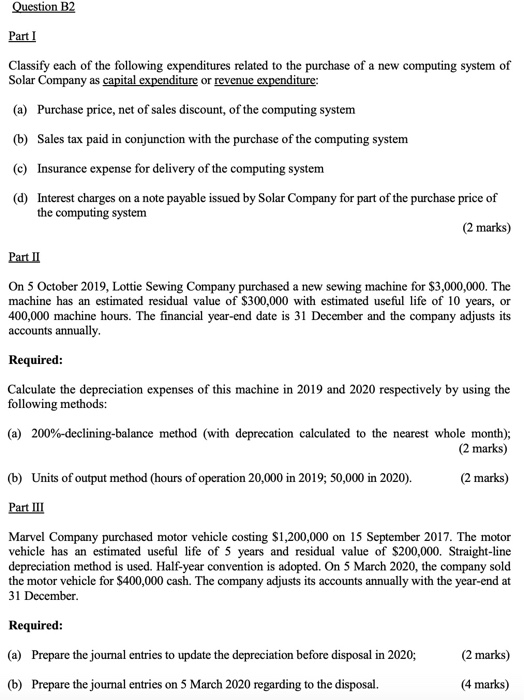

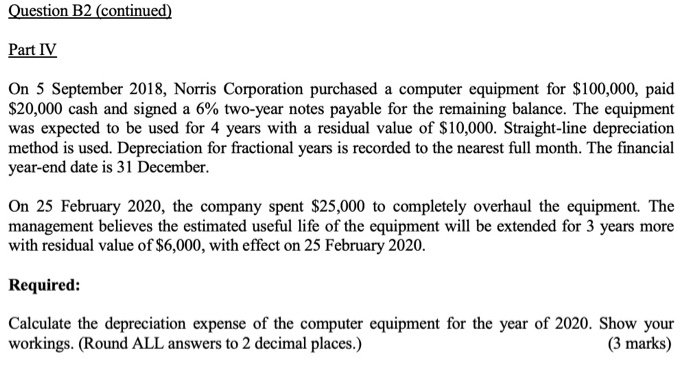

Question B2 Part I Classify each of the following expenditures related to the purchase of a new computing system of Solar Company as capital expenditure or revenue expenditure: (a) Purchase price, net of sales discount, of the computing system (b) Sales tax paid in conjunction with the purchase of the computing system (c) Insurance expense for delivery of the computing system (d) Interest charges on a note payable issued by Solar Company for part of the purchase price of the computing system (2 marks) Part II On 5 October 2019, Lottie Sewing Company purchased a new sewing machine for $3,000,000. The machine has an estimated residual value of $300,000 with estimated useful life of 10 years, or 400,000 machine hours. The financial year-end date is 31 December and the company adjusts its accounts annually. Required: Calculate the depreciation expenses of this machine in 2019 and 2020 respectively by using the following methods: a) 200%-declining-balance method (with deprecation calculated to the nearest whole month); (2 marks) (b) Units of output method (hours of operation 20,000 in 2019; 50,000 in 2020). (2 marks) Part III Marvel Company purchased motor vehicle costing $1,200,000 on 15 September 2017. The motor vehicle has an estimated useful life of 5 years and residual value of $200,000. Straight-line depreciation method is used. Half-year convention is adopted. On 5 March 2020, the company sold the motor vehicle for $400,000 cash. The company adjusts its accounts annually with the year-end at 31 December Required: (2 marks) (a) Prepare the journal entries to update the depreciation before disposal in 2020; (b) Prepare the journal entries on 5 March 2020 regarding to the disposal. (4 marks) Question B2 (continued) Part IV On 5 September 2018, Norris Corporation purchased a computer equipment for $100,000, paid $20,000 cash and signed a 6% two-year notes payable for the remaining balance. The equipment was expected to be used for 4 years with a residual value of $10,000. Straight-line depreciation method is used. Depreciation for fractional years is recorded to the nearest full month. The financial year-end date is 31 December. On 25 February 2020, the company spent $25,000 to completely overhaul the equipment. The management believes the estimated useful life of the equipment will be extended for 3 years more with residual value of $6,000, with effect on 25 February 2020. Required: Calculate the depreciation expense of the computer equipment for the year of 2020. Show your workings. (Round ALL answers to 2 decimal places.)