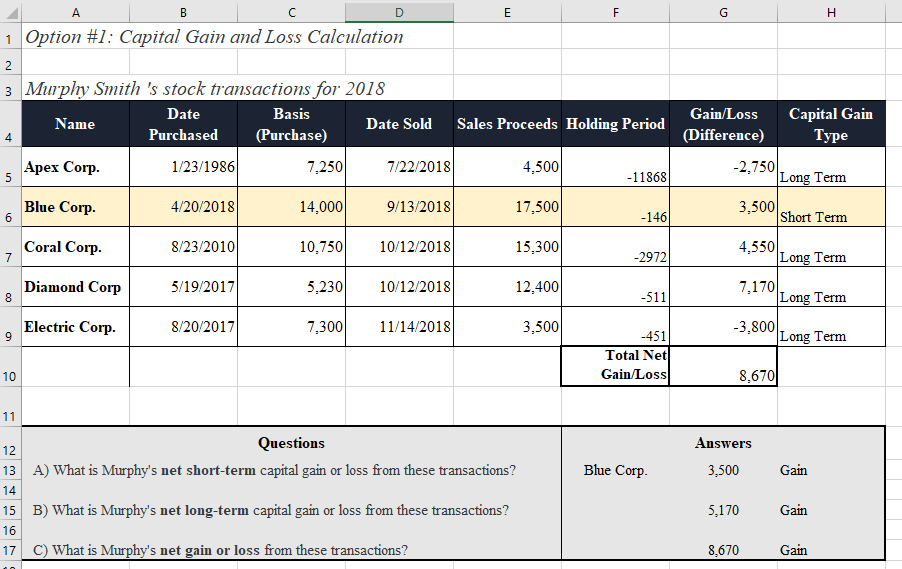

Question: Question: Based on (a) through (c), complete Murphy's Schedule D using the IRS fillable tax forms. B E F G I A 1 Option #1:

Question: Based on (a) through (c), complete Murphy's Schedule D using the IRS fillable tax forms.

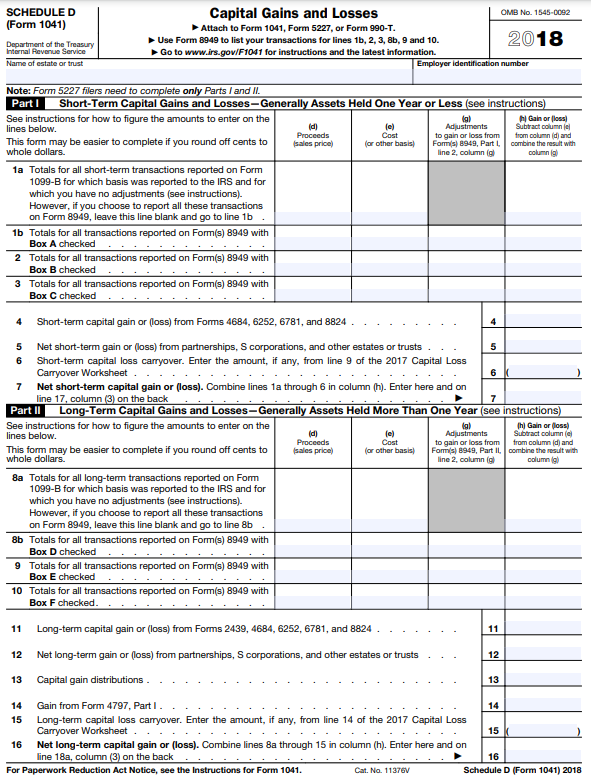

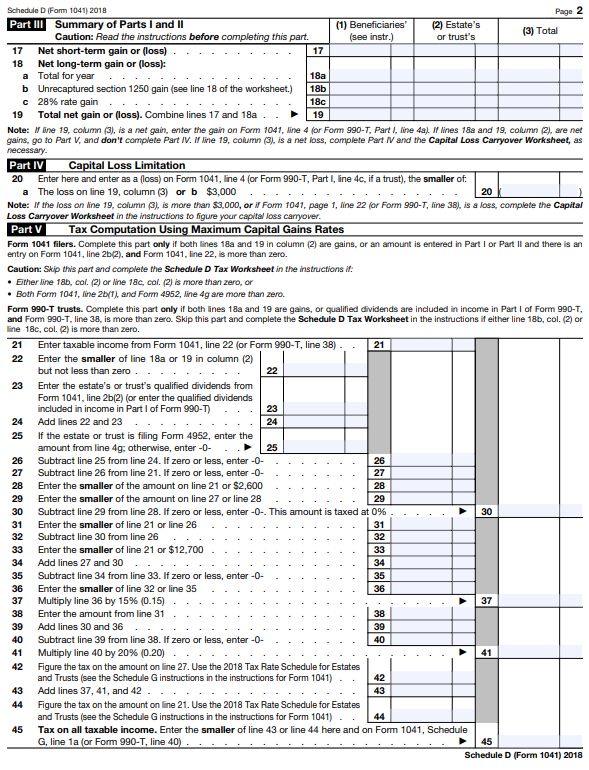

B E F G I A 1 Option #1: Capital Gain and Loss Calculation 2 3 Murphy Smith 's stock transactions for 2018 Date Basis Name Date Sold 4 Purchased Sales Proceeds Holding Period (Purchase) Apex Corp. 1/23/1986 7.250 7/22/2018 4,500 5 -11868 Gain/Loss (Difference) Capital Gain Type -2.750 Long Term 3,500 Short Term Blue Corp 4/20/2018) 14,000 9/13/2018 17,500 6 -146 Coral Corp 8/23/2010 10.750 10/12/2018 15,300 7 -2972 Diamond Corp 5/19/2017 5,230 10/12/2018 12.400 8 -511 4,550 Long Term 7.170 Long Term -3.800 Long Term Electric Corp. 8/20/2017 7,300 11/14/2018 3,500 9 -451 Total Net Gain/Loss 10 8,6701 11 Answers 12 Questions A) What is Murphy's net short-term capital gain or loss from these transactions? 13 Blue Corp 3,500 Gain 14 15 B) What is Murphy's net long-term capital gain or loss from these transactions? 5,170 Gain 16 17 C) What is Murphy's net gain or loss from these transactions? 8,670 Gain SCHEDULED (Form 1041) Capital Gains and Losses OMB No. 1545-0092 Attach to Form 1041, Form 5227, or Form 990-T. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9 and 10. 2018 Go to www.irs.gov/F1041 for instructions and the latest information Employer identification number Department of the Treasury Internal Revenue Service Name of estate ar trust Note: Form 5227 filers need to complete only Parts I and II. Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lal Hi Gain or loss (d) lines below. le) Adjustments Subtract column Proceeds Cost to gain or loss from from column id and This form may be easier to complete if you round off cents to sales price for other basis Fomis) 8949, Part 1. combine the result with whole dollars. line 2 column column 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 to gain or loss from 4 Short-term capital gain or loss) from Forms 4684,6252, 6781, and 8824 5 Net short-term gain or loss) from partnerships, Scorporations, and other estates or trusts. 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 9 of the 2017 Capital Loss Carryover Worksheet. 6 7 Net short-term capital gain or (loss). Combine lines ta through 6 in column (h). Enter here and on line 17, column (3) on the back 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lal th Gain or loss) lines below. (d) Adjustments Subtract column Proceeds Cost from column id and This form may be easier to complete if you round off cents to sales price for other basis) Fomis) 8949, Part It combine the result with whole dollars. line 2 columna column 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b. 