Answered step by step

Verified Expert Solution

Question

1 Approved Answer

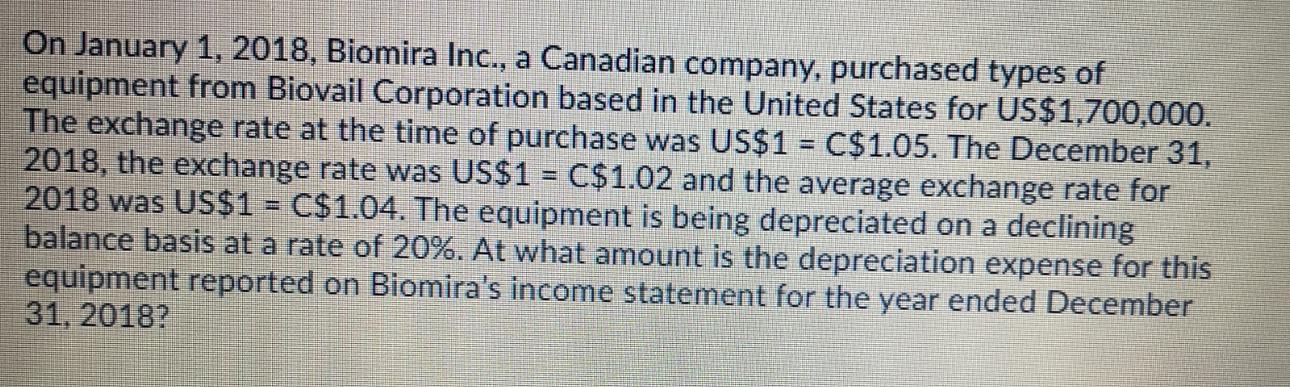

On January 1, 2018, Biomira Inc., a Canadian company, purchased types of equipment from Biovail Corporation based in the United States for US$1,700,000. The

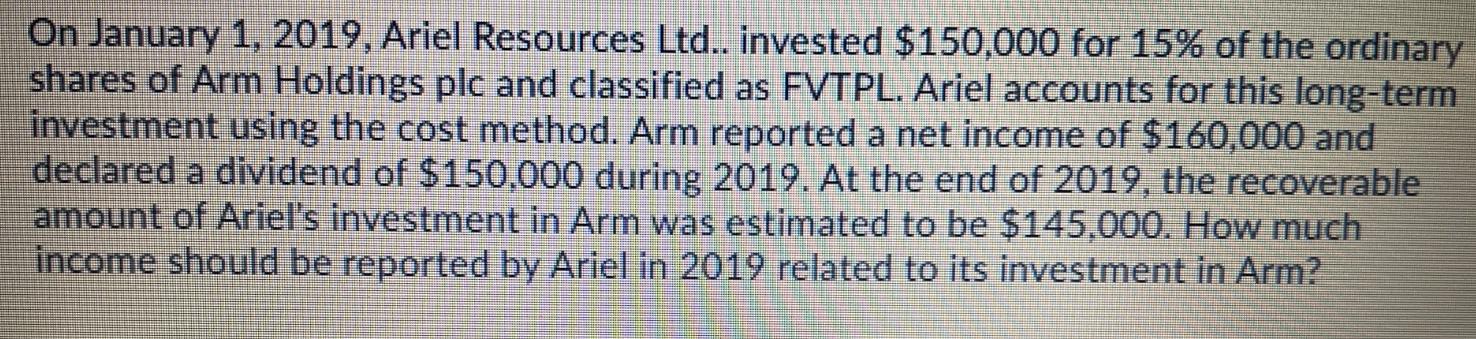

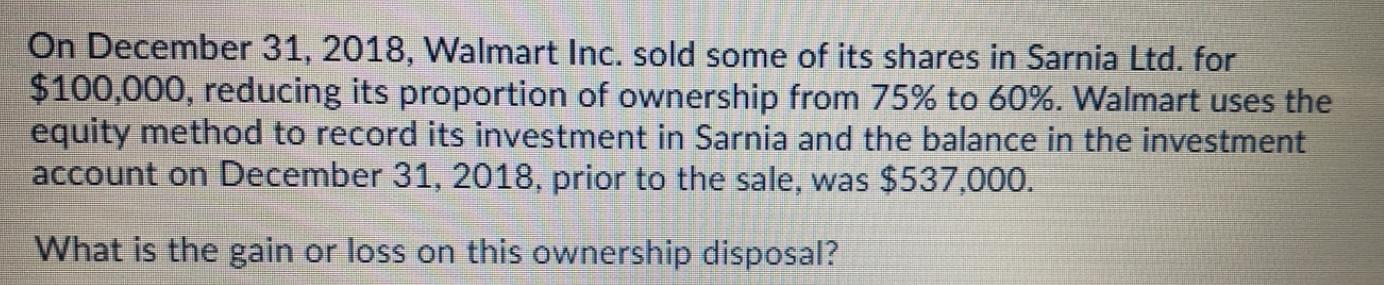

On January 1, 2018, Biomira Inc., a Canadian company, purchased types of equipment from Biovail Corporation based in the United States for US$1,700,000. The exchange rate at the time of purchase was US$1 = C$1.05. The December 31, 2018, the exchange rate was US$1 = C$1.02 and the average exchange rate for 2018 was US$1 = C$1.04. The equipment is being depreciated on a declining balance basis at a rate of 20%. At what amount is the depreciation expense for this equipment reported on Biomira's income statement for the year ended December 31, 2018? On January 1, 2019, Ariel Resources Ltd.. invested $150,000 for 15% of the ordinary shares of Arm Holdings plc and classified as FVTPL. Ariel accounts for this long-term investment using the cost method. Arm reported a net income of $160,000 and declared a dividend of $150,000 during 2019. At the end of 2019, the recoverable amount of Ariel's investment in Arm was estimated to be $145,000. How much income should be reported by Ariel in 2019 related to its investment in Arm? On December 31, 2018, Walmart Inc. sold some of its shares in Sarnia Ltd. for $100,000, reducing its proportion of ownership from 75% to 60%. Walmart uses the equity method to record its investment in Sarnia and the balance in the investment account on December 31, 2018, prior to the sale, was $537,000. What is the gain or loss on this ownership disposal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate the depreciation expense for the equipment on Biomiras income statement for the year ended December 31 2018 Given data Purchase price of equipment US1700000 Exchange rate at purchase US1 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started