Answered step by step

Verified Expert Solution

Question

1 Approved Answer

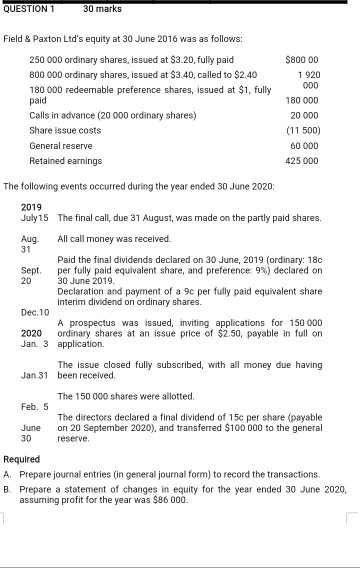

question answer space is like this QUESTION 1 30 marks Field & Paxton Ltd's equity at 30 June 2016 was as follows: 250 000 ordinary

question

answer space is like this

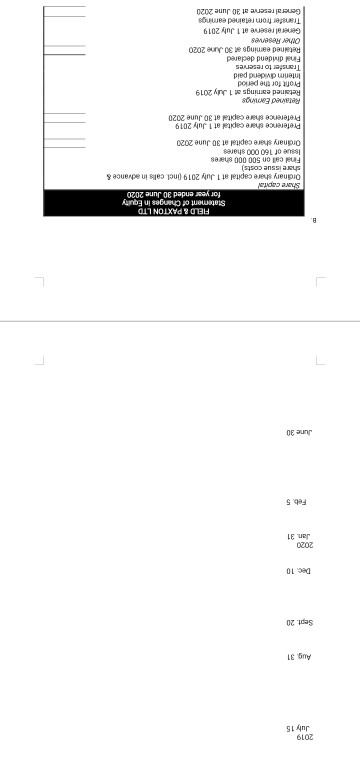

QUESTION 1 30 marks Field & Paxton Ltd's equity at 30 June 2016 was as follows: 250 000 ordinary shares, issued at $3.20, fully paid 800 000 ordinary shares, issued at $3.40, called to $2.40 180 000 redeemable preference shares, issued at $1, fully paid Calls in advance (20 000 ordinary shares) Share issue costs General reserve Retained earnings $800 00 1 920 000 180 000 20 000 (11 500) 60 000 425 000 The following events occurred during the year ended 30 June 2020 2019 July 15 The final call, due 31 August, was made on the partly paid shares. Aug. All call money was received. Sept. 20 Paid the final dividends declared on 30 June, 2019 (ordinary: 18c per fully paid equivalent share, and preference: 9%) declared on 30 June 2019 Declaration and payment of a 9c per fully paid equivalent share interim dividend on ordinary shares. Dec. 10 2020 Jan. 3 A prospectus was issued, inviting applications for 150 000 ordinary shares at an issue price of $2.50, payable in full on application. The issue closed fully subscribed, with all money due having Jan 31 been received The 150 000 shares were allotted. Feb. 5 June 30 The directors declared a final dividend of 150 per share (payable on 20 September 2020), and transferred $100 000 to the general reserve. Required A Prepare journal entries (in general journal form) to record the transactions B. Prepare a statement of changes in equity for the year ended 30 June 2020, assuming profit for the year was $86 000. 2019 July 15 Aug 31 Sept. 20 Dec. 10 2020 Jan. 31 Feb. 5 June 30 FIELD & PAXTON LTD Statement of Changes in Equity for year ended 30 June 2020 Streceita Ordinary share capital at 1 July 2019 incl calls in advance & share issue costs) Final calon 500 000 shares Issue of 160 000 shares Ordinary share capital at 30 June 2020 Preference share capital at 1 July 2019 Preference share capital at 30 June 2020 Retaved Earnings Retained earnings at 1 July 2019 Profit for the period Interim dividend paid Transfer to reserves Final dividend declared Retained eamings af 30 June 2020 Other Reserves General reserve at 1 July 2019 Transfer from retained earnings General reserve at 20 June 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started