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Long-term capital gain or loss) from Forms 2439, 4684,6252, 6781, and 8824. 11 12 Net long-term gain or loss) from partnerships, S corporations, and other estates or trusts 12 13 Capital gain distributions. 13 14 Gain from Form 4797, Part I. 14 15 Long-term capital loss carryover. Enter the amount, if any, from line 14 of the 2017 Capital Loss Carryover Worksheet. 15 16 Net long-term capital gain or loss). Combine lines Ba through 15 in column (h). Enter here and on line 18a, column (3) on the back 16 For Paperwork Reduction Act Notice, see the Instructions for Form 1041. Cat. Na. 11376V Schedule D (Form 1041) 2018 Page 2 Schedule D (Form 1041) 2018 Part III Summary of Parts I and II (1) Beneficiaries (2) Estate's Caution: Read the instructions before completing this part. (see instr.) or trust's (3) Total 17 Net short-term gain or loss) 17 18 Net long-term gain or loss): a Total for year 18a b Unrecaptured section 1250 gain (see line 18 of the worksheet.) 18b C 28% rate gain 18c 19 Total net gain or loss). Combine lines 17 and 18a 19 Note: I line 19, column (3), is a net gain, enter the gain on Form 1041, line 4 for Form 990-T, Part I, line 48). If lines 18 and 19, column (2), are net gains, go to Part V, and don't complete Part IV. If line 19. column (3), is a net loss, complete Part 1 and the Capital Loss Carryover Worksheet, as necessary Part IV Capital Loss Limitation 20 Enter here and enter as a loss) on Form 1041, line 4 (or Form 990-T, Part 1, line 4c, if a trust), the smaller of: a The loss on line 19, column (3) or b $3,000 20 Note: If the loss on line 19, column 3), is more than $3,000, or il Form 1041, page 1, line 22 (or Form 990-T, line 38), is a loss, complete the Capital Loss Carryover Worksheet in the instructions to figure your capital loss carryover. Part V Tax Computation Using Maximum Capital Gains Rates Form 1041 filers. Complete this part only if both lines 18 and 19 in column (2) are gains, or an amount is entered in Part I or Part II and there is an entry on Form 1041, line 26(2), and Form 1041, line 22, is more than zero. Caution: Skip this part and complete the Schedule D Tax Worksheet in the instructions if: . Either line 18b, col. (2) or line 18c, col. (2) is more than zero, or Both Form 1041, line 25/1), and Form 4952, line 4g are more than zero. Form 990-T trusts. Complete this part only if both lines 18 and 19 are gains, or qualified dividends are included in income in Part 1 of Form 990-T, and Form 990-T, line 38, is more than zero. Skip this part and complete the Schedule D Tax Worksheet in the instructions il either line 18b, col. (2) or line 18c, col. (2) is more than zero. 21 Enter taxable income from Form 1041, line 22 (or Form 990-T, line 38) - 21 22 Enter the smaller of line 189 or 19 in column (2) but not less than zero. 22 23 Enter the estate's or