Answered step by step

Verified Expert Solution

Question

1 Approved Answer

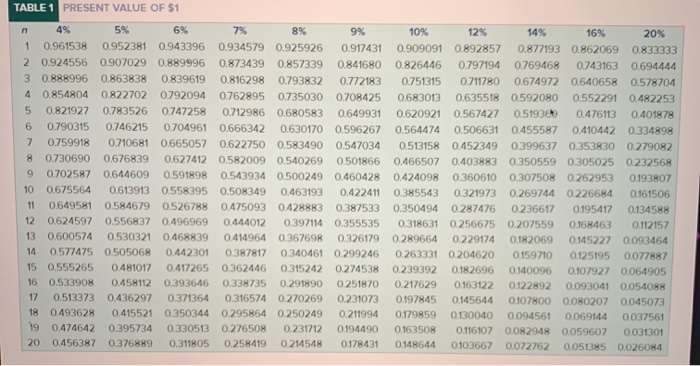

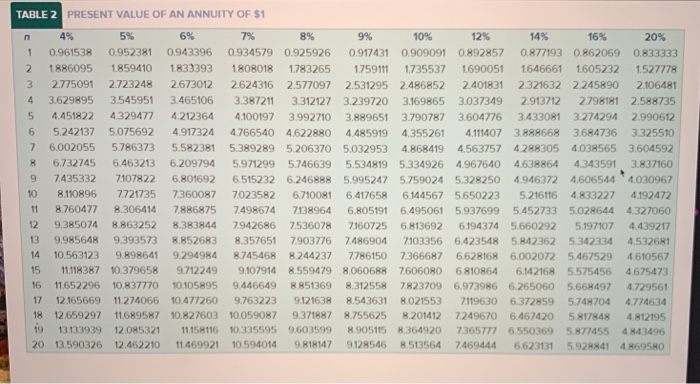

Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have

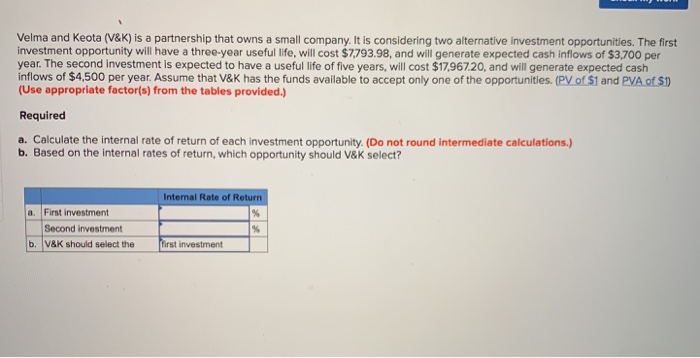

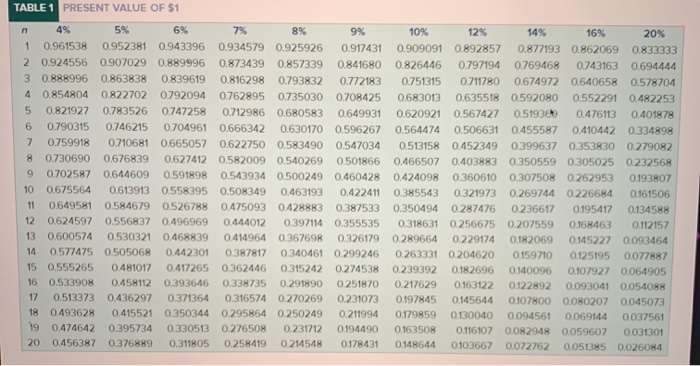

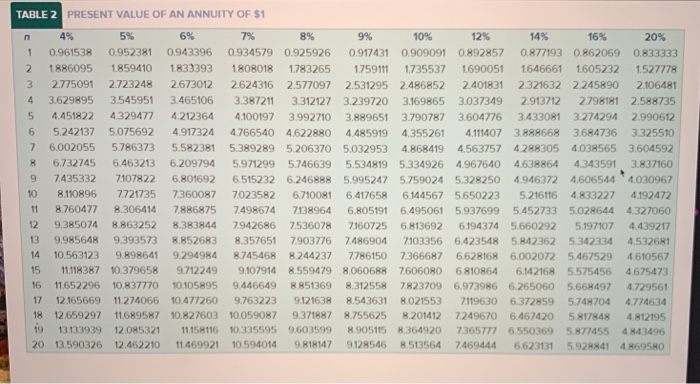

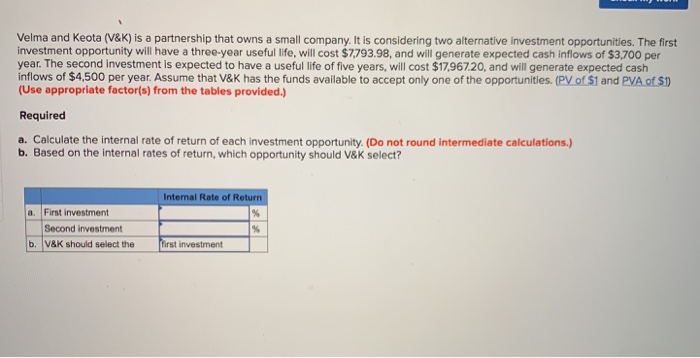

Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have a three-year useful life will cost $7.793.98, and will generate expected cash inflows of $3.700 per year. The second Investment is expected to have a useful life of five years, will cost $17.967.20, and will generate expected cash inflows of $4,500 per year. Assume that V&K has the funds available to accept only one of the opportunities. (PV of $1 and PVA of S1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the internal rate of return of each investment opportunity. (Do not round intermediate calculations.) b. Based on the internal rates of return, which opportunity should V&K select? Internal Rate of Return a. First investment Second investment b. V&K should select the first investment TABLE 1 PRESENT VALUE OF $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.8620690833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 30.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0751315 0711780 0.674972 0.640658 0.578704 4 0.85480408227020792094 0762895 0.735030 0708425 0683013 0635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0712986 0.680583 0.649931 0.620921 0.567427 0.51933 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0622750 0.583490 0.547034 0.513158 0,452349 0.399637 0.353830 0.279082 80730690 0.6768390.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.3505590.305025 0.232568 90.702587 0644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0193807 10 0.675564 0.6139130.558395 0.508349 0.463193 0.422411 0.385543 0.3219730.269744 0.226684 0.161506 11 0649581 0.584679 0.526788 0.475093 0.428883 0.3875330.350494 0.287476 0236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.2075590.168463 0.112157 13 0.600574 0.530321 0.4688390.414964 0.367698 0.3261790.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.4423010387817 0.340461 0.299246 0.263331 0204620 01597100125195 0077887 15 0.555265 0481017 0.417265 0.362446 0.315242 0274538 0.239392 0.182696 0.540096 0.107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.2176290.163122 0.