Answered step by step

Verified Expert Solution

Question

1 Approved Answer

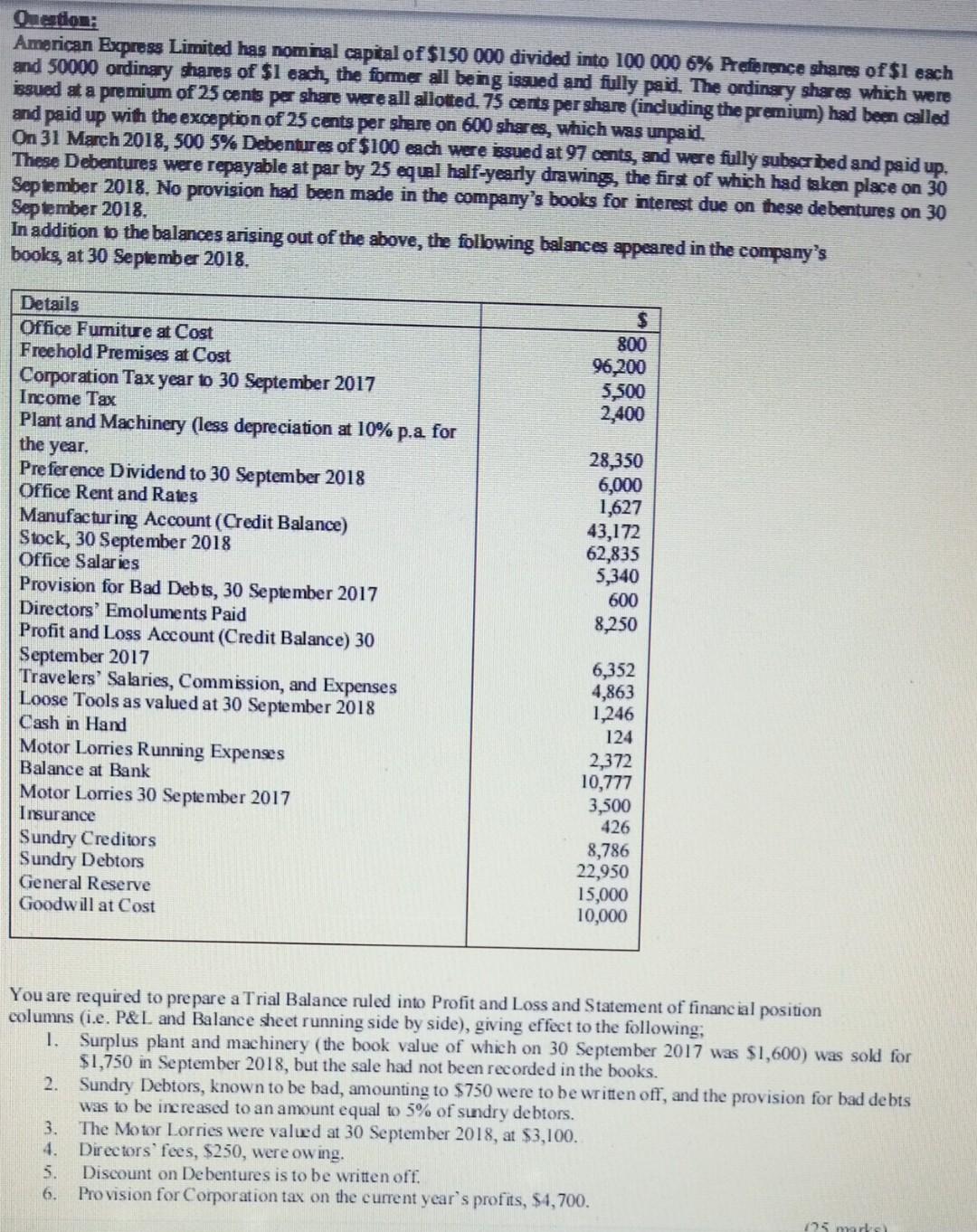

Question; American Express Limited has nominal capital of $150 000 divided into 100 000 6% Preference shares of $1 each and 50000 ordinary shares of

