Answered step by step

Verified Expert Solution

Question

1 Approved Answer

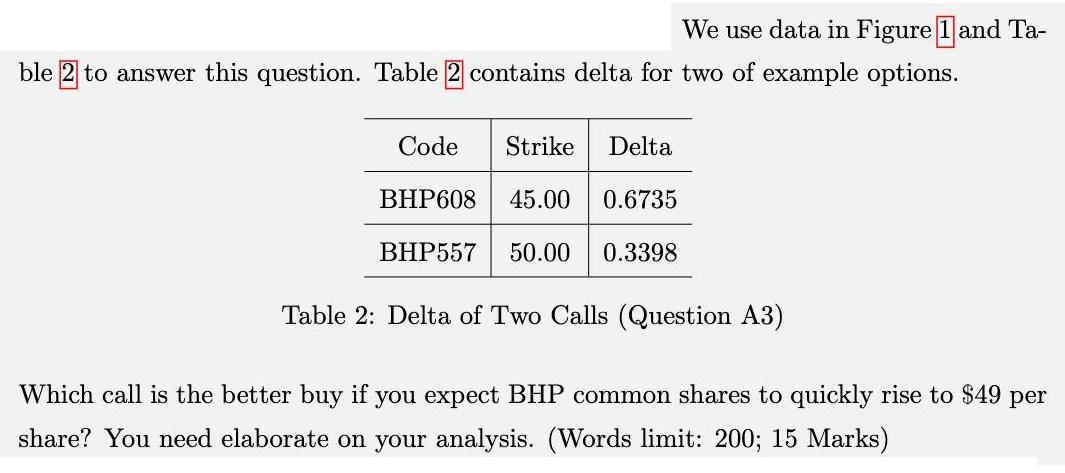

We use data in Figure 1 and Ta- ble 2 to answer this question. Table 2 contains delta for two of example options. Code

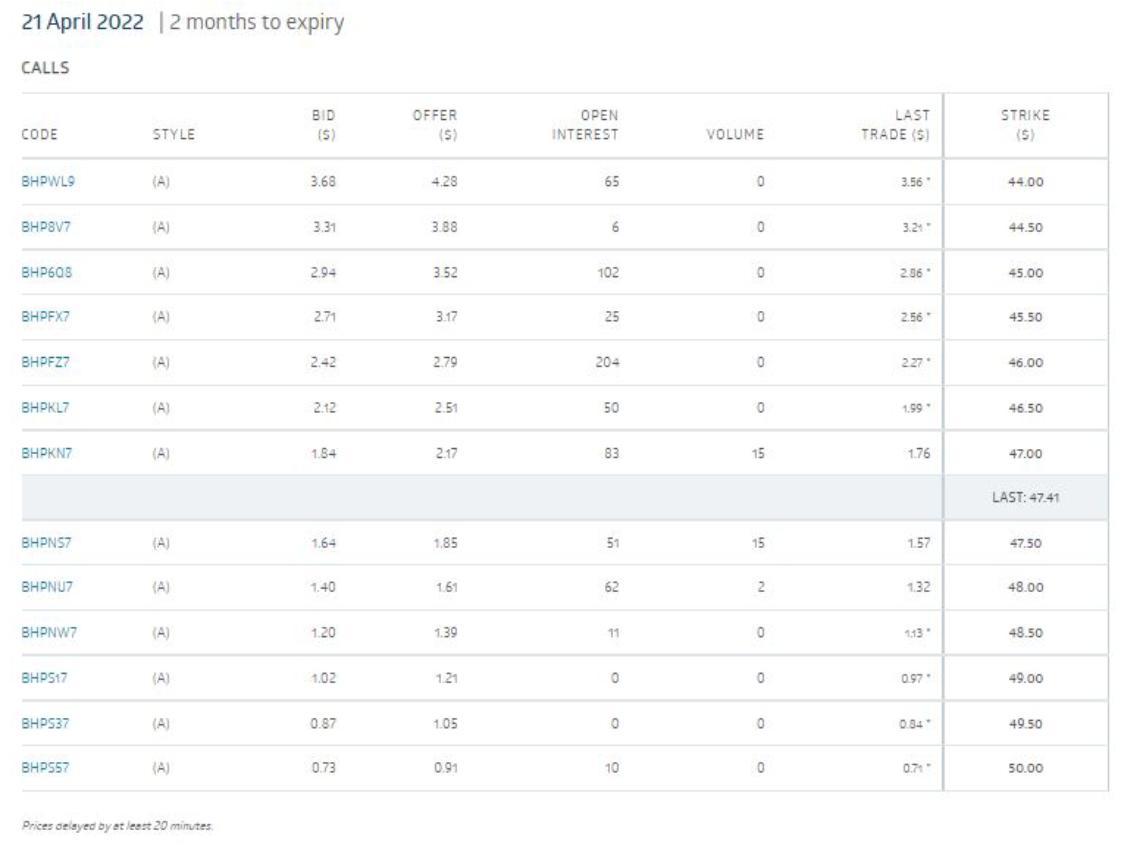

We use data in Figure 1 and Ta- ble 2 to answer this question. Table 2 contains delta for two of example options. Code Strike Delta BHP608 45.00 0.6735 BHP557 50.00 0.3398 Table 2: Delta of Two Calls (Question A3) Which call is the better buy if you expect BHP common shares to quickly rise to $49 per share? You need elaborate on your analysis. (Words limit: 200; 15 Marks) 21 April 2022 | 2 months to expiry CALLS CODE BHPWL9 BHP8V7 BHP608 BHPFX7 BHPFZ7 BHPKL7 BHPKN7 BHPNS7 BHPNU7 BHPNW7 BHPS17 BHPS37 BHPS57 STYLE a (A) A L (A) (A) (A) F (A) (A) Prices delayed by at least 20 minutes BID (5) 3.68 3.31 2.94 2.71 2.42 2.12 1.84 1.64 1.40 1.20 1.02 0.87 0.73 OFFER (5) 4.28 3.88 3.52 3.17 2.79 2.51 2.17 1.85 1.61 1.39 1.21 1.05 0.91 OPEN INTEREST 65 6 102 25 204 50 83 51 62 11 0 0 10 VOLUME 0 0 0 0 0 0 15 15 2 0 0 0 0 LAST TRADE (S) 3.56 3.24 2.96 2.56 2.27 1.99 1.76 1.57 1.32 1.13 0.97 0.84 0.71 STRIKE (5) 44.00 44.50 45.00 45.50 46.00 46.50 47.00 LAST: 47.41 47.50 48.00 48.50 49.00 49.50 50.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which call option is a better buy if we expect BHP common shares to quickly rise to 49 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started