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0231073 0.197845 0145644 0.107800 0080207 0.045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0179859 0130040 0.094561 0069144 0.037561 190.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0.059607 0031301 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.1486440103667 0.072762 0.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 4% 5% 6% 79 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.9090910892857 0.877193 0.862069 0.833333 2 1886095 185941018333931808018 1.783265 1759111 1735537 1.690051 1646661 1605232 1527778 3 2.775091 2.723248 2.673012 2624316 2.577097 2.531295 2.486852 2401831 2.321632 2.245890 2.106481 4 3.629895 3.545951 3.465106 3.387211 3.312127 3.239720 3.169865 3.0373492.913712 2.798181 2.588735 4.451822 4329477 4.212364 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 6 5.242137 5.075692 4.917324 4766540 4.622880 4.485919 4.355261 4.111407 3.888668 3.684736 3.325510 7 6.002055 57863735.582381 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 8 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 9 74353327107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.6065444 .030967 10 8.110896 7721735 7360087 7023582 6.710081 6.417658 6.144567 56502235.216116 4.833227 4.192472 11 8.760477 8.306414 7.886875 7498674 7138964 6.805191 6.495061 5.937699 5.452733 5.028644 4327060 129.385074 8.863252 8.383844 7942686 7.536078 7160725 6.813692 6.194374 5.660292 5.197107 4.439217 13 9.985648 9.393573 8.8526838.357651 7.903776 7486904 7103356 6.423548 5.842362 5.3423344532681 14 10.563123 9.898641 9.294984 8.745468 8.244237 7786150 7366687 6.628168 6.002072 5.467529 4610567 1511118387 10.379658 9.712249 9.107914 8.5594798060688 7606080 6810864 6.142168 5.575456 4.675473 16 11652296 10.837770 10.105895 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 5.668497 4.729561 17 12.165669 11.274066 10.477260 9.7632239121638 8.543631 8.021553 7119630 6.372859 57487044774634 18 12.659297 11689587 10.827603 10.059087 9371887 8.755625 8.201412 7249670 6.467420 5.817848 4.812195 19 13.133939 12.085321 11158116 10.335595 9.603599 8.9051158364920 7365777 6.550369 5.877455 4843496 20 13.590326 12.462210 11.469921 10.594014 9.818147 9.128546 8.513564 7469444 6.623131 5.928841 4869580

Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have a three-year useful life will cost $7.793.98, and will generate expected cash inflows of $3.700 per year. The second Investment is expected to have a useful life of five years, will cost $17.967.20, and will generate expected cash inflows of $4,500 per year. Assume that V&K has the funds available to accept only one of the opportunities. (PV of $1 and PVA of S1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the internal rate of return of each investment opportunity. (Do not round intermediate calculations.) b. Based on the internal rates of return, which opportunity should V&K select? Internal Rate of Return a. First investment Second investment b. V&K should select the first investment TABLE 1 PRESENT VALUE OF $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.8620690833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 30.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0751315 0711780 0.674972 0.640658 0.578704 4 0.85480408227020792094 0762895 0.735030 0708425 0683013 0635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0712986 0.680583 0.649931 0.620921 0.567427 0.51933 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0622750 0.583490 0.547034 0.513158 0,452349 0.399637 0.353830 0.279082 80730690 0.6768390.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.3505590.305025 0.232568 90.702587 0644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0193807 10 0.675564 0.6139130.558395 0.508349 0.463193 0.422411 0.385543 0.3219730.269744 0.226684 0.161506 11 0649581 0.584679 0.526788 0.475093 0.428883 0.3875330.350494 0.287476 0236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.2075590.168463 0.112157 13 0.600574 0.530321 0.4688390.414964 0.367698 0.3261790.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.4423010387817 0.340461 0.299246 0.263331 0204620 01597100125195 0077887 15 0.555265 0481017 0.417265 0.362446 0.315242 0274538 0.239392 0.182696 0.540096 0.107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.2176290.163122 0.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0231073 0.197845 0145644 0.107800 0080207 0.045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0179859 0130040 0.094561 0069144 0.037561 190.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0.059607 0031301 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.1486440103667 0.072762 0.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 4% 5% 6% 79 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.9090910892857 0.877193 0.862069 0.833333 2 1886095 185941018333931808018 1.783265 1759111 1735537 1.690051 1646661 1605232 1527778 3 2.775091 2.723248 2.673012 2624316 2.577097 2.531295 2.486852 2401831 2.321632 2.245890 2.106481 4 3.629895 3.545951 3.465106 3.387211 3.312127 3.239720 3.169865 3.0373492.913712 2.798181 2.588735 4.451822 4329477 4.212364 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 6 5.242137 5.075692 4.917324 4766540 4.622880 4.485919 4.355261 4.111407 3.888668 3.684736 3.325510 7 6.002055 57863735.582381 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 8 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 9 74353327107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.6065444 .030967 10 8.110896 7721735 7360087 7023582 6.710081 6.417658 6.144567 56502235.216116 4.833227 4.192472 11 8.760477 8.306414 7.886875 7498674 7138964 6.805191 6.495061 5.937699 5.452733 5.028644 4327060 129.385074 8.863252 8.383844 7942686 7.536078 7160725 6.813692 6.194374 5.660292 5.197107 4.439217 13 9.985648 9.393573 8.8526838.357651 7.903776 7486904 7103356 6.423548 5.842362 5.3423344532681 14 10.563123 9.898641 9.294984 8.745468 8.244237 7786150 7366687 6.628168 6.002072 5.467529 4610567 1511118387 10.379658 9.712249 9.107914 8.5594798060688 7606080 6810864 6.142168 5.575456 4.675473 16 11652296 10.837770 10.105895 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 5.668497 4.729561 17 12.165669 11.274066 10.477260 9.7632239121638 8.543631 8.021553 7119630 6.372859 57487044774634 18 12.659297 11689587 10.827603 10.059087 9371887 8.755625 8.201412 7249670 6.467420 5.817848 4.812195 19 13.133939 12.085321 11158116 10.335595 9.603599 8.9051158364920 7365777 6.550369 5.877455 4843496 20 13.590326 12.462210 11.469921 10.594014 9.818147 9.128546 8.513564 7469444 6.623131 5.928841 4869580

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started