Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question (around 950 words) Required: Use financial statements to analyse its financial performance and operation results with recommendations. Use of data and tools for analysing

Question (around 950 words) Required: Use financial statements to analyse its financial performance and operation results with recommendations.

Use of data and tools for analysing financial performance and operation results. (10 marks)

Analysis and interpretation of financial performance and operation results (30marks)

Recommendation

(feasible, cover sufficient broad areas of analysis, sufficiently targeted to the results found from your analysis, considers the internal and external environment of the company.) (20 marks)

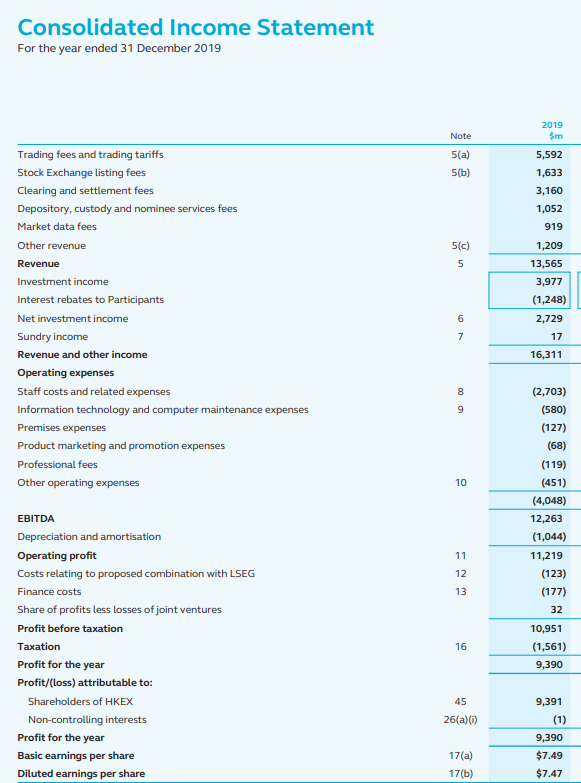

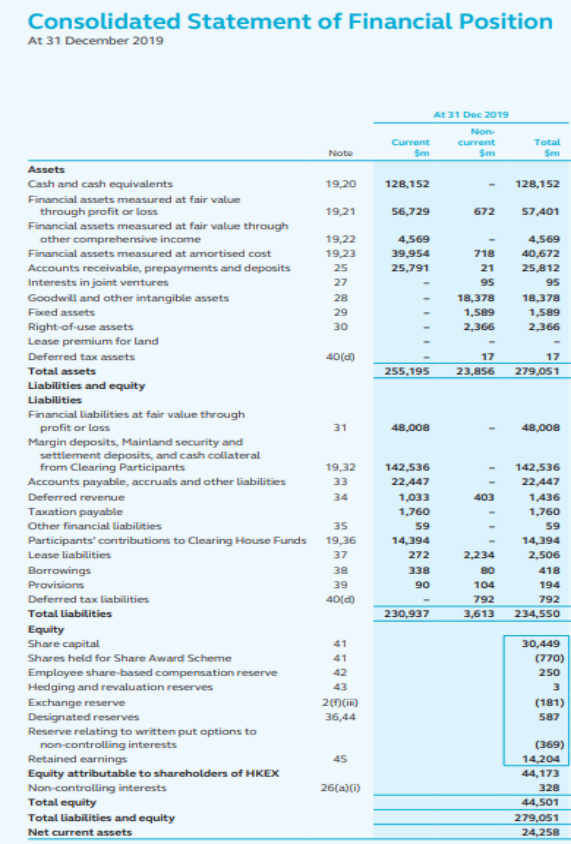

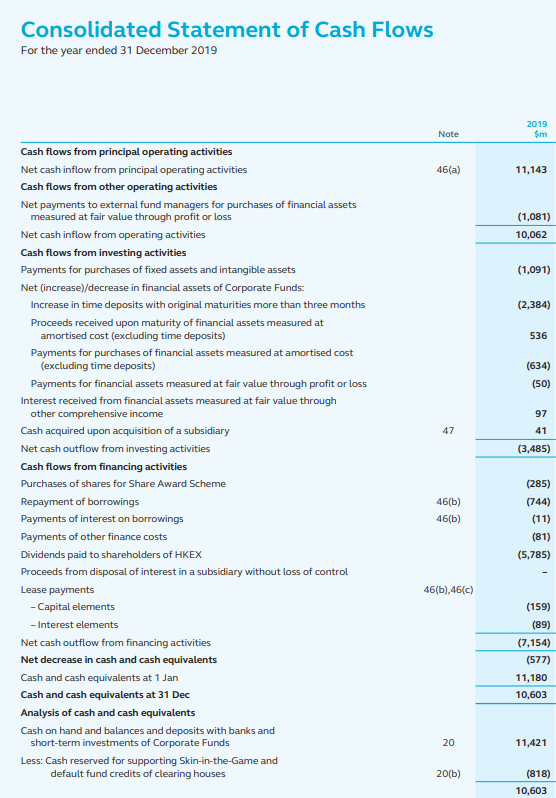

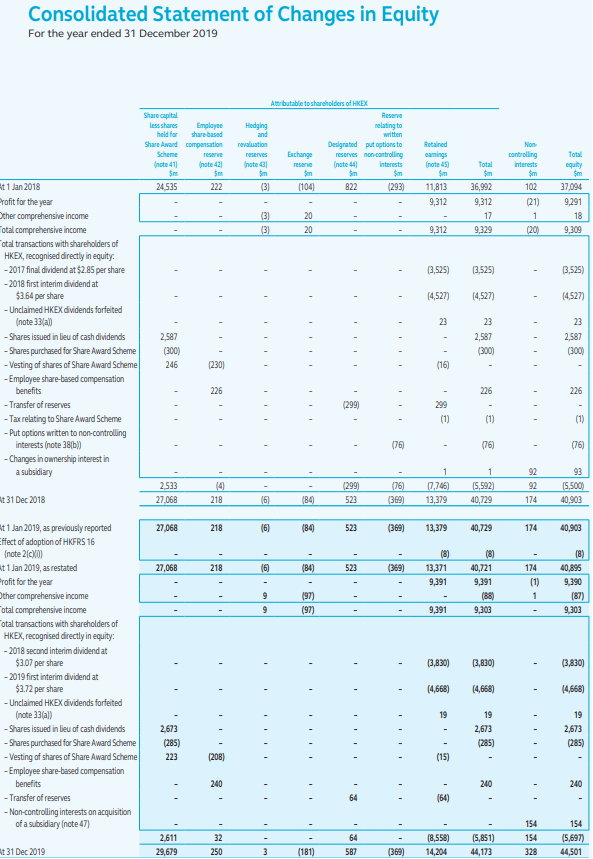

Consolidated Income Statement For the year ended 31 December 2019 Note 2019 $m 5(a) 5(b) 5,592 1,633 3,160 1,052 919 5(c) 5 Trading fees and trading tariffs Stock Exchange listing fees Clearing and settlement fees Depository, custody and nominee services fees Market data fees Other revenue Revenue Investment income Interest rebates to Participants Net investment income Sundry income Revenue and other income Operating expenses Staff costs and related expenses Information technology and computer maintenance expenses Premises expenses Product marketing and promotion expenses Professional fees Other operating expenses 1,209 13,565 3,977 (1,248) 2,729 17 16,311 6 7 8 9 10 (2,703) (580) (127) (68) (119) (451) (4,048) 12,263 (1,044) 11,219 (123) (177) 32 11 12 13 EBITDA Depreciation and amortisation Operating profit Costs relating to proposed combination with LSEG Finance costs Share of profits less losses of joint ventures Profit before taxation Taxation Profit for the year Profit/(Loss) attributable to: Shareholders of HKEX Non-controlling interests Profit for the year Basic earnings per share Diluted earnings per share 16 10,951 (1,561) 9,390 45 26(a)0) 9,391 (1) 9,390 $7.49 $7.47 17(a) 17(b) Consolidated Statement of Financial Position At 31 December 2019 At 31 Dec 2019 Non Current current Sim Sm Total Sen Note 128,152 128,152 56,729 672 57,401 4,569 39,954 25,791 718 21 95 18,378 1,589 2,366 4,569 40,672 25,812 95 18,378 1.589 2,366 17 255,195 23,856 17 279,051 31 48,008 48,008 403 Assets Cash and cash equivalents 19,20 Financial assets measured at fair value through profit or loss 19.21 Financial assets measured at fair value through other comprehensive income 19,22 Financial assets measured at amortised cost 19,23 Accounts receivable, prepayments and deposits 25 Interests in joint ventures 27 Goodwill and other intangible assets 28 Foced assets 29 Right-of-use assets 30 Lease premium for land Deferred tax assets 