QUESTION:

Accrual-basis accounting includes all assets for the company.

o True

o False

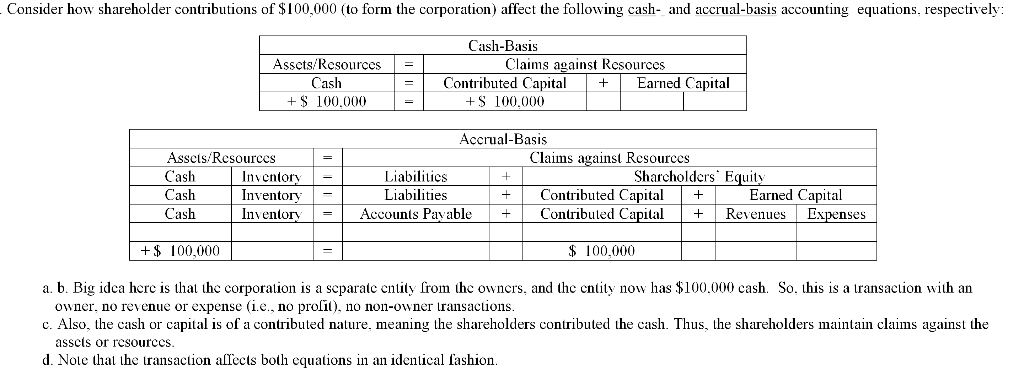

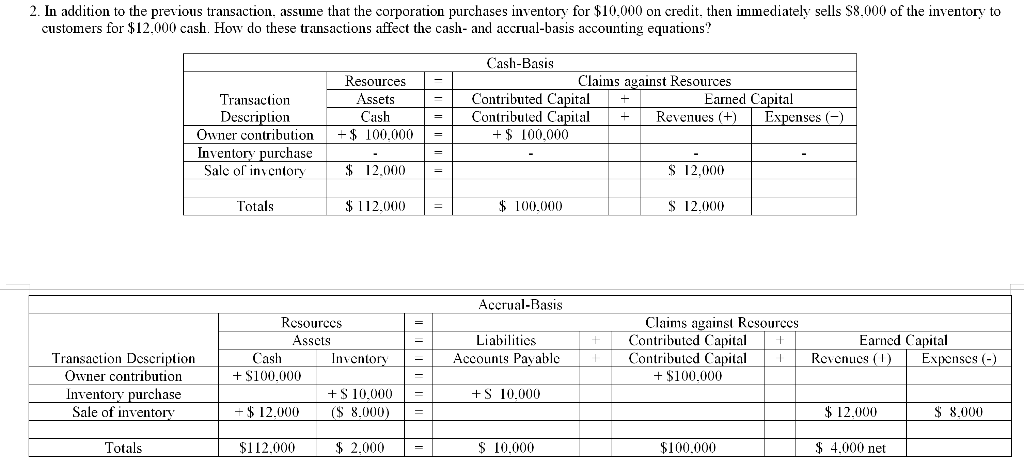

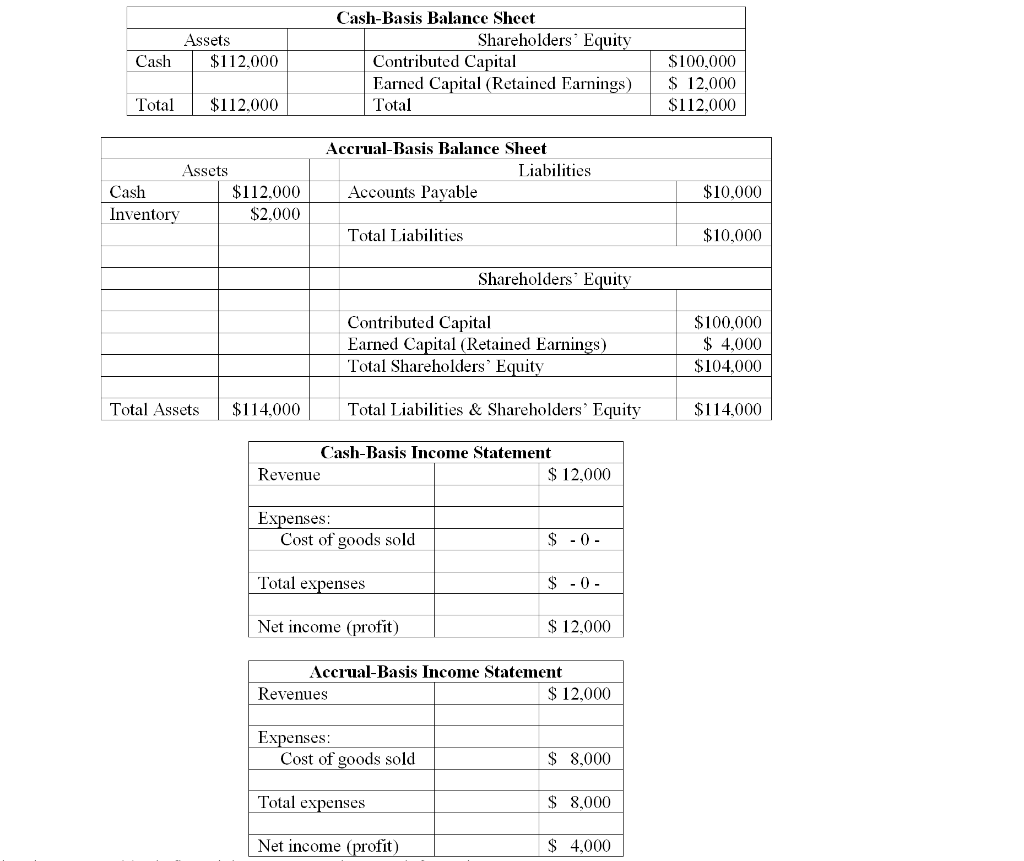

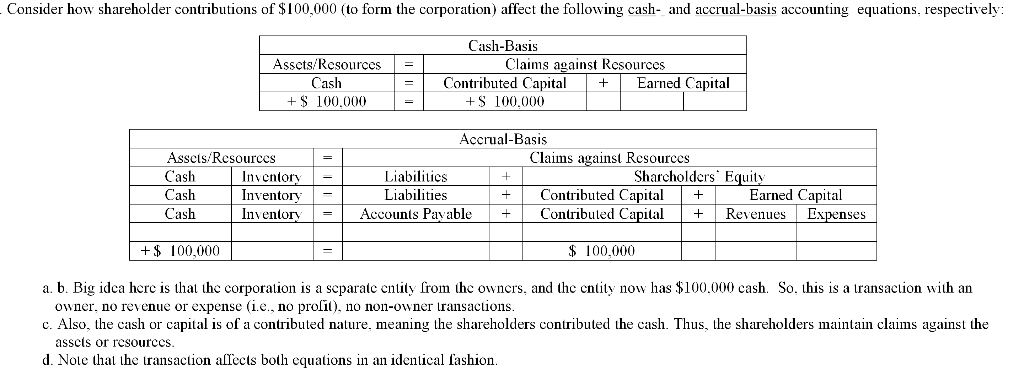

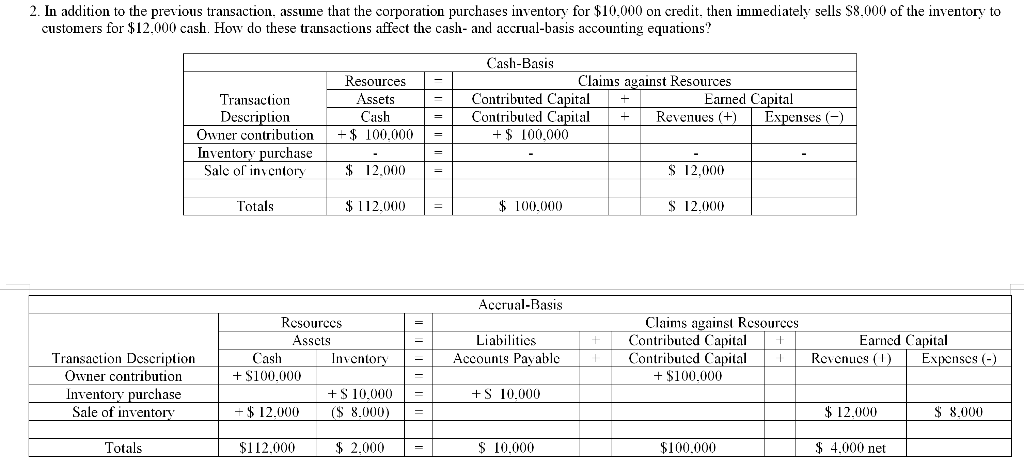

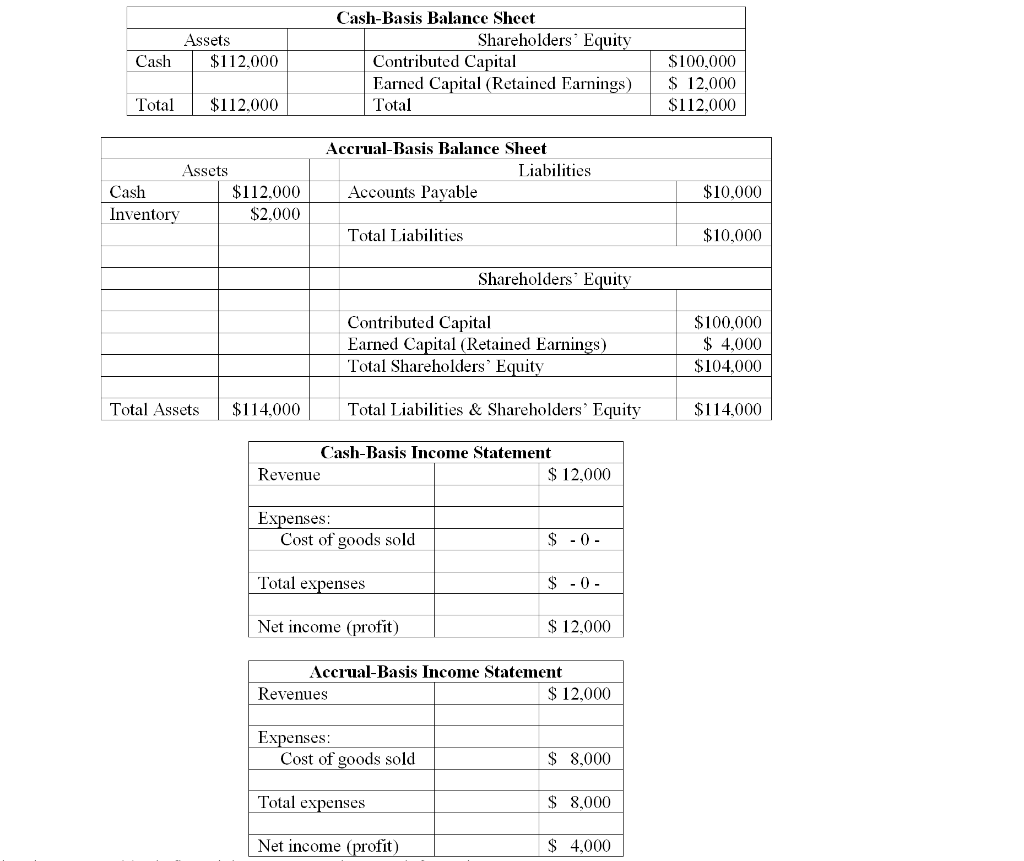

Consider how shareholder contributions of $100,000 (to form the corporation) affect the following cash- and accrual-basis accounting equations, respectively: Assets/Resources Cash +$ 100.000 Cash-Basis Claims against Resources Contributed Capital Earned Capital +S 100.000 + Assets/Resources Cash Inventory Cash Inventory Cash Inventory Accrual-Basis Claims against Resources Liabilities Sharcholders' Equity Liabilities Contributed Capital + Earned Capital Accounts Payable Contributed Capital + Revenues Expenses + + + +$ 100.000 $ 100.000 a. b. Big idea here is that the corporation is a separate entity from the owners, and the entity now has $100.000 cash. So, this is a transaction with