Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question B only- Please don't just post the answers, but explain how you got the numbers. Thanks. Problem 3-1 The two following separate cases show

Question B only- Please don't just post the answers, but explain how you got the numbers. Thanks.

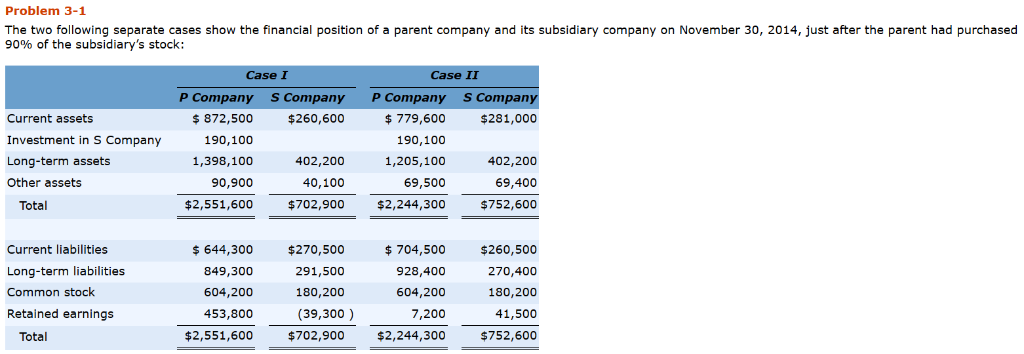

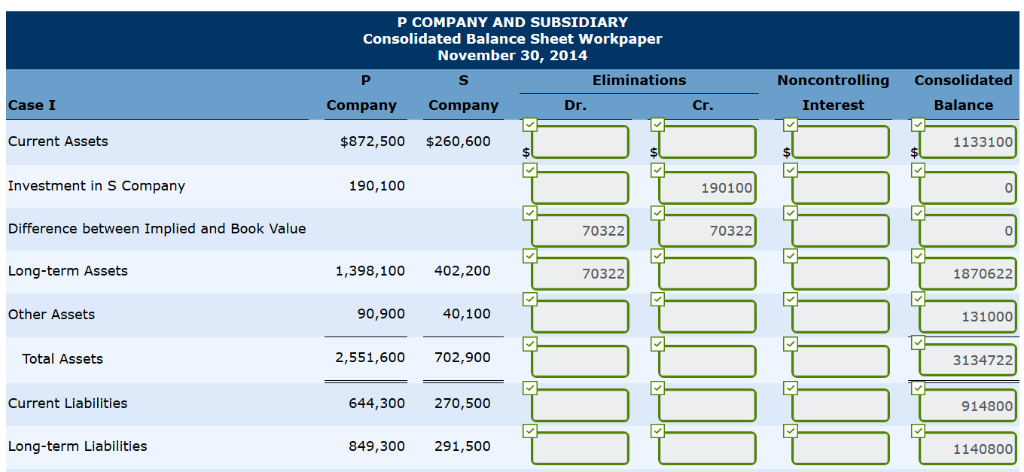

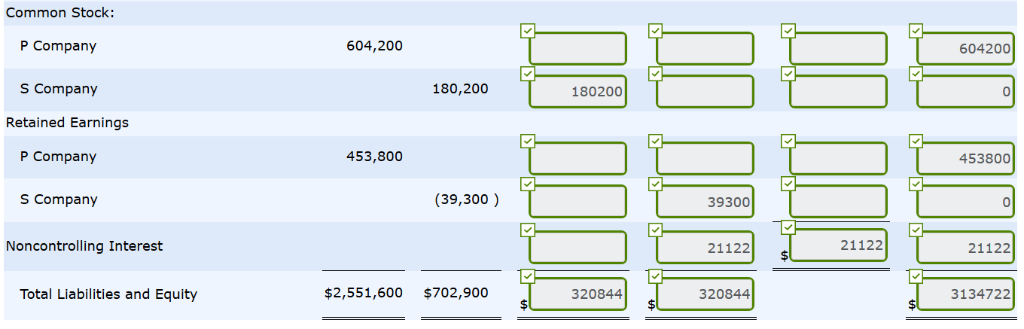

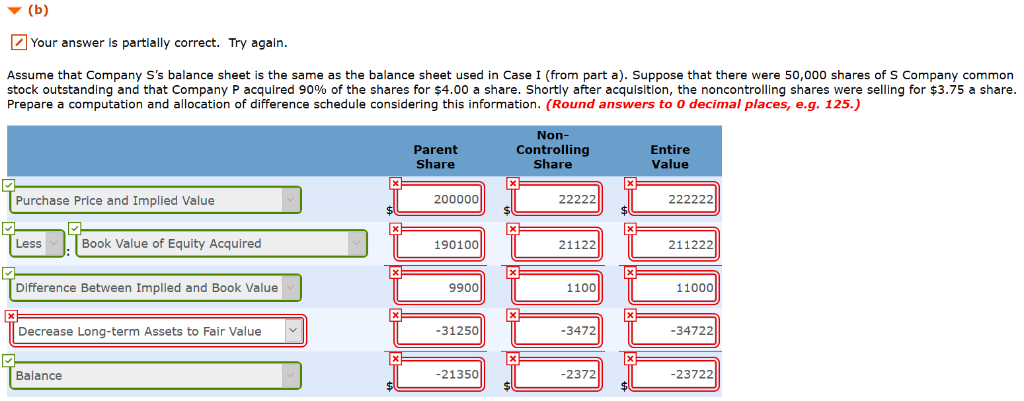

Problem 3-1 The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock; Case I Case II P Company $872,500 190,100 1,398,100 90,900 $2,551,600 S Company $260,600 P CompanyS Company Current assets Investment in S Company Long-term assets Other assets 779,600 190,100 1,205,100 69,500 $2,244,300 $281,000 402,200 40,100 $702,900 402,200 69,400 $752,600 Total Current liabilities Long-term liabilities Common stock Retained earnings $644,300 849,300 604,200 453,800 $2,551,600 $270,500 291,500 180,200 $704,500 928,400 604,200 7,200 $2,244,300 $260,500 270,400 180,200 41,500 $752,600 (39,300) Total $702,900 P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2014 Eliminations NoncontrollingConsolidated Case I Company Company Dr. Cr. Interest Balance Current Assets $872,500 $260,600 1133100 Investment in S Co mpany 190,100 190100 0 Difference between Implied and