40(0) Total assets Liabilities and equity Liabilities Financial liabilities at fair value through profit or loss Margin deposits, Mainland security and settlement deposits, and cash collateral from Clearing Participants 19,32 Accounts payable, accruals and other liabilities Deferred revenue Taxation payable Other financial liabilities 35 Participants' contributions to Clearing House Funds 19,36 Lease liabilities 37 Borrowings 38 Provisions 39 Deferred tax liabilities 40(0) Total liabilities Equity Share capital Shares held for Share Award Scheme 41 Employee share-based compensation reserve Hedging and revaluation reserves Exchange reserve 2000 Designated reserves 36,44 Reserve relating to written put options to non-controlling interests Retained earnings 45 Equity attributable to shareholders of HKEX Non-controlling interests 26(a)(i) Total equity Total liabilities and equity Net current assets 142,536 22,447 1,033 1,760 59 14,394 272 338 90 142,536 22.447 1.436 1,760 59 14,394 2.506 418 194 792 234,550 2,234 BO 104 792 3,613 230,937 41 30,449 (770) 250 42 (181) 587 (369) 14,204 44,173 328 44,501 279.051 24,258 Consolidated Statement of Cash Flows For the year ended 31 December 2019 2019 Note $m 46(a) 11,143 (1,081) 10,062 (1,091) (2,384) 536 (634) (50) 97 47 41 (3,485) Cash flows from principal operating activities Net cash inflow from principal operating activities Cash flows from other operating activities Net payments to external fund managers for purchases of financial assets measured at fair value through profit or loss Net cash inflow from operating activities Cash flows from investing activities Payments for purchases of fixed assets and intangible assets Net (increase)/decrease in financial assets of Corporate Funds: Increase in time deposits with original maturities more than three months Proceeds received upon maturity of financial assets measured at amortised cost (excluding time deposits) Payments for purchases of financial assets measured at amortised cost (excluding time deposits) Payments for financial assets measured at fair value through profit or loss Interest received from financial assets measured at fair value through other comprehensive income Cash acquired upon acquisition of a subsidiary Net cash outflow from investing activities Cash flows from financing activities Purchases of shares for Share Award Scheme Repayment of borrowings Payments of interest on borrowings Payments of other finance costs Dividends paid to shareholders of HKEX Proceeds from disposal of interest in a subsidiary without loss of control Lease payments - Capital elements - Interest elements Net cash outflow from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at 1 Jan Cash and cash equivalents at 31 Dec Analysis of cash and cash equivalents Cash on hand and balances and deposits with banks and short-term investments of Corporate