trust's qualified dividends from Form 1041, line 26(2) (or enter the qualified dividends included in income in Part 1 of Form 990-T) 23 24 Add lines 22 and 23 24 25 If the estate or trust is filing Form 4952, enter the amount from line 4g; otherwise, enter-O- 25 26 Subtract line 25 from line 24. If zero or less, enter-O- 26 27 Subtract line 26 from line 21. If zero or less, enter-O- 27 28 Enter the smaller of the amount on line 21 or $2,600 28 29 Enter the smaller of the amount on line 27 or line 28 29 30 Subtract line 29 from line 28. If zero or less, enter-O-. This amount is taxed at 0% 30 31 Enter the smaller of line 21 or line 26 31 32 Subtract line 30 from line 26 32 33 Enter the smaller of line 21 or $12,700 33 34 Add lines 27 and 30 34 35 Subtract line 34 from line 33. If zero or less, enter-O- 35 36 Enter the smaller of line 32 or line 35 36 37 Multiply line 36 by 15% (0.15) 37 38 Enter the amount from line 31 38 39 Add lines 30 and 36 39 40 Subtract line 39 from line 38. If zero or less, enter-O- 40 41 Multiply line 40 by 20% (0.20) 42 Figure the tax on the amount on line 27. Use the 2018 Tax Rate Schedule for Estates and Trusts (see the Schedule G instructions in the instructions for Form 1041) 42 43 Add lines 37, 41, and 42 43 44 Figure the tax on the amount on line 21. Use the 2018 Tax Rate Schedule for Estates and Trusts (see the Schedule G instructions in the instructions for Form 1041) 44 45 Tax on all taxable income. Enter the smaller of line 43 or line 44 here and on Form 1041, Schedule G, line 1a (or Form 990-T, line 40). 45 Schedule D (Form 1041) 2018 A 41 B E F G I A 1 Option #1: Capital Gain and Loss Calculation 2 3 Murphy Smith 's stock transactions for 2018 Date Basis Name Date Sold 4 Purchased Sales Proceeds Holding Period (Purchase) Apex Corp. 1/23/1986 7.250 7/22/2018 4,500 5 -11868 Gain/Loss (Difference) Capital Gain Type -2.750 Long Term 3,500 Short Term Blue Corp 4/20/2018) 14,000 9/13/2018 17,500 6 -146 Coral Corp 8/23/2010 10.750 10/12/2018 15,300 7 -2972 Diamond Corp 5/19/2017 5,230 10/12/2018 12.400 8 -511 4,550 Long Term 7.170 Long Term -3.800 Long Term Electric Corp. 8/20/2017 7,300 11/14/2018 3,500 9 -451 Total Net Gain/Loss 10 8,6701 11 Answers 12 Questions A) What is Murphy's net short-term capital gain or loss from these transactions? 13 Blue Corp 3,500 Gain 14 15 B) What is Murphy's net long-term capital gain or loss from these transactions? 5,170 Gain 16 17 C) What is Murphy's net gain or loss from these transactions? 8,670 Gain SCHEDULED (Form 1041) Capital Gains and Losses OMB No. 1545-0092 Attach to Form 1041, Form 5227, or Form 990-T. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9 and 10. 2018 Go to www.irs.gov/F1041 for instructions and the latest information Employer identification number Department of the Treasury Internal Revenue Service Name of estate ar trust Note: Form 5227 filers need to complete only Parts I and II. Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lal Hi Gain or loss (d) lines below. le) Adjustments Subtract column Proceeds Cost to gain or loss from from column id and This form may be easier to complete if you round off cents to sales price for other basis Fomis) 8949, Part 1. combine the result with whole dollars. line 2 column column 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 to gain or loss from 4 Short-term capital gain or loss) from Forms 4684,6252, 6781, and 8824 5 Net short-term gain or loss) from partnerships, Scorporations, and other estates or trusts. 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 9 of the 2017 Capital Loss Carryover Worksheet. 6 7 Net short-term capital gain or (loss). Combine lines ta through 6 in column (h). Enter here and on line 17, column (3) on the back 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lal th Gain or loss) lines below. (d) Adjustments Subtract column Proceeds Cost from column id and This form may be easier to complete if you round off cents to sales price for other basis) Fomis) 8949, Part It combine the result with whole dollars. line 2 columna column 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b. 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Long-term capital gain or loss) from Forms 2439, 4684,6252, 6781, and 8824. 11 12 Net long-term gain or loss) from partnerships, S corporations, and other estates or trusts 12 13 Capital gain distributions. 13 14 Gain from Form 4797, Part I. 14 15 Long-term capital loss carryover. Enter the amount, if any, from line 14 of the 2017 Capital Loss Carryover Worksheet. 15 16 Net long-term capital gain or loss). Combine lines Ba through 15 in column (h). Enter here and on line 18a, column (3) on the back 16 For Paperwork Reduction Act Notice, see the Instructions for Form 1041. Cat. Na. 11376V Schedule D (Form 1041) 2018 Page 2 Schedule D (Form 1041) 2018 Part III Summary of Parts I and II (1) Beneficiaries (2) Estate's Caution: Read the instructions before completing this part. (see instr.) or trust's (3) Total 17 Net short-term gain or loss) 17 18 Net long-term gain or loss): a Total for year 18a b Unrecaptured section 1250 gain (see line 18 of the worksheet.) 18b C 28% rate gain 18c 19 Total net gain or loss). Combine lines 17 and 18a 19 Note: I line 19, column (3), is a net gain, enter the gain on Form 1041, line 4 for Form 990-T, Part I, line 48). If lines 18 and 19, column (2), are net gains, go to Part V, and don't complete Part IV. If line 19. column (3), is a net loss, complete Part 1 and the Capital Loss Carryover Worksheet, as necessary Part IV Capital Loss Limitation 20 Enter here and enter as a loss) on Form 1041, line 4 (or Form 990-T, Part 1, line 4c, if a trust), the smaller of: a The loss on line 19, column (3) or b $3,000 20 Note: If the loss on line 19, column 