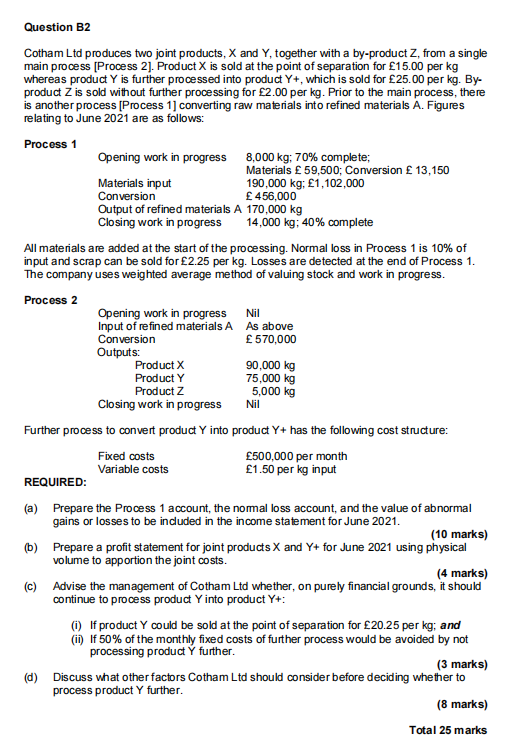

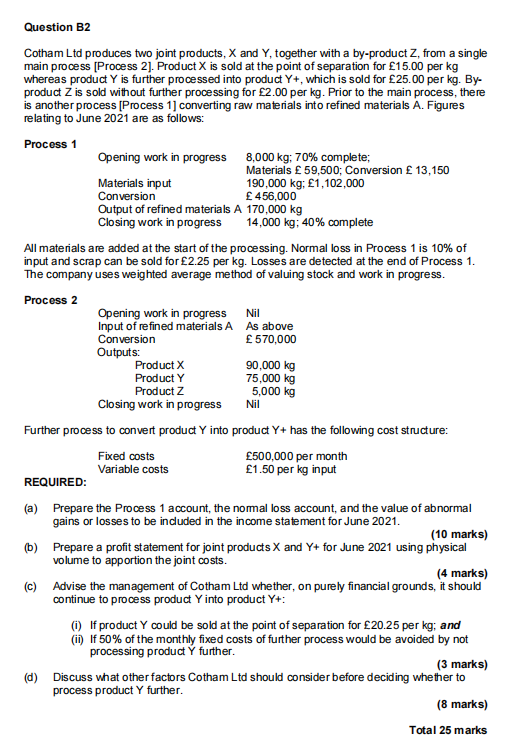

Question B2 Cotham Ltd produces two joint products, X and Y, together with a by-product Z, from a single main process [Process 2). Product X is sold at the point of separation for 15.00 per kg whereas product Y is further processed into product Y+, which is sold for 25.00 per kg. By- product Z is sold without further processing for 2.00 per kg. Prior to the main process, there is another process [Process 1] converting raw materials into refined materials A. Figures relating to June 2021 are as follows: Process 1 Opening work in progress 8,000 kg; 70% complete; Materials 59,500; Conversion 13,150 Materials input 190,000 kg; 1,102,000 Conversion 456,000 Output of refined materials A 170,000 kg Closing work in progress 14,000 kg; 40% complete All materials are added at the start of the processing. Normal loss in Process 1 is 10% of input and scrap can be sold for 2.25 per kg. Losses are detected at the end of Process 1. The company uses weighted average method of valuing stock and work in progress. Process 2 Opening work in progress Nil Input of refined materials A As above Conversion 570,000 Outputs: Product X 90,000 kg Product Y 75,000 kg Product Z 5,000 kg Closing work in progress Nil Further process to convert product Yinto product Y+ has the following cost structure: Fixed costs Variable costs 500,000 per month 1.50 per kg input REQUIRED: (a) Prepare the Process 1 account, the normal loss account, and the value of abnormal (10 marks) gains or losses to be induded in the income statement for June 2021. (6) Prepare a profit statement for joint products X and Y+ for June 2021 using physical volume to apportion the joint costs. (4 marks) (c) Advise the management of Cotham Ltd whether, on purely financial grounds, it should continue to process product Yinto product Y+: () If product Y could be sold at the point of separation for 20.25 per kg; and (1) If 50% of the monthly fixed costs of further process would be avoided by not processing product further. (3 marks) (d) Discuss what other factors Cotham Ltd should consider before deciding whether to process product Y further. (8 marks) Total 25 marks Question B2 Cotham Ltd produces two joint products, X and Y, together with a by-product Z, from a single main process [Process 2). Product X is sold at the point of separation for 15.00 per kg whereas product Y is further processed into product Y+, which is sold for 25.00 per kg. By- product Z is sold without further processing for 2.00 per kg. Prior to the main process, there is another process [Process 1] converting raw materials into refined materials A. Figures relating to June 2021 are as follows: Process 1 Opening work in progress 8,000 kg; 70% complete; Materials 59,500; Conversion 13,150 Materials input 190,000 kg; 1,102,000 Conversion 456,000 Output of refined materials A 170,000 kg Closing work in progress 14,000 kg; 40% complete All materials are added at the start of the processing. Normal loss in Process 1 is 10% of input and scrap can be sold for 2.25 per kg. Losses are detected at the end of Process 1. The company uses weighted average method of valuing stock and work in progress. Process 2 Opening work in progress Nil Input of refined materials A As above Conversion 570,000 Outputs: Product X 90,000 kg Product Y 75,000 kg Product Z 5,000 kg Closing work in progress Nil Further process to convert product Yinto product Y+ has the following cost structure: Fixed costs Variable costs 500,000 per month 1.50 per kg input REQUIRED: (a) Prepare the Process 1 account, the normal loss account, and the value of abnormal (10 marks) gains or losses to be induded in the income statement for June 2021. (6) Prepare a profit statement for joint products X and Y+ for June 2021 using physical volume to apportion the joint costs. (4 marks) (c) Advise the management of Cotham Ltd whether, on purely financial grounds, it should continue to process product Yinto product Y+: () If product Y could be sold at the point of separation for 20.25 per kg; and (1) If 50% of the monthly fixed costs of further process would be avoided by not processing product further. (3 marks) (d) Discuss what other factors Cotham Ltd should consider before deciding whether to process product Y further. (8 marks) Total 25 marks