Book Value 70322 70322 0 Long-term Assets 1,398,100 402,200 70322 1870622 Other Assets 90,900 40,100 131000 Total Assets 2,551,600 702,900 3134722 Current Liabilities 644,300 270,500 914800 Long-term Liabilities 849,300 291,500 1140800 Common Stock P Company 604,200 604200 S Company 180,200 180200 0 Retained Earnings P Company 453,800 453800 S Company (39,300) 39300 Noncontrolling Interest 21122 $ 21122 21122 Total Liabilities and Equity $2,551,600 $702,900 320844 320844 3134722 Your answer is partially correct. Try again Assume that Company S's balance sheet is the same as the balance sheet used in Case I (from part a). Suppose that there were 50,000 shares of S Company common stock outstanding and that Company P acquired 90% of the shares for $4.00 a share. Shortly after acquisition, the noncontrolling shares were selling for $3.75 a share Prepare a computation and allocation of difference schedule considering this information. (Round answers to 0 decimal places, e.g. 125.) Parent Share Non- Controlling Share Entire Value Purchase Price and Implied Value 200000 Less Book Value of Equity Acquired 190100 21122 211222 Difference Between Implied and Book Value 9900 1100 11000 Decrease Long-term Assets to Fair Value -31250 3472 34722 Balance -21350 -2372 -23722

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started