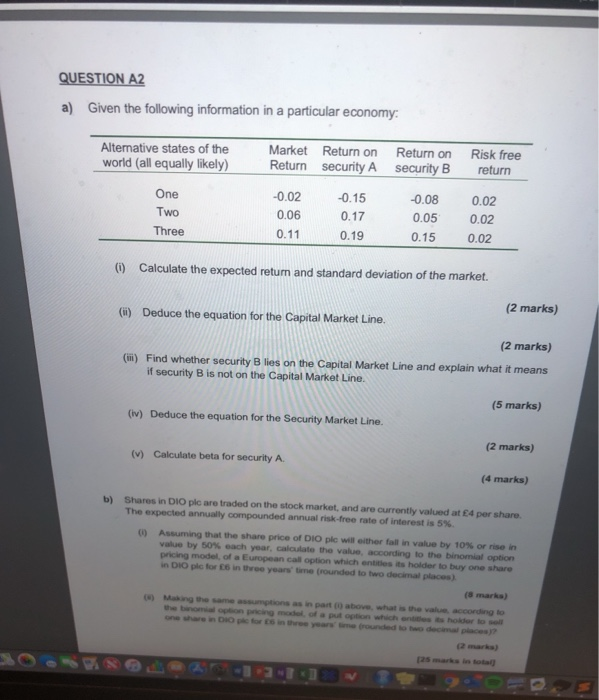

QUESTION A2 a) Given the following information in a particular economy: Alternative states of the world (all equally likely) Market Return on Return security A Return on security B Risk free return One Two Three -0.02 0.06 0.11 -0.15 0.17 0.19 -0.08 0.05 0.15 0.02 0.02 0.02 ( Calculate the expected return and standard deviation of the market. (2 marks) () Deduce the equation for the Capital Market Line. (2 marks) (W) Find whether security Blies on the Capital Market Line and explain what it means if security B is not on the Capital Market Line. (5 marks) (1) Deduce the equation for the Security Market Line. (2 marks) () Calculate beta for security A. (4 marks) b) Shares in DIO ple are traded on the stock market, and are currently valued at 4 per share The expected annually compounded annual risk-free rate of interest is 5% 0 Assuming that the share price of DIO ple will either fall in value by 10% or rise in value by 50% each year, calculate the value, according to the binomial option pricing model of European call option which is holder to buy one share in Doctors in year rounded to two decal place QUESTION A2 a) Given the following information in a particular economy: Alternative states of the world (all equally likely) Market Return on Return security A Return on security B Risk free return One Two Three -0.02 0.06 0.11 -0.15 0.17 0.19 -0.08 0.05 0.15 0.02 0.02 0.02 ( Calculate the expected return and standard deviation of the market. (2 marks) () Deduce the equation for the Capital Market Line. (2 marks) (W) Find whether security Blies on the Capital Market Line and explain what it means if security B is not on the Capital Market Line. (5 marks) (1) Deduce the equation for the Security Market Line. (2 marks) () Calculate beta for security A. (4 marks) b) Shares in DIO ple are traded on the stock market, and are currently valued at 4 per share The expected annually compounded annual risk-free rate of interest is 5% 0 Assuming that the share price of DIO ple will either fall in value by 10% or rise in value by 50% each year, calculate the value, according to the binomial option pricing model of European call option which is holder to buy one share in Doctors in year rounded to two decal place