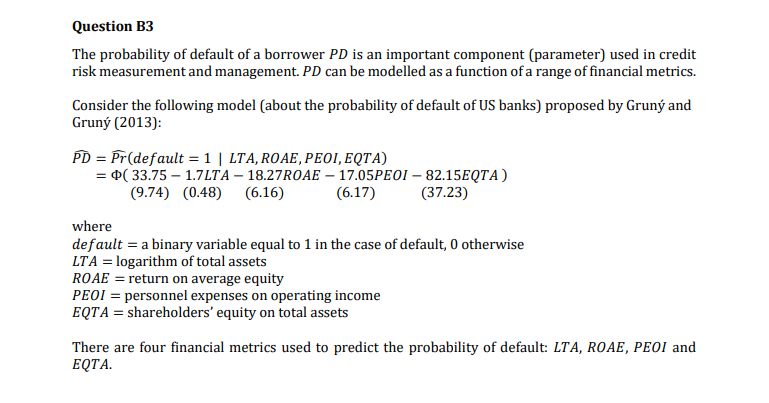

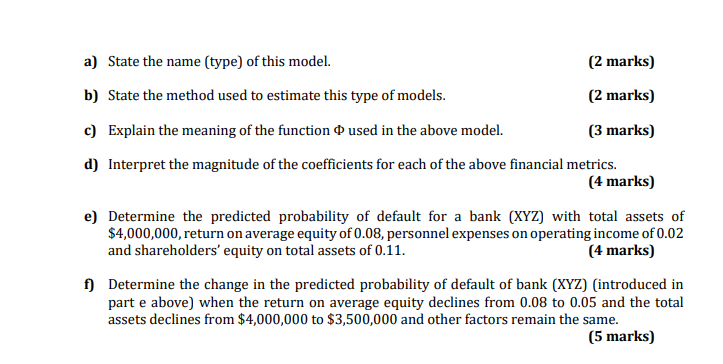

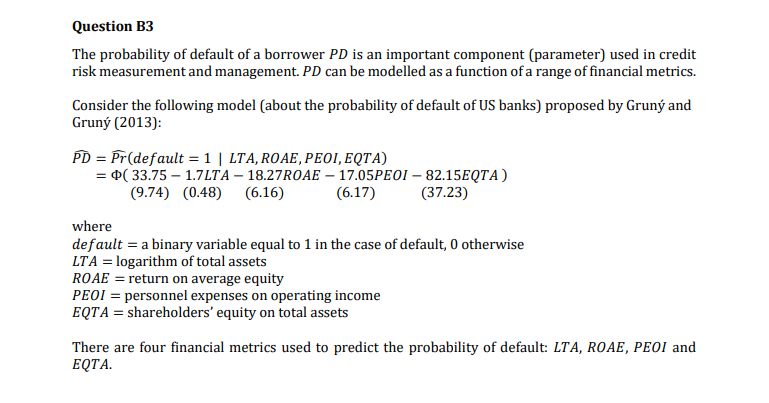

Question B3 The probability of default of a borrower PD is an important component (parameter) used in credit risk measurement and management. PD can be modelled as a function of a range of financial metrics. Consider the following model (about the probability of default of US banks) proposed by Grun and Grun (2013): PD = Pr(default = 1 | LTA, ROAE, PEOI, EQTA) = (33.75 1.7LTA 18.27ROAE 17.05PEOI - 82.15EQTA) (9.74) (0.48) (6.16) (6.17) (37.23) where default = a binary variable equal to 1 in the case of default, 0 otherwise LTA = logarithm of total assets ROAE = return on average equity PEOI = personnel expenses on operating income EQTA = shareholders' equity on total assets There are four financial metrics used to predict the probability of default: LTA, ROAE, PEOI and EQTA. a) State the name (type) of this model. (2 marks) b) State the method used to estimate this type of models. (2 marks) c) Explain the meaning of the function o used in the above model. (3 marks) d) Interpret the magnitude of the coefficients for each of the above financial metrics. (4 marks) e) Determine the predicted probability of default for a bank (XYZ) with total assets of $4,000,000, return on average equity of 0.08, personnel expenses on operating income of 0.02 and shareholders' equity on total assets of 0.11. (4 marks) f) Determine the change in the predicted probability of default of bank (XYZ) (introduced in part e above) when the return on average equity declines from 0.08 to 0.05 and the total assets declines from $4,000,000 to $3,500,000 and other factors remain the same. (5 marks) Question B3 The probability of default of a borrower PD is an important component (parameter) used in credit risk measurement and management. PD can be modelled as a function of a range of financial metrics. Consider the following model (about the probability of default of US banks) proposed by Grun and Grun (2013): PD = Pr(default = 1 | LTA, ROAE, PEOI, EQTA) = (33.75 1.7LTA 18.27ROAE 17.05PEOI - 82.15EQTA) (9.74) (0.48) (6.16) (6.17) (37.23) where default = a binary variable equal to 1 in the case of default, 0 otherwise LTA = logarithm of total assets ROAE = return on average equity PEOI = personnel expenses on operating income EQTA = shareholders' equity on total assets There are four financial metrics used to predict the probability of default: LTA, ROAE, PEOI and EQTA. a) State the name (type) of this model. (2 marks) b) State the method used to estimate this type of models. (2 marks) c) Explain the meaning of the function o used in the above model. (3 marks) d) Interpret the magnitude of the coefficients for each of the above financial metrics. (4 marks) e) Determine the predicted probability of default for a bank (XYZ) with total assets of $4,000,000, return on average equity of 0.08, personnel expenses on operating income of 0.02 and shareholders' equity on total assets of 0.11. (4 marks) f) Determine the change in the predicted probability of default of bank (XYZ) (introduced in part e above) when the return on average equity declines from 0.08 to 0.05 and the total assets declines from $4,000,000 to $3,500,000 and other factors remain the same