Funds Less: Cash reserved for supporting Skin-in-the-Game and default fund credits of clearing houses 46(b) 46(b) (285) (744) (11) (81) (5,785) 46(b),46(c) (159) (89) (7,154) (577) 11,180 10,603 20 11,421 20(b) (818) 10,603 Consolidated Statement of Changes in Equity For the year ended 31 December 2019 Share capital less shares Employee held for share based Share Award compensation Scheme note 41 Inote 421) $m $m 24,535 222 Attributable to shareholders of HEX Reserve Hedging relating to and written revaluation Designated put options to reserves Exchange reserves non controlling Inste (note 44 interests Sm Sm Sim $m (3) (104) 822 (293) Retained samnings notes Non controlling interests $m 102 (21) Total $m 36,992 9,312 17 9,329 11,813 9,312 Total equity $m 37,094 9,291 18 9,309 1 (3) (3) 20 20 9,312 (20) ! - 3,525) 3,525) 3,525) - (4.527) [4,527) (4,527) 23 t1 Jan 2018 Profit for the year ther comprehensive income otal comprehensive income otal transactions with shareholders of HKEX, recognised directly in equity -2017 final dividend at $2.85 per share -2018 first interim dividend at $3.64 per share - Unclaimed HKEX dividends forfeited (note 33(a) -Shares issued in lieu of cash dividends - Shares purchased for Share Award Scheme - Vesting of shares of Share Award Scheme - Employee share-based compensation benefits - Transfer of reserves - Tax relating to Share Award Scheme - Put options written to non-controlling interests (note 38[b - Changes in ownership interest in a subsidiary 2,587 (300) 246 23 2,587 (300) 23 2,587 (300) 230) (16) 226 226 226 (299) 299 (1) (1) (76) (76) (76) 1 1 17,746) 2.533 27,068 14 218 (299) 523 (76) (369) 92 92 174 15,592) 40,729 t31 Dec 2018 93 15,500) 40,903 (6) (B4 13.379 27.068 218 (6) (84) 523 (369) 13,379 40,729 174 40,903 (8) 27,068 218 16) (84) 523 (369) 13,371 (8) 40,721 9,391 (88) 9,303 174 (1) 9,391 18) 40,895 9,390 (87) 9,303 197 1 9 9 (97) 9,391 (3,830) 3,830) (3,830) t1 Jan 2019, as previously reported ffect of adoption of HKFRS 16 (note 2) t1 Jan 2019, as restated Profit for the year Other comprehensive Income otal comprehensive income otal transactions with shareholders of HKEX, recognised directly in equity: -2018 second interim dividendat $3.07 per share -2019 first interim dividend at $3.72 per share - Unclaimed HKEX dividends forfeited (note 33(al) - Shares issued in lieu of cash dividends -Shares purchased for Share Award Scheme - Vesting of shares of Share Award Scheme -Employee share-based compensation benefits - Transfer of reserves - Non-controlling interests on acquisition of a subsidiary (note 47) - (4,668) (4,668) - (4,668) 19 2673 (285) 223 19 2,673 (285) 19 2,673 (285) (208) (15) 240 240 240 64 (64) 2,611 29,679 32 250 64 587 (8,558) 14,204 (5,851) 44,173 154 154 328 154 (5,697) 44,501 t 31 Dec 2019 3 (181) (369)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started