Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Answer sheet Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a

Question

Answer sheet

Hi, I would like to get the calculations and solution of this question. Excel format will be appreciated. I am in a hurry, so quick response would be really appreciated.

Thanks!

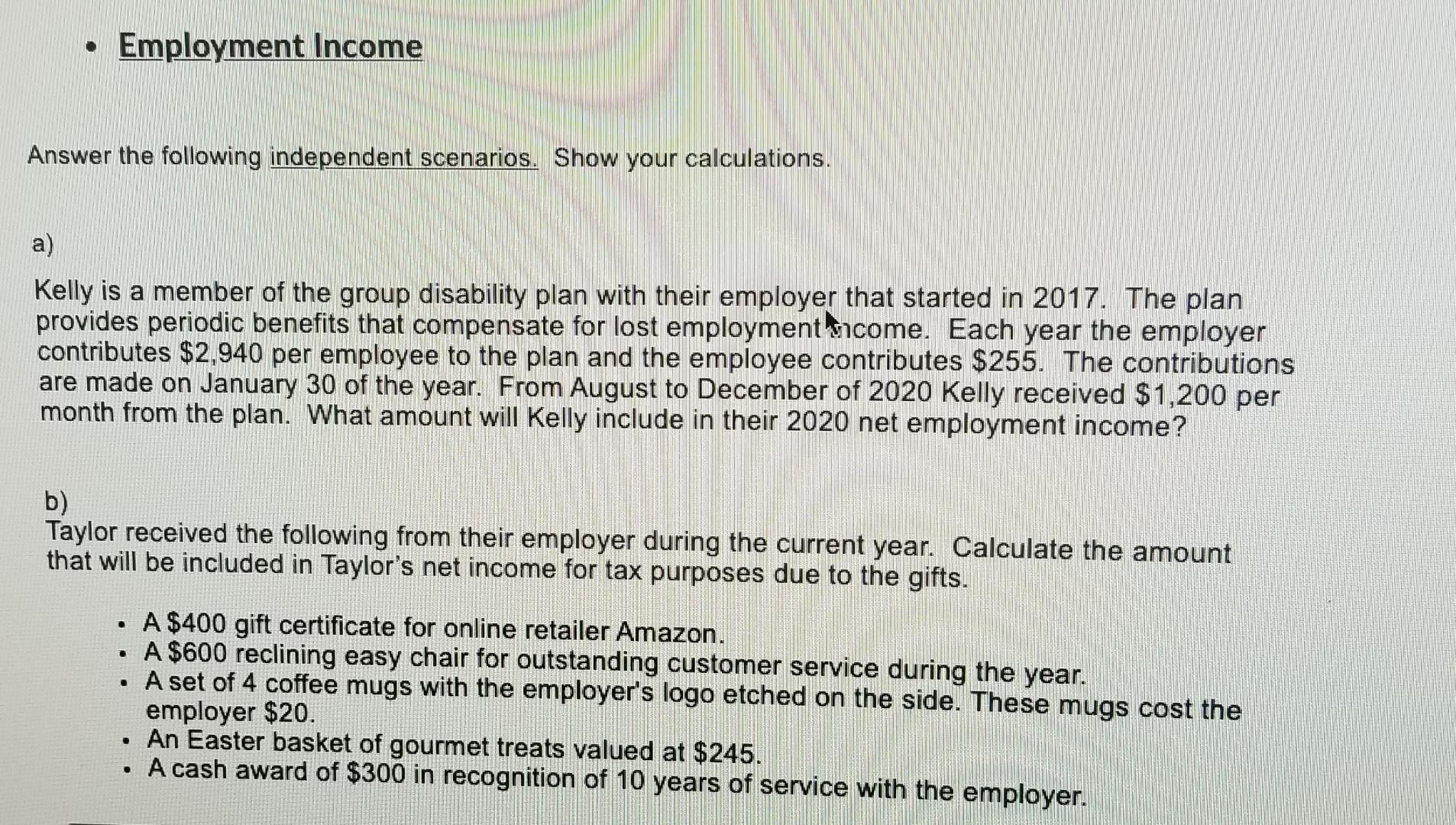

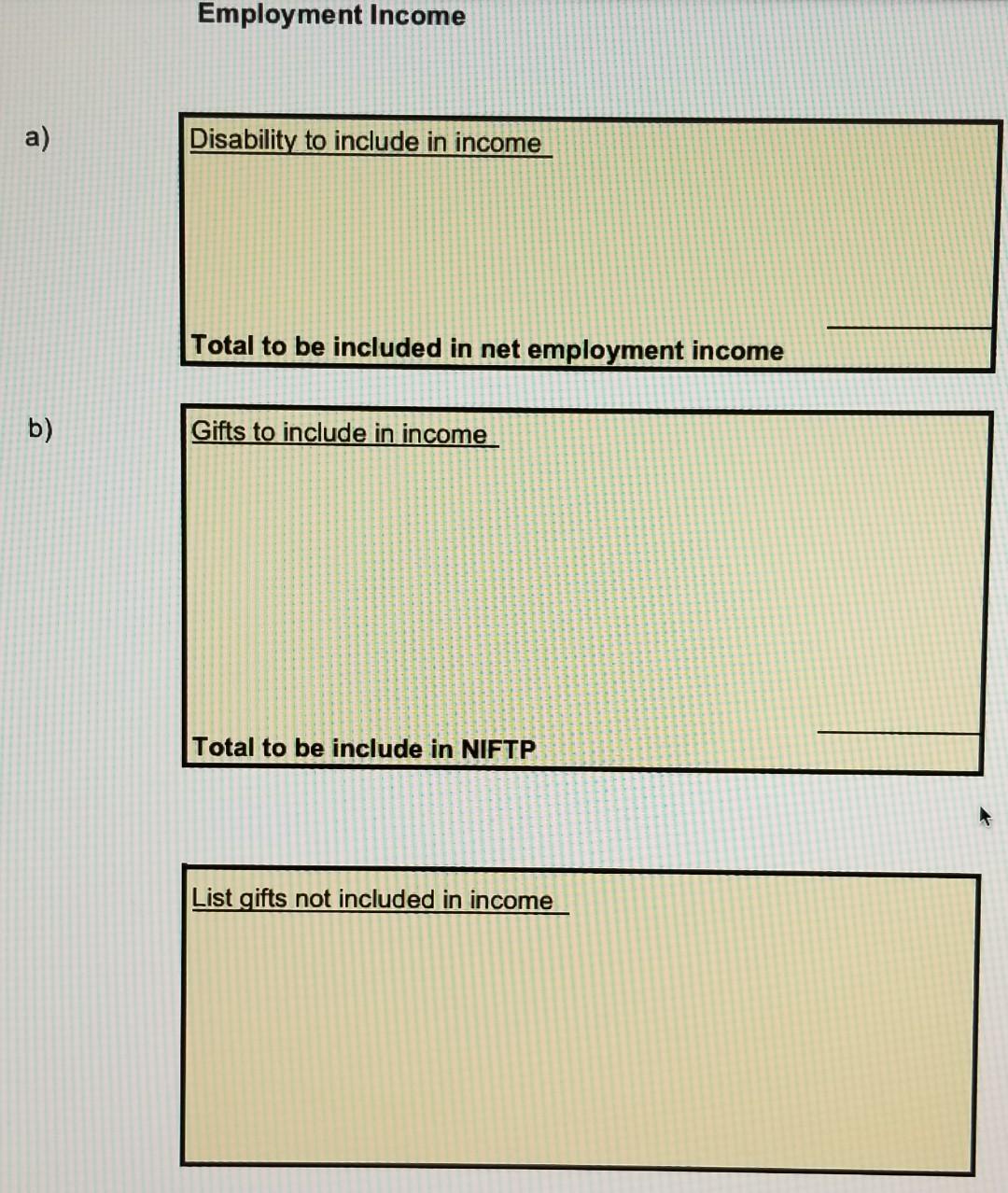

Employment Income Answer the following independent scenarios. Show your calculations. a) Kelly is a member of the group disability plan with their employer that started in 2017. The plan provides periodic benefits that compensate for lost employment income. Each year the employer contributes $2,940 per employee to the plan and the employee contributes $255. The contributions are made on January 30 of the year. From August to December of 2020 Kelly received $1,200 per month from the plan. What amount will Kelly include in their 2020 net employment income? b) Taylor received the following from their employer during the current year. Calculate the amount that will be included in Taylor's net income for tax purposes due to the gifts. . A $400 gift certificate for online retailer Amazon. A $600 reclining easy chair for outstanding customer service during the year. A set of 4 coffee mugs with the employer's logo etched on the side. These mugs cost the employer $20. An Easter basket of gourmet treats valued at $245. A cash award of $300 in recognition of 10 years of service with the employer. . . Employment Income a) Disability to include in income Total to be included in net employment income b ) Gifts to include in income Total to be include in NIFTP List gifts not included in incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started