3), is more than $3,000, or il Form 1041, page 1, line 22 (or Form 990-T, line 38), is a loss, complete the Capital Loss Carryover Worksheet in the instructions to figure your capital loss carryover. Part V Tax Computation Using Maximum Capital Gains Rates Form 1041 filers. Complete this part only if both lines 18 and 19 in column (2) are gains, or an amount is entered in Part I or Part II and there is an entry on Form 1041, line 26(2), and Form 1041, line 22, is more than zero. Caution: Skip this part and complete the Schedule D Tax Worksheet in the instructions if: . Either line 18b, col. (2) or line 18c, col. (2) is more than zero, or Both Form 1041, line 25/1), and Form 4952, line 4g are more than zero. Form 990-T trusts. Complete this part only if both lines 18 and 19 are gains, or qualified dividends are included in income in Part 1 of Form 990-T, and Form 990-T, line 38, is more than zero. Skip this part and complete the Schedule D Tax Worksheet in the instructions il either line 18b, col. (2) or line 18c, col. (2) is more than zero. 21 Enter taxable income from Form 1041, line 22 (or Form 990-T, line 38) - 21 22 Enter the smaller of line 189 or 19 in column (2) but not less than zero. 22 23 Enter the estate's or trust's qualified dividends from Form 1041, line 26(2) (or enter the qualified dividends included in income in Part 1 of Form 990-T) 23 24 Add lines 22 and 23 24 25 If the estate or trust is filing Form 4952, enter the amount from line 4g; otherwise, enter-O- 25 26 Subtract line 25 from line 24. If zero or less, enter-O- 26 27 Subtract line 26 from line 21. If zero or less, enter-O- 27 28 Enter the smaller of the amount on line 21 or $2,600 28 29 Enter the smaller of the amount on line 27 or line 28 29 30 Subtract line 29 from line 28. If zero or less, enter-O-. This amount is taxed at 0% 30 31 Enter the smaller of line 21 or line 26 31 32 Subtract line 30 from line 26 32 33 Enter the smaller of line 21 or $12,700 33 34 Add lines 27 and 30 34 35 Subtract line 34 from line 33. If zero or less, enter-O- 35 36 Enter the smaller of line 32 or line 35 36 37 Multiply line 36 by 15% (0.15) 37 38 Enter the amount from line 31 38 39 Add lines 30 and 36 39 40 Subtract line 39 from line 38. If zero or less, enter-O- 40 41 Multiply line 40 by 20% (0.20) 42 Figure the tax on the amount on line 27. Use the 2018 Tax Rate Schedule for Estates and Trusts (see the Schedule G instructions in the instructions for Form 1041) 42 43 Add lines 37, 41, and 42 43 44 Figure the tax on the amount on line 21. Use the 2018 Tax Rate Schedule for Estates and Trusts (see the Schedule G instructions in the instructions for Form 1041) 44 45 Tax on all taxable income. Enter the smaller of line 43 or line 44 here and on Form 1041, Schedule G, line 1a (or Form 990-T, line 40). 45 Schedule D (Form 1041) 2018 A 41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts