Answered step by step

Verified Expert Solution

Question

1 Approved Answer

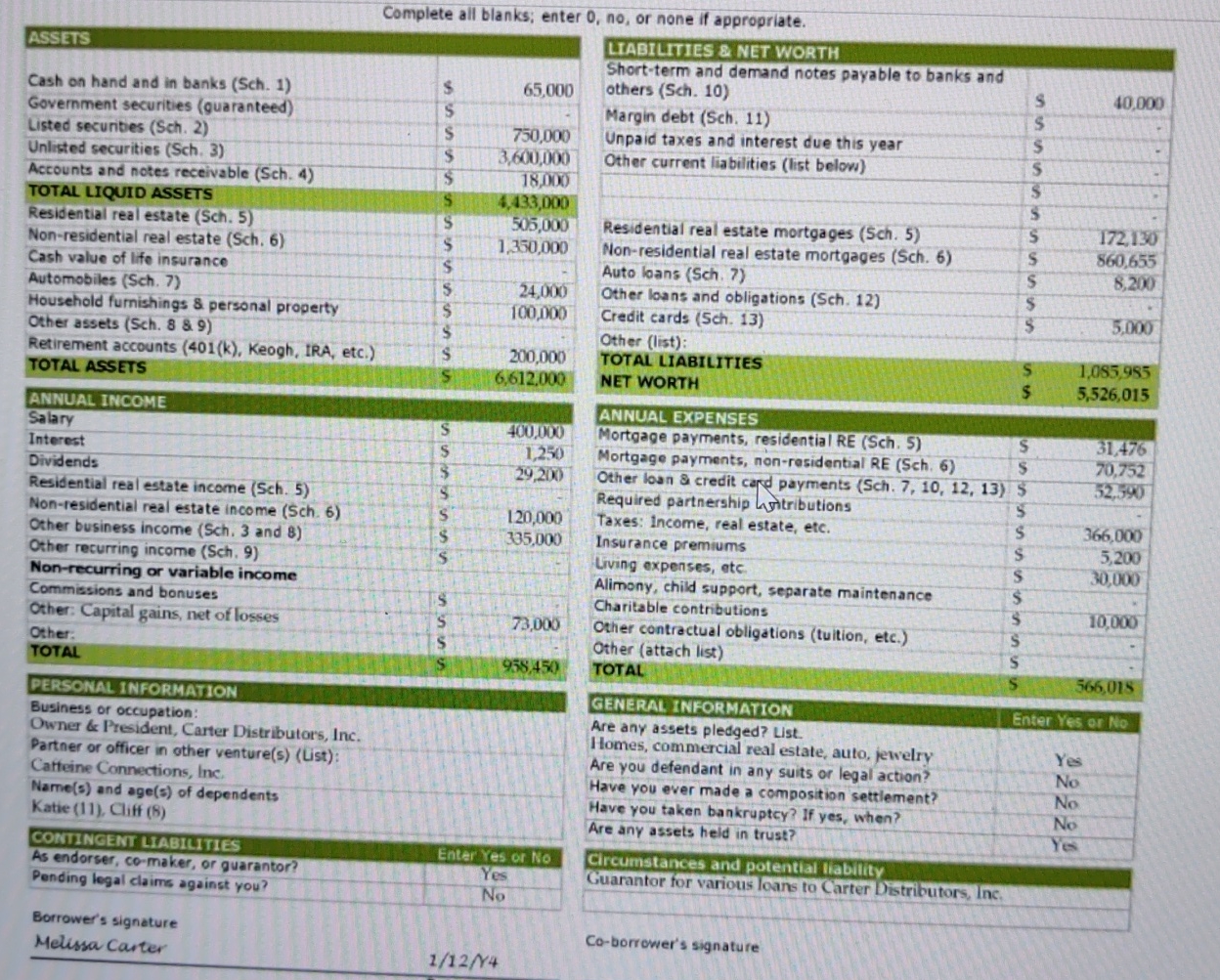

Question ( b ) Directions: Click the Case Link above and use the information provided in the Melissa Carter case and the following assumptions to

Question b

Directions: Click the Case Link above and use the information provided in the Melissa Carter case and the following assumptions to answer this question:

The amount in her retirement account can be converted to cash, but converting it would incur taxes and penalties totaling

The values shown for her residences and the land and building leased to Carter Distributors are verified amounts

Do not include the $ household furnishings and personal property when calculating adjusted net worth

As a guarantor for a loan to Carter Distributors, Inc., what is Melissa Carter's ratio of total liabilities to adjusted net worth?

ASSETSCash on hand and in banks SchGovernment securities quaranteedListed secunitbes SchUnlisted securities SchAccounts and notes receivable SchTOTAL LIQUID ASSETSResidential real estate SchNonresidential real estate SchCash value of life insuranceAutomobiles SchHousehold furnishings & personal propertyOther assets Sch & Retirement accounts k Keogh, IRA, etc.TOTAL ASSETSANNUAL INCOMESalaryInterestDividendsResidential real estate income SchNonresidential real estate income SchOther business income Sch and Other recurring income SchNonrecurring or variable incomeCommissions and bonusesOther: Capital gains, net of lossesOther.TOTALPERSONAL INFORMATIONBusiness or occupation:Owner & President, Carter Distributors, Inc.Partner or officer in other venturesUst:Catteine Connections, Inc.Names and ages of dependentsKatie Ciff CONTINGENT LIABILITIESAs endorser, comaker, or guarantor?Pending legal claims against you?Borrower's signatureMelussa CarterComplete all blanks; enter no or none if appropriate.SYNoEnter Yes or NoYesLIABILITIES & NET WORTHShortterm and demand notes payable to banks andothers SchMargin debt SchUnpaid taxes and interest due this yearOther current liabilities list beloResidential real estate mortgages SchNonresidential real estate mortgages SchAuto loans SchOther loans and obligations SchCredit cards SchOther list:TOTAL LIABILITIESNET WORTHANNUAL EXPENSESMortgage payments, residential RE SchMortgage payments, nonresidential RE SchOther loan & creditKequired partnerakPayments SchtributionsTaxes: Income, real estate, etc.Insurance premiumsUving expenses, etcAlimony, child support, separate maintenanceCharitable contributionsOther contractual obligations tulition etc.Other attach listTOTALGENERAL INFORMATIONAre any assets pledged? ListHomes, commercial real estate, auto, jewelryAre you defendant in any suits or legal action?Have you ever made a composition settlement?Have you taken bankruptcy? If yes, when?Are any assets heid in trust?Circumstances and potential liabilityGuarantor for various lons to Carter Distributors, IncCoborrower's signatureSSSYesNoNoNoYesEnter Yes or No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started