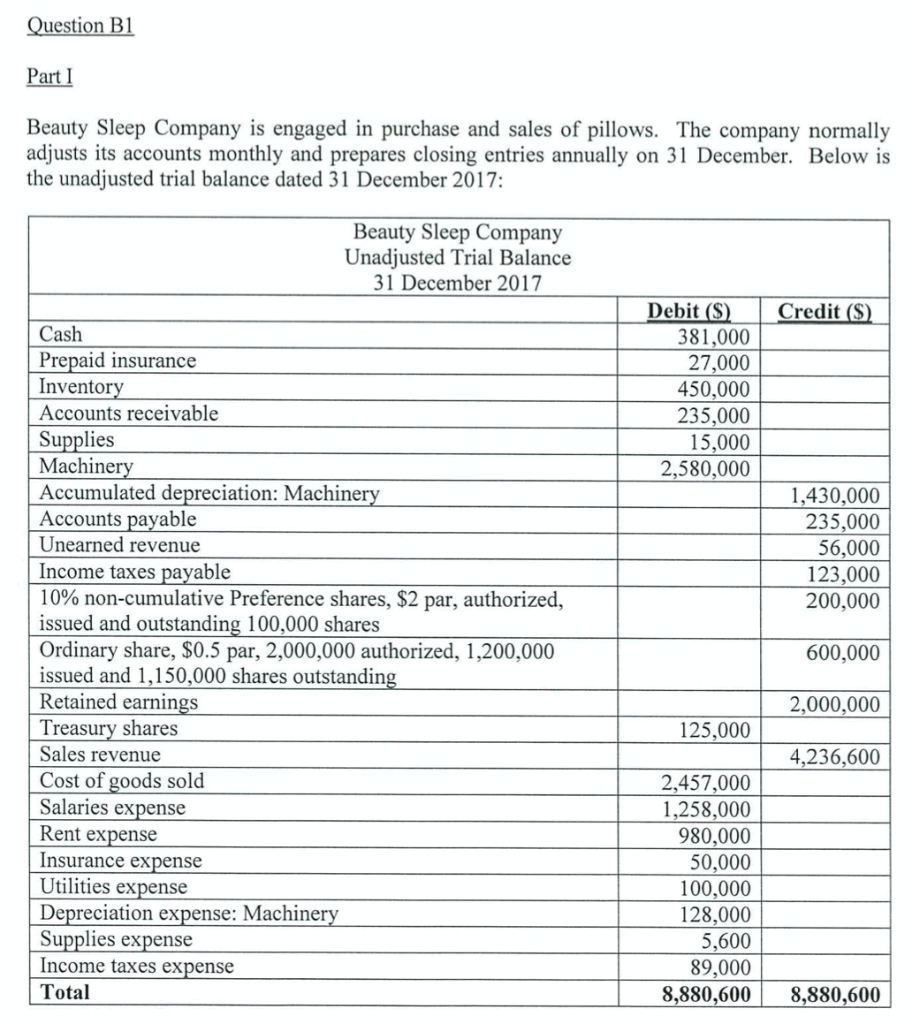

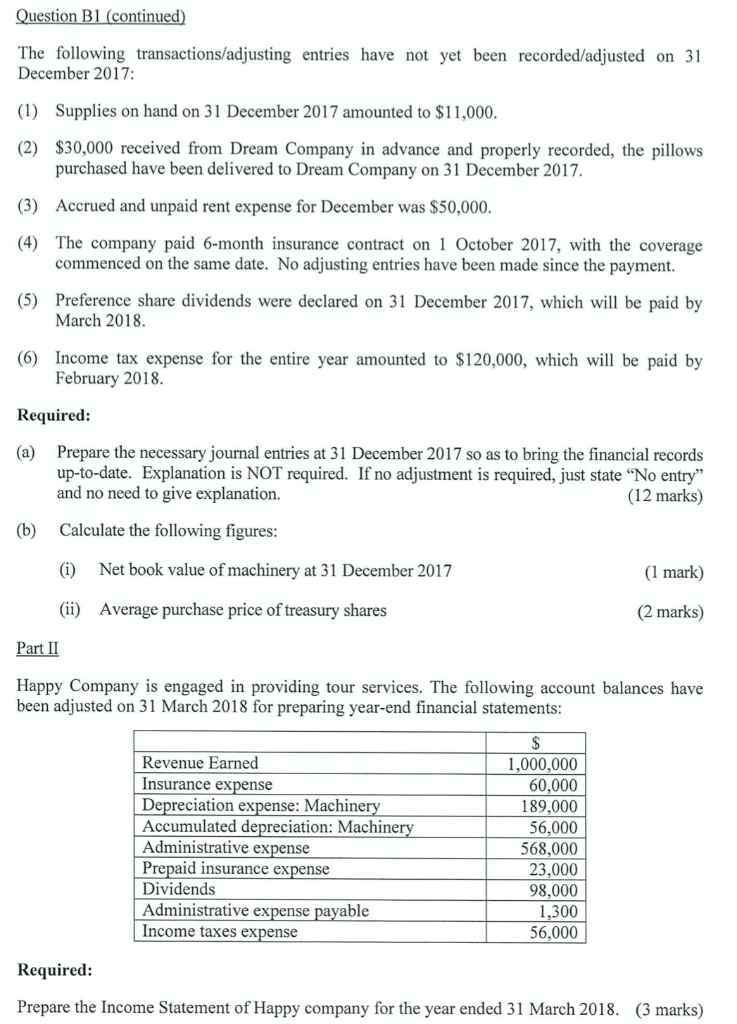

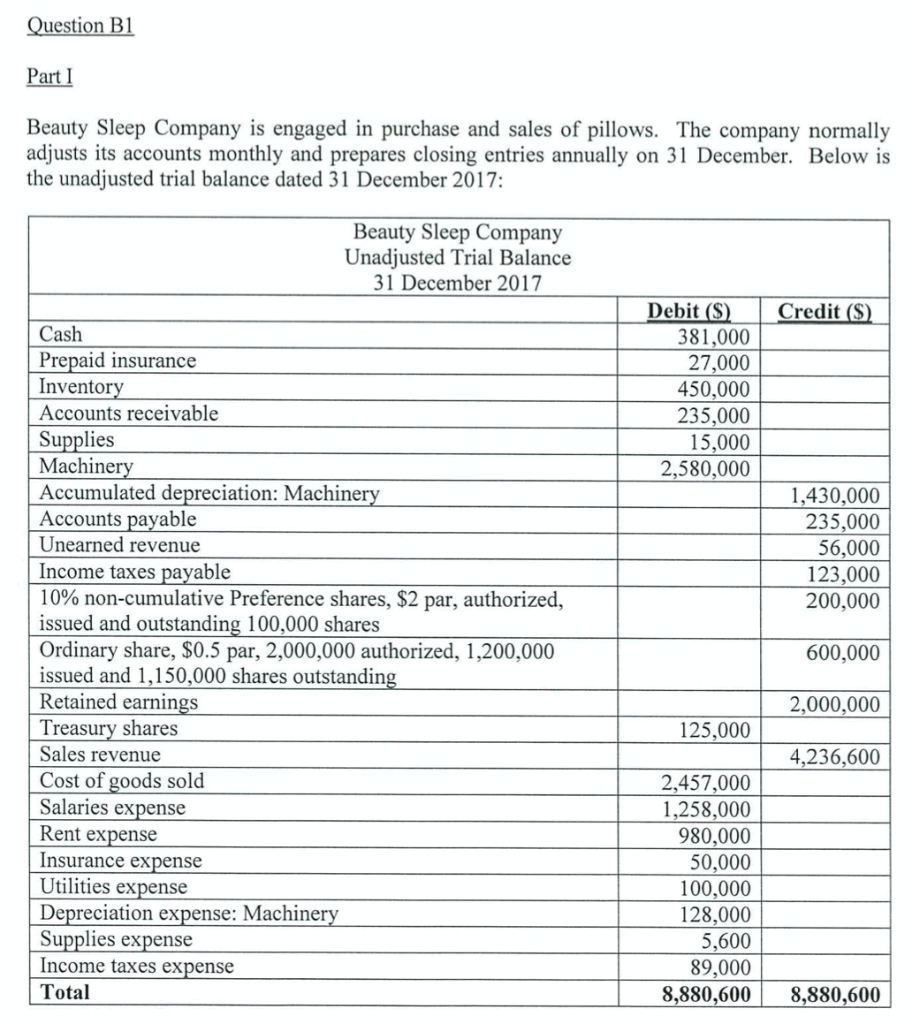

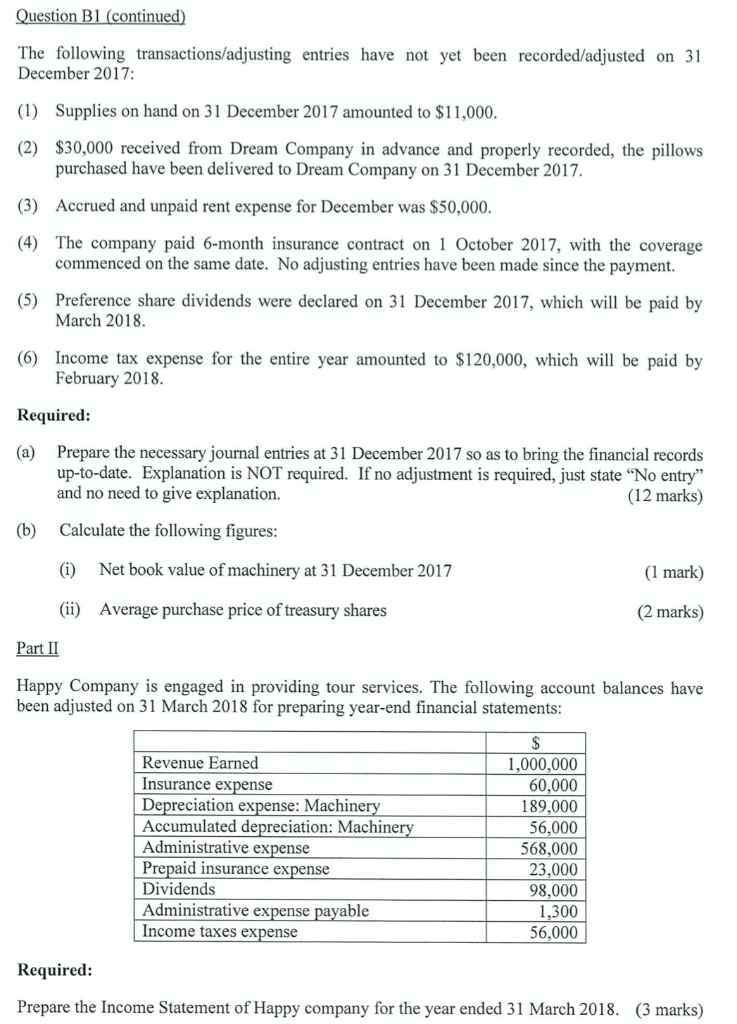

Question B1 Part I Beauty Sleep Company is engaged in purchase and sales of pillows. The company normally adjusts its accounts monthly and prepares closing entries annually on 31 December. Below is the unadjusted trial balance dated 31 December 2017: Beauty Sleep Company Unadjusted Trial Balance 31 December 2017 Credit (S) Debit (S) 381,000 27,000 450,000 235,000 15,000 2,580,000 1,430,000 235,000 56,000 123,000 200,000 Cash Prepaid insurance Inventory Accounts receivable Supplies Machinery Accumulated depreciation: Machinery Accounts payable Unearned revenue Income taxes payable 10% non-cumulative Preference shares, $2 par, authorized, issued and outstanding 100,000 shares Ordinary share, $0.5 par, 2,000,000 authorized, 1,200,000 issued and 1,150,000 shares outstanding Retained earnings Treasury shares Sales revenue