an owner, no revenue or expense (i.e., no proil), 10 non-owner transactions. c. Also, the cash or capital is of a contributed nature, meaning the shareholders contributed the cash. Thus, the shareholders maintain claims against the asscis or resources. d. Note that the transaction allects both equations in an identical fashion. 2. In addition to the previous transaction, assume that the corporation purchases inventory for $10,000 on credit, then immediately sells $8.000 of the inventory to customers for $12.000 cash. How do these transactions affect the cash- and accrual-basis accounting equations? Transaction Description Owner contribution Inventory purchase Sale of inventory + Cash-Basis Claims against Resources Contributed Capital Earned Capital Contributed Capital + Revenues (+) Expenses (-) +$ 100.000 Resources Assets Cash +$ 100.000 $ 12.000 = $ 12.000 Totals $112.000 $ 100.000 $ 12.000 Accrual-Basis + Liabilities Accounts Payable Earned Capital Revenues (1) Expenses (-) Transaction Description Owner contribution Inventory purchase Sale of inventory Resources Assets Cash Inventory + $100.000 + S 10.000 $ 12.000 ($ 8.000) Claims against Resources Contributed Capital + Contributed Capital 1 + $100.000 +S 10.000 = $ 12.000 $ 8.000 Totals $112.000 $ 2.000 $ 10.000 $100.000 $ 4.000 net Assets $112.000 Cash Cash-Basis Balance Sheet Shareholders' Equity Contributed Capital Earned Capital (Retained Earnings) Total $100,000 $ 12,000 $112,000 Total $112.000 Assets Cash $112.000 Inventory $2.000 Accrual-Basis Balance Sheet Liabilities Accounts Payable $10,000 Total Liabilities $10,000 Shareholders' Equity Contributed Capital Earned Capital (Retained Earnings) Total Shareholders' Equity $100,000 $ 4,000 $104,000 Total Assets $114,000 Total Liabilities & Shareholders' Equity $114,000 Cash-Basis Income Statement Revenue $ 12,000 Expenses: Cost of goods sold $ -0 - Total expenses $ -0 - Net income (profit) $ 12,000 Accrual-Basis Income Statement Revenues $ 12,000 Expenses: Cost of goods sold $ 8,000 Total expenses $ 8.000 Net income (profit) $ 4,000