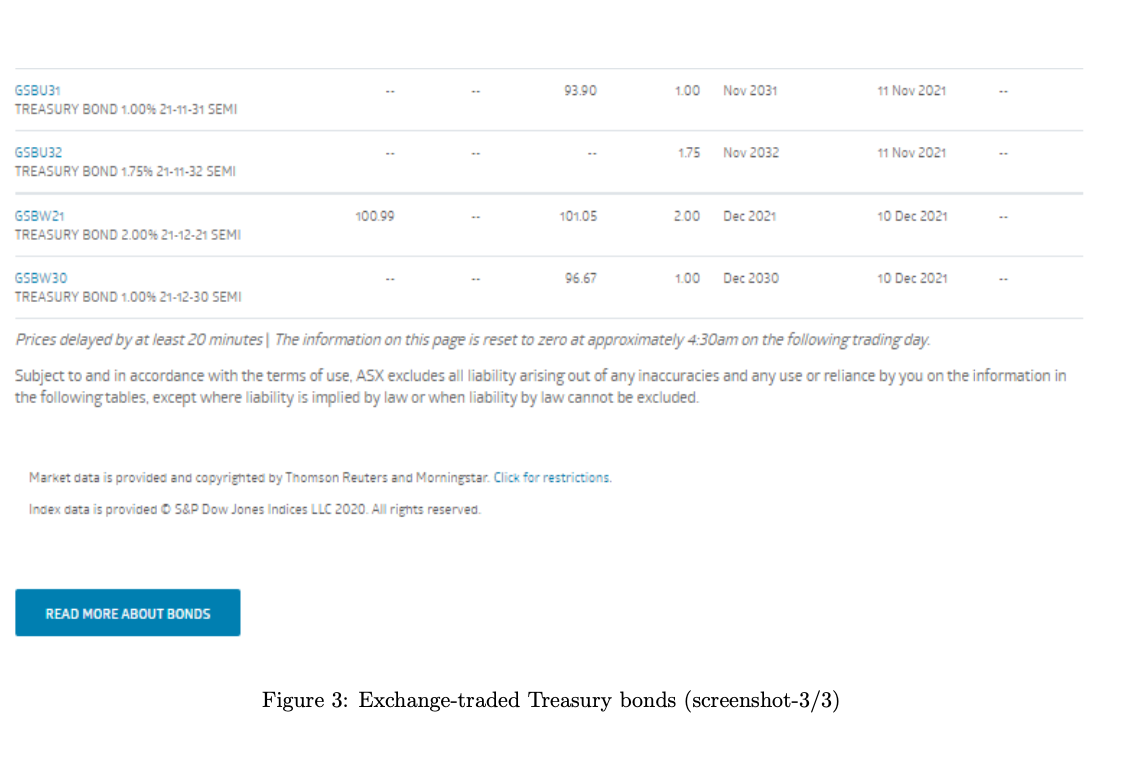

Question A2 (Term Structure). Replicating is a way to learn. This question asks you to replicate the Treasury yield curve which you see on top of the screenshot-1/3 by using market data contained in all 3 screenshots. Of course, you are only required to draw current Treasury yield curve. The finished work should be close to the one in skyblue . Then briefly discuss your observation on your yield curve. (Maximum 150 words, 10 Marks)

Question A3 (Interest Rate and Bond Price). This question is to explore the duration. approximation. Construct a graph for GSBG29 showing the relationship between bond price (Y-axis) on 20th July 2021 and yield (X-axis) for a range of yield (annualized, semi-annual compounding) of 0.00% through 8.00% with step size of 0.50%. Briefly discuss the relation between bond price and yield.

Compute, explicitly, the duration of GSBG29 on 20th July 2021. Explicitly means you need show your step by step calculation, as in lecture-example, rather than using Excel function. (5 Marks)

Assume yield changes from 1.00% to 1.5%, what is expected actual bond price change? what is the approximated change using duration? Assume yield changes from 1.00% to 2.00%, what is expected actual bond price change? what is the approximated change using duration? Discuss your observation on these results.