Cost of goods sold Salaries expense Rent expense Insurance expense Utilities expense Depreciation expense: Machinery Supplies expense Income taxes expense Total 600,000 2,000,000 125,000 4,236,600 2,457,000 1,258,000 980,000 50,000 100,000 128,000 5,600 89,000 8,880,600 8,880,600 Question B1 (continued) The following transactions/adjusting entries have not yet been recorded/adjusted on 31 December 2017: (1) Supplies on hand on 31 December 2017 amounted to $11,000. (2) $30,000 received from Dream Company in advance and properly recorded, the pillows purchased have been delivered to Dream Company on 31 December 2017. (3) Accrued and unpaid rent expense for December was $50,000. (4) The company paid 6-month insurance contract on 1 October 2017, with the coverage commenced on the same date. No adjusting entries have been made since the payment. (5) Preference share dividends were declared on 31 December 2017, which will be paid by March 2018 (6) Income tax expense for the entire year amounted to $120,000, which will be paid by February 2018 Required: (a) Prepare the necessary journal entries at 31 December 2017 so as to bring the financial records up-to-date. Explanation is NOT required. If no adjustment is required, just state "No entry" and no need to give explanation. (12 marks) (b) Calculate the following figures: (i) Net book value of machinery at 31 December 2017 (1 mark) (2 marks) (ii) Average purchase price of treasury shares Part II Happy Company is engaged in providing tour services. The following account balances have been adjusted on 31 March 2018 for preparing year-end financial statements: Revenue Earned Insurance expense Depreciation expense: Machinery Accumulated depreciation: Machinery Administrative expense Prepaid insurance expense Dividends Administrative expense payable Income taxes expense 1,000,000 60,000 189,000 56,000 568,000 23,000 98,000 1,300 56,000 Required: Prepare the Income Statement of Happy company for the year ended 31 March 2018