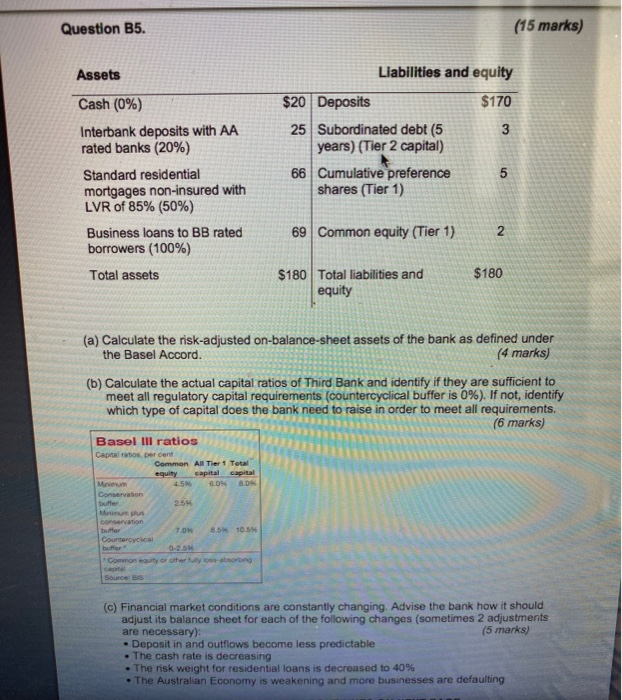

Question B5. (15 marks) Assets Cash (0%) Interbank deposits with AA rated banks (20%) Standard residential mortgages non-insured with LVR of 85% (50%) Liabilities and equity $20 Deposits $170 25 Subordinated debt (5 years) (Tier 2 capital) 66 Cumulative preference shares (Tier 1) on Business loans to BB rated borrowers (100%) 69 Common equity (Tier 1) 2 Total assets $180 $180 Total liabilities and equity (a) Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under the Basel Accord (4 marks) (b) Calculate the actual capital ratios of Third Bank and identify if they are sufficient to meet all regulatory capital requirements (countercyclical buffer is 0%). If not, identify which type of capital does the bank need to raise in order to meet all requirements. (6 marks) Basel lll ratios Common A Tier To equity capital capital buffer -Common Equity or other tuty los atsoron (c) Financial market conditions are constantly changing. Advise the bank how it should adjust its balance sheet for each of the following changes (sometimes 2 adjustments are necessary): (5 marks) - Deposit in and outflows become less predictable . The cash rate is decreasing The risk weight for residential loans is decreased to 40% The Australian Economy is weakening and more businesses are defaulting Question B5. (15 marks) Assets Cash (0%) Interbank deposits with AA rated banks (20%) Standard residential mortgages non-insured with LVR of 85% (50%) Liabilities and equity $20 Deposits $170 25 Subordinated debt (5 years) (Tier 2 capital) 66 Cumulative preference shares (Tier 1) on Business loans to BB rated borrowers (100%) 69 Common equity (Tier 1) 2 Total assets $180 $180 Total liabilities and equity (a) Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under the Basel Accord (4 marks) (b) Calculate the actual capital ratios of Third Bank and identify if they are sufficient to meet all regulatory capital requirements (countercyclical buffer is 0%). If not, identify which type of capital does the bank need to raise in order to meet all requirements. (6 marks) Basel lll ratios Common A Tier To equity capital capital buffer -Common Equity or other tuty los atsoron (c) Financial market conditions are constantly changing. Advise the bank how it should adjust its balance sheet for each of the following changes (sometimes 2 adjustments are necessary): (5 marks) - Deposit in and outflows become less predictable . The cash rate is decreasing The risk weight for residential loans is decreased to 40% The Australian Economy is weakening and more businesses are defaulting