Bonds Government Corporate Government Bonds EXCHANGE-TRADED TREASURY BONDS EXCHANGE-TRADED TREASURY INDEXED BONDS Current Imago Treasury yield curve 2.5% 20% 15% 10% OSX 0 2 12y 15y 20y 30y Prices delayed by at least 20 minutes. The information on this page is reset to zero at approximately 4:30am on the following trading day. CODE SECURITY DESCRIPTION BID (5) OFFER (5 LAST TRADE (S) COUPON MATURITY (9) TRIGGER DATE NEXT EX-DATE STATUS CODE 12134 122.00 121.97 GSBE47 TREASURY BOND 3.00% 21-03-47 SEMI 3.00 Mar 2047 10 Sep 2021 111.50 110.91 GSBG23 TREASURY BOND 5.50% 21-04-23 SEMI 5.50 Apr 2023 12 Oct 2021 108.13 107.90 GSBG24 TREASURY BOND 2.75% 21-04-24 SEMI 2.75 Apr 2024 12 Oct 2021 11156 11.86 111.36 111.50 325 Apr 2025 GSBG25 TREASURY BOND 3.25% 21-04-25 SEMI Apr 2025 12 Oct 2021 118.49 118.99 118.27 425 Apr 2026 GSBG26 TREASURY BOND 4.259 21-04-26 SEMI 12 Oct 2021 102.00 123.67 4.75 Apr 2027 12 Oct 2021 GSBG27 TREASURY BOND 4.75% 21-04-27 SEMI 118.02 118.52 117.85 GSBG29 TREASURY BOND 3.25% 21-04-29 SEMI 325 Apr 2029 12 Oct 2021 Figure 1: Exchange-traded Treasury bonds (screenshot-1/3) 118.02 118.52 117.85 3.25 Apr 2029 12 Oct 2021 GSBG29 TREASURY BOND 3.25% 21-04-29 SEMI 127.80 136.31 4:50 Apr 2033 12 Oct 2021 GSBG33 TREASURY BOND 4.50% 21-04-33 SEMI 131.15 131.95 GSBG37 TREASURY BOND 3.75% 21-04-37 SEMI 130.98 3.75 Apr 2037 12 Oct 2021 . 10770 GSBI28 TREASURY BOND 2.25% 21-05-28 SEMI 225 May 2028 11 Nov 2021 112.54 13.04 113.04 109.95 GSBI30 TREASURY BOND 2.50% 21-05-30 SEMI 2.50 May 2030 11 Nov 2021 - 95 26 125 May 2032 11 Nov 2021 GSB132 TREASURY BOND 1.25% 21-05-32 SEMI G58141 109.00 115.43 2.75 May 2041 11 Nov 2021 TREASURY BOND 2.75% 21-05-41 SEMI 103.30 104.10 10193 GSBK31 TREASURY BOND 1,50% 21-06-31 SEMI 1.50 Jun 2031 10 Dec 2021 112.50 113.89 2.75 Jun 2035 10 Dec 2021 GSBK35 TREASURY BOND 2.75% 21-06-35 SEMI 123.59 124 39 GSBK39 TREASURY BOND 3.25% 21-06-39 SEMI 123.02 3.25 Jun 2039 10 Dec 2021 04:11 94.11 GSBK51 TREASURY BOND 1.75% 21-06-51 SEMI 94.91 94.42 1.75 Jun 2051 10 Dec 2021 10570 106.00 106.00 105 70 575 Jul 2022 GSBM22 TREASURY BOND 5.759 15-07-22 SEMI 06 Jan 2022 99.58 100.00 99.88 0.50 Sep 2026 10 Sep 2021 GSBO26 TREASURY BOND 0.50% 21-09-26 SEMI 103 32 103.62 103.31 225 Nov 2022 11 Nov 2021 GSBU22 TREASURY BOND 2.25% 21-11-22 SEMI 100.01 100.31 99.59 GSBU24 TREASURY BOND 0.25% 21-11-24 SEMI 0.25 Nov 2024 11 Nov 2021 98.96 GSBU25 TREASURY BOND 0.25% 21-11-25 SEMI 0.25 Nov 2025 11 Nov 2021 11222 GSBUZZ TREASURY BOND 2.75% 21-11-27 SEMI 2.75 Nov 2027 11 Nov 2021 113.59 114.39 113.41 GSBU23 TREASURY BOND 2.75% 21-11-28 SEMI 275 Nov 2028 11 Nov 2021 11428 GSBU29 TREASURY BOND 2.75% 21-11-29 SEMI 2.75 Nov 2029 11 Nov 2021 GSBU31 93.90 100 Nov 2031 11 Nov 2021 . 