Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Question Audit Opinion (11 marks) Required: The following are four (4) independent situations. For each case, state the type of audit opinion which should

.

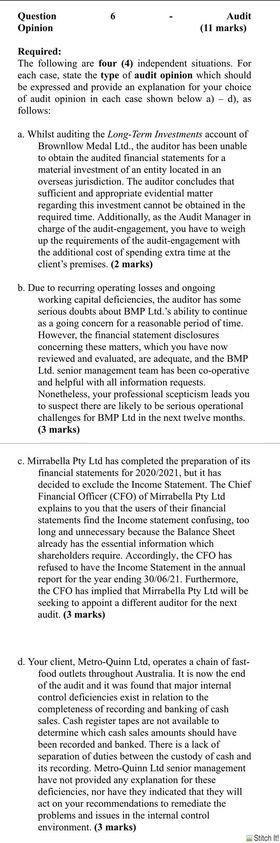

Question Audit Opinion (11 marks) Required: The following are four (4) independent situations. For each case, state the type of audit opinion which should be expressed and provide an explanation for your choice of audit opinion in each case shown below a) - d), as follows: a. Whilst auditing the Long-Term Investments account of Brownllow Medal Ltd., the auditor has been unable to obtain the audited financial statements for a material investment of an entity located in an overseas jurisdiction. The auditor concludes that sufficient and appropriate evidential matter regarding this investment cannot be obtained in the required time. Additionally, as the Audit Manager in charge of the audit-engagement, you have to weigh up the requirements of the audit-engagement with the additional cost of spending extra time at the client's premises. (2 marks) b. Due to recurring operating losses and ongoing working capital deficiencies, the auditor has some serious doubts about BMP Ltd.'s ability to continue as a going concern for a reasonable period of time. However, the financial statement disclosures concerning these matters, which you have now reviewed and evaluated are adequate, and the BMP Ltd. senior management team has been co-operative and helpful with all information requests. Nonetheless, your professional scepticism leads you to suspect there are likely to be serious operational challenges for BMP Ltd in the next twelve months. (3 marks) c. Mirabella Pty Ltd has completed the preparation of its financial statements for 2020/2021, but it has decided to exclude the Income Statement. The Chief Financial Officer (CFO) of Mirabella Pty Ltd explains to you that the users of their financial statements find the Income statement confusing, too long and unnecessary because the Balance Sheet already has the essential information which shareholders require. Accordingly, the CFO has refused to have the Income Statement in the annual report for the year ending 30/06/21. Furthermore, the CFO has implied that Mirrabella Pty Ltd will be seeking to appoint a different auditor for the next audit. (3 marks) d. Your client, Metro-Quinn Ltd, operates a chain of fast- food outlets throughout Australia. It is now the end of the audit and it was found that major internal control deficiencies exist in relation to the completeness of recording and banking of cash sales. Cash register tapes are not available to determine which cash sales amounts should have been recorded and banked. There is a lack of separation of duties between the custody of cash and its recording. Metro-Quinn Ltd senior management have not provided any explanation for these deficiencies, nor have they indicated that they will act on your recommendations to remediate the problems and issues in the internal control environment. (3 marks) Stich Question Audit Opinion (11 marks) Required: The following are four (4) independent situations. For each case, state the type of audit opinion which should be expressed and provide an explanation for your choice of audit opinion in each case shown below a) - d), as follows: a. Whilst auditing the Long-Term Investments account of Brownllow Medal Ltd., the auditor has been unable to obtain the audited financial statements for a material investment of an entity located in an overseas jurisdiction. The auditor concludes that sufficient and appropriate evidential matter regarding this investment cannot be obtained in the required time. Additionally, as the Audit Manager in charge of the audit-engagement, you have to weigh up the requirements of the audit-engagement with the additional cost of spending extra time at the client's premises. (2 marks) b. Due to recurring operating losses and ongoing working capital deficiencies, the auditor has some serious doubts about BMP Ltd.'s ability to continue as a going concern for a reasonable period of time. However, the financial statement disclosures concerning these matters, which you have now reviewed and evaluated are adequate, and the BMP Ltd. senior management team has been co-operative and helpful with all information requests. Nonetheless, your professional scepticism leads you to suspect there are likely to be serious operational challenges for BMP Ltd in the next twelve months. (3 marks) c. Mirabella Pty Ltd has completed the preparation of its financial statements for 2020/2021, but it has decided to exclude the Income Statement. The Chief Financial Officer (CFO) of Mirabella Pty Ltd explains to you that the users of their financial statements find the Income statement confusing, too long and unnecessary because the Balance Sheet already has the essential information which shareholders require. Accordingly, the CFO has refused to have the Income Statement in the annual report for the year ending 30/06/21. Furthermore, the CFO has implied that Mirrabella Pty Ltd will be seeking to appoint a different auditor for the next audit. (3 marks) d. Your client, Metro-Quinn Ltd, operates a chain of fast- food outlets throughout Australia. It is now the end of the audit and it was found that major internal control deficiencies exist in relation to the completeness of recording and banking of cash sales. Cash register tapes are not available to determine which cash sales amounts should have been recorded and banked. There is a lack of separation of duties between the custody of cash and its recording. Metro-Quinn Ltd senior management have not provided any explanation for these deficiencies, nor have they indicated that they will act on your recommendations to remediate the problems and issues in the internal control environment. (3 marks) StichStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started