Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question : As audit management for Company XY, please prepare an audit report which includes : a. Audit findings b. Recommendation In 2022, Company XY

Question : As audit management for Company XY, please prepare an audit report which includes : a. Audit findings b. Recommendation

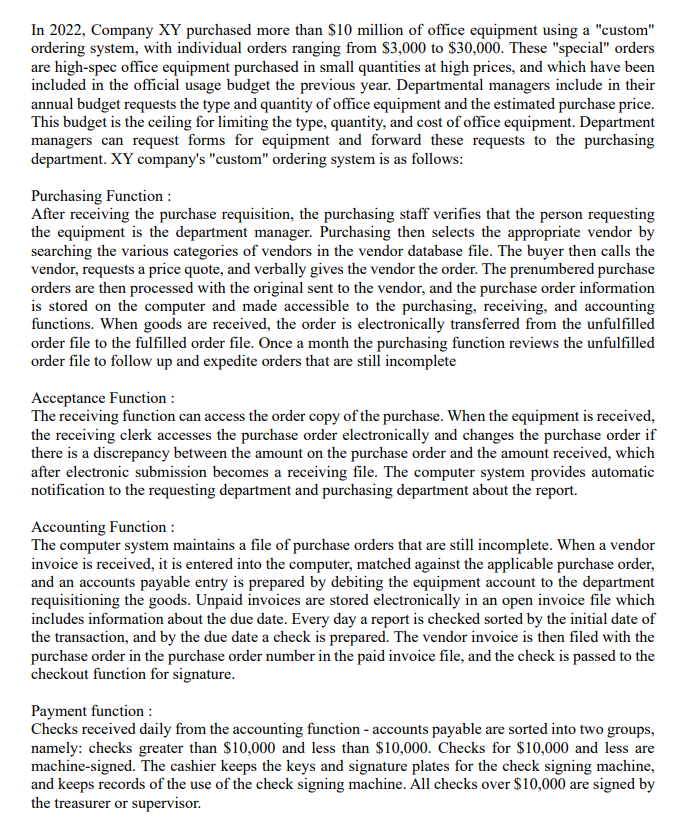

In 2022, Company XY purchased more than \$10 million of office equipment using a "custom" ordering system, with individual orders ranging from $3,000 to $30,000. These "special" orders are high-spec office equipment purchased in small quantities at high prices, and which have been included in the official usage budget the previous year. Departmental managers include in their annual budget requests the type and quantity of office equipment and the estimated purchase price. This budget is the ceiling for limiting the type, quantity, and cost of office equipment. Department managers can request forms for equipment and forward these requests to the purchasing department. XY company's "custom" ordering system is as follows: Purchasing Function : After receiving the purchase requisition, the purchasing staff verifies that the person requesting the equipment is the department manager. Purchasing then selects the appropriate vendor by searching the various categories of vendors in the vendor database file. The buyer then calls the vendor, requests a price quote, and verbally gives the vendor the order. The prenumbered purchase orders are then processed with the original sent to the vendor, and the purchase order information is stored on the computer and made accessible to the purchasing, receiving, and accounting functions. When goods are received, the order is electronically transferred from the unfulfilled order file to the fulfilled order file. Once a month the purchasing function reviews the unfulfilled order file to follow up and expedite orders that are still incomplete Acceptance Function : The receiving function can access the order copy of the purchase. When the equipment is received, the receiving clerk accesses the purchase order electronically and changes the purchase order if there is a discrepancy between the amount on the purchase order and the amount received, which after electronic submission becomes a receiving file. The computer system provides automatic notification to the requesting department and purchasing department about the report. Accounting Function : The computer system maintains a file of purchase orders that are still incomplete. When a vendor invoice is received, it is entered into the computer, matched against the applicable purchase order, and an accounts payable entry is prepared by debiting the equipment account to the department requisitioning the goods. Unpaid invoices are stored electronically in an open invoice file which includes information about the due date. Every day a report is checked sorted by the initial date of the transaction, and by the due date a check is prepared. The vendor invoice is then filed with the purchase order in the purchase order number in the paid invoice file, and the check is passed to the checkout function for signature. Payment function : Checks received daily from the accounting function - accounts payable are sorted into two groups, namely: checks greater than $10,000 and less than $10,000. Checks for $10,000 and less are machine-signed. The cashier keeps the keys and signature plates for the check signing machine, and keeps records of the use of the check signing machine. All checks over $10,000 are signed by the treasurer or supervisorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started