93.90 1.00 Nov 2031 11 Nov 2021 GSBU31 TREASURY BOND 1.00% 21-11-31 SEMI . 1.75 Nov 2032 11 Nov 2021 GSBU32 TREASURY BOND 1.75% 21-11-32 SEMI 100.99 101.05 200 Dec 2021 10 Dec 2021 GSBW21 TREASURY BOND 2.00% 21-12-21 SEMI 96.67 100 Dec 2030 10 Dec 2021 GSBW30 TREASURY BOND 1.00% 21-12-30 SEMI Prices delayed by at least 20 minutes. The information on this page is reset to zero at approximately 4:30am on the following trading day. Subject to and in accordance with the terms of use, ASX excludes all liability arising out of any inaccuracies and any use or reliance by you on the information in the following tables, except where liability is implied by law or when liability by law cannot be excluded. Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. Index data is provided o 5&P Dow Jones Indices LLC 2020. All rights reserved READ MORE ABOUT BONDS Figure 3: Exchange-traded Treasury bonds (screenshot-3/3) Bonds Government Corporate Government Bonds EXCHANGE-TRADED TREASURY BONDS EXCHANGE-TRADED TREASURY INDEXED BONDS Current Imago Treasury yield curve 2.5% 20% 15% 10% OSX 0 2 12y 15y 20y 30y Prices delayed by at least 20 minutes. The information on this page is reset to zero at approximately 4:30am on the following trading day. CODE SECURITY DESCRIPTION BID (5) OFFER (5 LAST TRADE (S) COUPON MATURITY (9) TRIGGER DATE NEXT EX-DATE STATUS CODE 12134 122.00 121.97 GSBE47 TREASURY BOND 3.00% 21-03-47 SEMI 3.00 Mar 2047 10 Sep 2021 111.50 110.91 GSBG23 TREASURY BOND 5.50% 21-04-23 SEMI 5.50 Apr 2023 12 Oct 2021 108.13 107.90 GSBG24 TREASURY BOND 2.75% 21-04-24 SEMI 2.75 Apr 2024 12 Oct 2021 11156 11.86 111.36 111.50 325 Apr 2025 GSBG25 TREASURY BOND 3.25% 21-04-25 SEMI Apr 2025 12 Oct 2021 118.49 118.99 118.27 425 Apr 2026 GSBG26 TREASURY BOND 4.259 21-04-26 SEMI 12 Oct 2021 102.00 123.67 4.75 Apr 2027 12 Oct 2021 GSBG27 TREASURY BOND 4.75% 21-04-27 SEMI 118.02 118.52 117.85 GSBG29 TREASURY BOND 3.25% 21-04-29 SEMI 325 Apr 2029 12 Oct 2021 Figure 1: Exchange-traded Treasury bonds (screenshot-1/3) 118.02 118.52 117.85 3.25 Apr 2029 12 Oct 2021 GSBG29 TREASURY BOND 3.25% 21-04-29 SEMI 127.80 136.31 4:50 Apr 2033 12 Oct 2021 GSBG33 TREASURY BOND 4.50% 21-04-33 SEMI 131.15 131.95 GSBG37 TREASURY BOND 3.75% 21-04-37 SEMI 130.98 3.75 Apr 2037 12 Oct 2021 . 