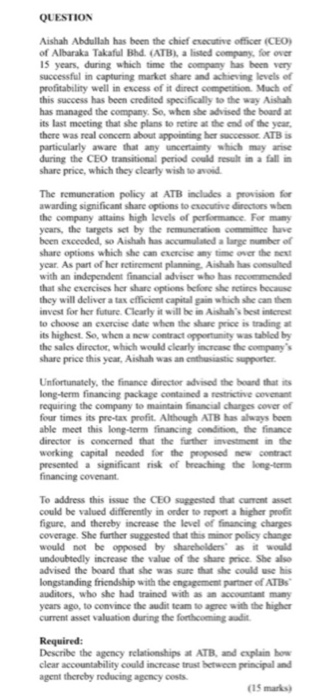

QUESTION Aishah Abdullah has been the chief executive officer (CEO) of Albaraka Takaful Bhd.(ATB) a listed company, for over 15 years, during which time the company has been very profitability well in exncess of it direct competition. Much of this success has been credited specificaly to the way Aishah has managed the company. So, when she advised the board at its last meeting that she plans to retire at the end of the year there was real concern about appointing her successor ATB is particularly aware that any uncertainty which may arise share price, which they clearly wish to avoid The remuneration play at ATB includs 1 pren lin le awarding significant share options to exocutive directors when the company attains high levels of perfomance. For many years, the targets set by the remuncration commitice have been exceeded, so Aishah has accumulated a large mumber of share options which she can exercise any time over the nex ycar. As part of her rctirement planning, Aishah has consulted with an independent financial adviser who has rcommended that she exercises her share options befone she netires because they will deliver a tax efficient capital gain which she can then invest for her future. Clearly it will be in Aishah's best inticrest its highest. So, when a new contract opportunity was tablod by the sales director, which would clcarly incrcasc the companys share price this year, Aishah was an enthusiastic supporter long-term financing package contained a restrictive covenant requiring the company to maintain financial charges cover of four times its pre-tax profit. Although ATB has always been able meet this long-term financing condition, the finance director is concerned that the further ivestment in the working capital neoded for the proposed new contract significant risk of breaching the long-term financing covenant To address this issue the CEO suggested that curent asset could be valued diffierently in order to repont a higher profi figure, and thereby increase the level of financing charges coverage. She further suggested that this minor pelicy change would not be opposed by sharchelders as it would btedly increase the value of the share price advised the board that she was sure that she could use his longstanding friendship with the engagement partner of ATBs auditors, who she had trained with as an accountant many years ago, to convince the audit tcam to agree with the higher current asset valuation during the for unng ndi Required: Describe the agency relationships t ATB, and explain clear accountability could increase trust betwecn principal and agent thercby reducing agency costs (15 marks)