Answered step by step

Verified Expert Solution

Question

1 Approved Answer

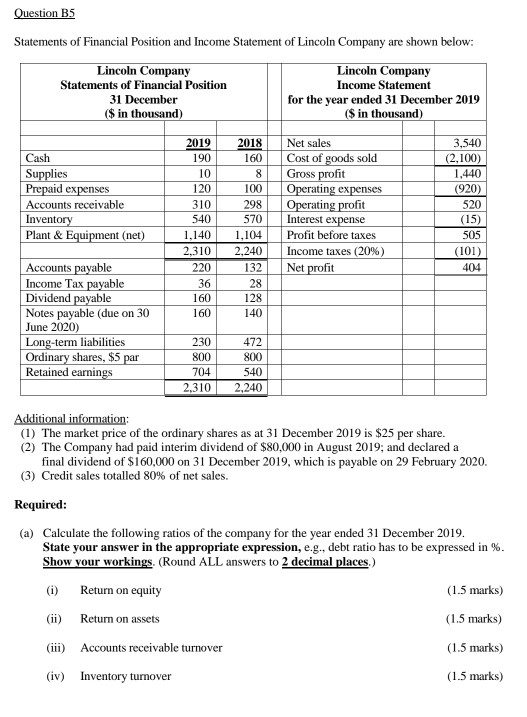

Question B5 Statements of Financial Position and Income Statement of Lincoln Company are shown below: Lincoln Company Statements of Financial Position 31 December ($ in

Question B5 Statements of Financial Position and Income Statement of Lincoln Company are shown below: Lincoln Company Statements of Financial Position 31 December ($ in thousand) Lincoln Company Income Statement for the year ended 31 December 2019 (S in thousand) Cash Supplies Prepaid expenses Accounts receivable Inventory Plant & Equipment (net) 2019 190 10 120 310 540 1.140 2.310 2018 160 8 100 2 98 570 1.104 2.240 132 28 128 140 Net sales Cost of goods sold Gross profit Operating expenses Operating profit Interest expense Profit before taxes Income taxes (20%) Net profit 3,540 (2.100) 1.440 (920) 520 (15) 505 (101) 36 160 160 Accounts payable Income Tax payable Dividend payable Notes payable (due on 30 June 2020) Long-term liabilities Ordinary shares, $5 par Retained earnings 230 800 704 2.310 472 800 540 2,240 Additional information: (1) The market price of the ordinary shares as at 31 December 2019 is $25 per share. (2) The Company had paid interim dividend of $80,000 in August 2019, and declared a final dividend of $160,000 on 31 December 2019, which is payable on 29 February 2020. (3) Credit sales totalled 80% of net sales. Required: (a) Calculate the following ratios of the company for the year ended 31 December 2019. State your answer in the appropriate expression, e.g., debt ratio has to be expressed in %. Show your workings (Round ALL answers to 2 decimal places.) (1) Return on equity (1.5 marks) (ii) Return on assets (1.5 marks) (iii) Accounts receivable turnover (1.5 marks) (iv) Inventory tumover (1.5 marks) (1.5 marks) (v) (vi) Price earnings ratio Dividend yield (1.5 marks) (vii) Quick ratio (1.5 marks) (viii) Debt ratio (1.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started