10770 GSBI28 TREASURY BOND 2.25% 21-05-28 SEMI 225 May 2028 11 Nov 2021 112.54 13.04 113.04 109.95 GSBI30 TREASURY BOND 2.50% 21-05-30 SEMI 2.50 May 2030 11 Nov 2021 - 95 26 125 May 2032 11 Nov 2021 GSB132 TREASURY BOND 1.25% 21-05-32 SEMI G58141 109.00 115.43 2.75 May 2041 11 Nov 2021 TREASURY BOND 2.75% 21-05-41 SEMI 103.30 104.10 10193 GSBK31 TREASURY BOND 1,50% 21-06-31 SEMI 1.50 Jun 2031 10 Dec 2021 112.50 113.89 2.75 Jun 2035 10 Dec 2021 GSBK35 TREASURY BOND 2.75% 21-06-35 SEMI 123.59 124 39 GSBK39 TREASURY BOND 3.25% 21-06-39 SEMI 123.02 3.25 Jun 2039 10 Dec 2021 04:11 94.11 GSBK51 TREASURY BOND 1.75% 21-06-51 SEMI 94.91 94.42 1.75 Jun 2051 10 Dec 2021 10570 106.00 106.00 105 70 575 Jul 2022 GSBM22 TREASURY BOND 5.759 15-07-22 SEMI 06 Jan 2022 99.58 100.00 99.88 0.50 Sep 2026 10 Sep 2021 GSBO26 TREASURY BOND 0.50% 21-09-26 SEMI 103 32 103.62 103.31 225 Nov 2022 11 Nov 2021 GSBU22 TREASURY BOND 2.25% 21-11-22 SEMI 100.01 100.31 99.59 GSBU24 TREASURY BOND 0.25% 21-11-24 SEMI 0.25 Nov 2024 11 Nov 2021 98.96 GSBU25 TREASURY BOND 0.25% 21-11-25 SEMI 0.25 Nov 2025 11 Nov 2021 11222 GSBUZZ TREASURY BOND 2.75% 21-11-27 SEMI 2.75 Nov 2027 11 Nov 2021 113.59 114.39 113.41 GSBU23 TREASURY BOND 2.75% 21-11-28 SEMI 275 Nov 2028 11 Nov 2021 11428 GSBU29 TREASURY BOND 2.75% 21-11-29 SEMI 2.75 Nov 2029 11 Nov 2021 GSBU31 93.90 100 Nov 2031 11 Nov 2021 . 93.90 1.00 Nov 2031 11 Nov 2021 GSBU31 TREASURY BOND 1.00% 21-11-31 SEMI . 1.75 Nov 2032 11 Nov 2021 GSBU32 TREASURY BOND 1.75% 21-11-32 SEMI 100.99 101.05 200 Dec 2021 10 Dec 2021 GSBW21 TREASURY BOND 2.00% 21-12-21 SEMI 96.67 100 Dec 2030 10 Dec 2021 GSBW30 TREASURY BOND 1.00% 21-12-30 SEMI Prices delayed by at least 20 minutes. The information on this page is reset to zero at approximately 4:30am on the following trading day. Subject to and in accordance with the terms of use, ASX excludes all liability arising out of any inaccuracies and any use or reliance by you on the information in the following tables, except where liability is implied by law or when liability by law cannot be excluded. Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. Index data is provided o 5&P Dow Jones Indices LLC 2020. All rights reserved READ MORE ABOUT BONDS Figure 3: Exchange-traded Treasury bonds (screenshot-3/3)