Question; American Express Limited has nominal capital of $150 000 divided into 100 000 6% Preference shares of $1 each and 50000 ordinary shares of $1 each, the former all being issued and fully paid. The ordinary shares which were issued at a premium of 25 cents per share were all allotted. 75 cents per share (including the premium) had been called and paid up with the exception of 25 cents per share on 600 shares, which was unpaid. On 31 March 2018,500 5% Debentures of $100 each were issued at 97 cents, and were fully subscr bed and paid up, These Debentures were repayable at par by 25 qual half-yearly drawing, the first of which had sken place on 30 September 2018. No provision had been made in the company's books for interest due on these debentures on 30 September 2018 In addition b the balances arising out of the above, the following balances appeared in the company's books, at 30 September 2018. Details Office Fumiture at Cost Freehold Premises at Cost Corporation Tax year to 30 September 2017 Income Tax Plant and Machinery (less depreciation at 10% p.a for $ 800 96,200 5,500 2,400 the year. 28,350 6,000 1,627 43,172 62,835 5,340 600 8,250 Preference Dividend to 30 September 2018 Office Rent and Rates Manufacturing Account (Credit Balance) Stock, 30 September 2018 Office Salaries Provision for Bad Debts, 30 September 2017 Directors' Emoluments Paid Profit and Loss Account (Credit Balance) 30 September 2017 Travelers' Salaries, Commission, and Expenses Loose Tools as valued at 30 September 2018 Cash in Hand Motor Lorries Running Expenses Balance at Bank Motor Lorries 30 September 2017 Insurance Sundry Creditors Sundry Debtors General Reserve Goodwill at Cost 6,352 4,863 1,246 124 2,372 10,777 3,500 426 8,786 22,950 15,000 10,000 You are required to prepare a Trial Balance ruled into Profit and Loss and Statement of financial position columns (i.e. P&L and Balance sheet running side by side), giving effect to the following: 1. Surplus plant and machinery (the book value of which on 30 September 2017 was $1,600) was sold for $1,750 in September 2018, but the sale had not been recorded in the books. 2. Sundry Debtors, known to be bad, amounting to $750 were to be written off, and the provision for bad debts was to be increased to an amount equal to 5% of sundry debtors. 3. The Motor Lorries were valued at 30 September 2018, at $3,100. 4. Directors' fees, $250, were owing. 5. Discount on Debentures is to be written off. 6. Provision for Corporation tax on the current year's profits, $4,700. 125 mars Question; American Express Limited has nominal capital of $150 000 divided into 100 000 6% Preference shares of $1 each and 50000 ordinary shares of $1 each, the former all being issued and fully paid. The ordinary shares which were issued at a premium of 25 cents per share were all allotted. 75 cents per share (including the premium) had been called and paid up with the exception of 25 cents per share on 600 shares, which was unpaid. On 31 March 2018,500 5% Debentures of $100 each were issued at 97 cents, and were fully subscr bed and paid up, These Debentures were repayable at par by 25 qual half-yearly drawing, the first of which had sken place on 30 September 2018. No provision had been made in the company's books for interest due on these debentures on 30 September 2018 In addition b the balances arising out of the above, the following balances appeared in the company's books, at 30 September 2018. Details Office Fumiture at Cost Freehold Premises at Cost Corporation Tax year to 30 September 2017 Income Tax Plant and Machinery (less depreciation at 10% p.a for $ 800 96,200 5,500 2,400 the year. 28,350 6,000 1,627 43,172 62,835 5,340 600 8,250 Preference Dividend to 30 September 2018 Office Rent and Rates Manufacturing Account (Credit Balance) Stock, 30 September 2018 Office Salaries Provision for Bad Debts, 30 September 2017 Directors' Emoluments Paid Profit and Loss Account (Credit Balance) 30 September 2017 Travelers' Salaries, Commission, and Expenses Loose Tools as valued at 30 September 2018 Cash in Hand Motor Lorries Running Expenses Balance at Bank Motor Lorries 30 September 2017 Insurance Sundry Creditors Sundry Debtors General Reserve Goodwill at Cost 6,352 4,863 1,246 124 2,372 10,777 3,500 426 8,786 22,950 15,000 10,000 You are required to prepare a Trial Balance ruled into Profit and Loss and Statement of financial position columns (i.e. P&L and Balance sheet running side by side), giving effect to the following: 1. Surplus plant and machinery (the book value of which on 30 September 2017 was $1,600) was sold for $1,750 in September 2018, but the sale had not been recorded in the books. 2. Sundry Debtors, known to be bad, amounting to $750 were to be written off, and the provision for bad debts was to be increased to an amount equal to 5% of sundry debtors. 3. The Motor Lorries were valued at 30 September 2018, at $3,100. 4. Directors' fees, $250, were owing. 5. Discount on Debentures is to be written off. 6. Provision for Corporation tax on the current year's profits, $4,700. 125 mars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started