Answered step by step

Verified Expert Solution

Question

1 Approved Answer

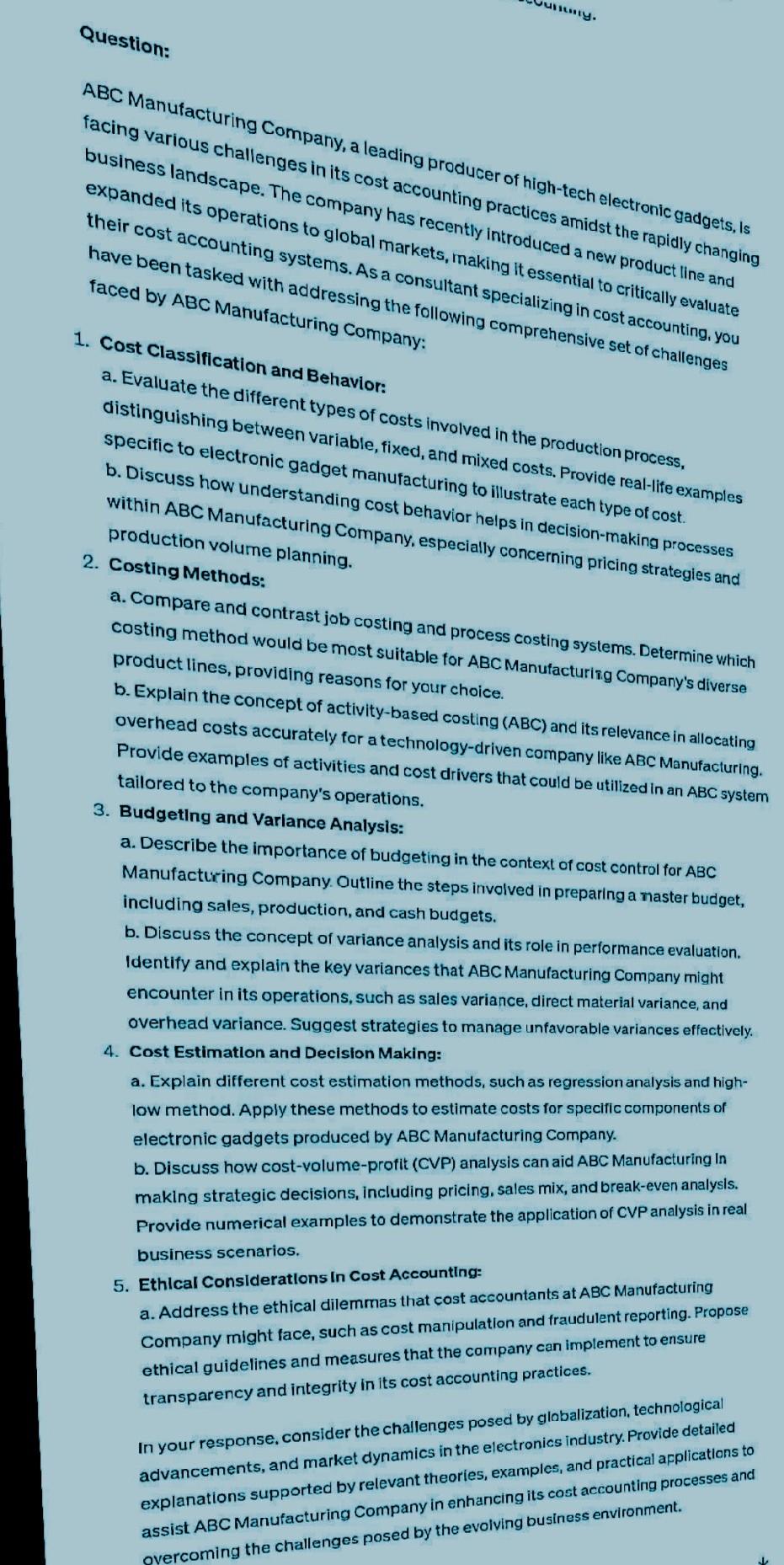

Question: ABC Manufacturing Company, a leading producer of high-tech electronic gadgets, is facing various challenges in its cost accounting practices amidst the rapidly changing business

Question: ABC Manufacturing Company, a leading producer of high-tech electronic gadgets, is facing various challenges in its cost accounting practices amidst the rapidly changing business landscape. The expanded its operation systems. As a consultant sp it essential to critically evaluate their cost account have been task faced by ABC Mast Classification and Behavior: 1. Cost Classificatic the different types of costs involved in the production process, distinguishing between variable, fixed, and mixed costs. Provide real-life examples specific to electronic gadget manufacturing to illustrate each type of cost. b. Discuss how understanding cost behavior helps in decision-making processes within ABC Manufacturing Company, especially concerning pricing strategies and production volume planning. 2. Costing Methods: a. Compare and contrast job costing and process costing systems. Determine which costing method would be most suitable for ABC Manufacturing Company's diverse product lines, providing reasons for your choice. b. Explain the concept of activity-based costing (ABC) and its relevance in allocating overhead costs accurately for a technology-driven company like ABC Manufacturing. Provide examples of activities and cost drivers that could be utilized in an ABC system tailored to the company's operations. 3. Budgeting and Variance Analysis: a. Describe the importance of budgeting in the context of cost control for ABC Manufacturing Company. Outline the steps involved in preparing a naster budget, including sales, production, and cash budgets. b. Discuss the concept of variance analysis and its role in performance evaluation. Identify and explain the key variances that ABC Manufacturing Company might encounter in its operations, such as sales variance, direct material variance, and overhead variance. Suggest strategies to manage unfavorable variances effectively. 4. Cost Estimatlon and Decision Making: a. Explain different cost estimation methods, such as regression analysis and highlow method. Apply these methods to estimate costs for specific components of electronic gadgets produced by ABC Manufacturing Company. b. Discuss how cost-volume-profit (CVP) analysis can aid ABC Manufacturing in making strategic decisions, including pricing, sales mix, and break-even analysis. Provide numerical examples to demonstrate the application of CVP analysis in real business scenarios. 5. Ethical Considerations in Cost Accounting: a. Address the ethical dilemmas that cost accountants at ABC Manufacturing Company might face, such as cost manipulation and fraudulent reporting. Propose ethical guidelines and measures that the company can implement to ensure transparency and integrity in its cost accounting practices. In your response, consider the challenges posed by globalization, technological advancements, and market dynamics in the electronics industry. Provide detailed explanations supported by relevant theories, examples, and practical applications to assist ABC Manufacturing Company in enhancing its cost accounting processes and overcoming the challenges posed by the evolving business environment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started