Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Alasdair is an accountant. His wife Tracy is a retired lawyer. Both wish to remain active and they invest in a gift shop that

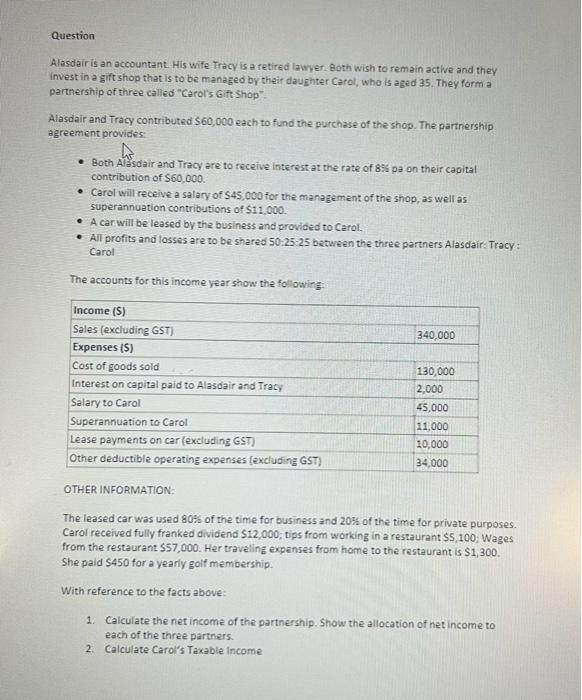

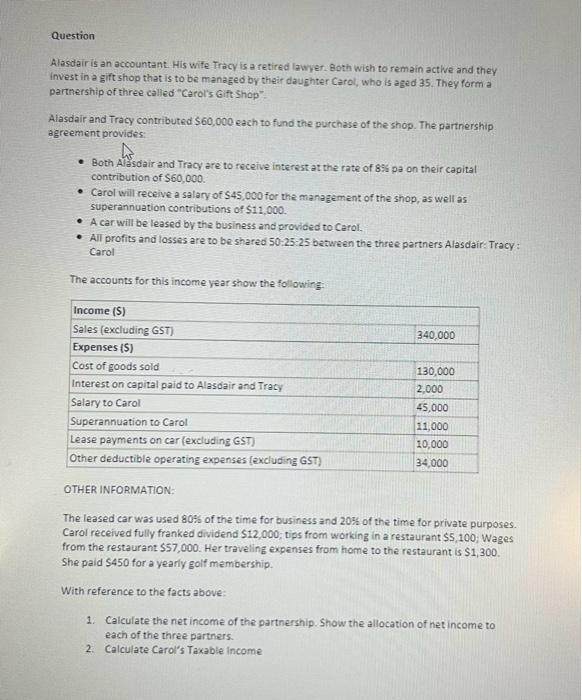

Question Alasdair is an accountant. His wife Tracy is a retired lawyer. Both wish to remain active and they invest in a gift shop that is to be managed by their daughter Carol, who is aged 35. They form a partnership of three called "Carol's Gift Shop". Alasdair and Tracy contributed $60,000 each to fund the purchase of the shop. The partnership agreement provides: A Both Alasdair and Tracy are to receive interest at the rate of 8% pe on their capital contribution of $60,000. Carol will receive a salary of $45,000 for the management of the shop, as well as superannuation contributions of $11,000. A car will be leased by the business and provided to Carol. All profits and losses are to be shared 50:25:25 between the three partners Alasdair: Tracy : Carol The accounts for this income year show the following: Income ($) Sales (excluding GST) Expenses ($) Cost of goods sold Interest on capital paid to Alasdair and Tracy Salary to Carol Superannuation to Carol Lease payments on car (excluding GST) Other deductible operating expenses (excluding GST) OTHER INFORMATION: 340,000 With reference to the facts above: 130,000 2,000 45,000 11,000 10,000 34,000 The leased car was used 80% of the time for business and 20% of the time for private purposes. Carol received fully franked dividend $12,000; tips from working in a restaurant $5,100; Wages from the restaurant $57,000. Her traveling expenses from home to the restaurant is $1,300. She paid $450 for a yearly golf membership. Calculate the net income of the partnership. Show the allocation of net income to each of the three partners. 2. Calculate Carol's Taxable Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started