Answered step by step

Verified Expert Solution

Question

1 Approved Answer

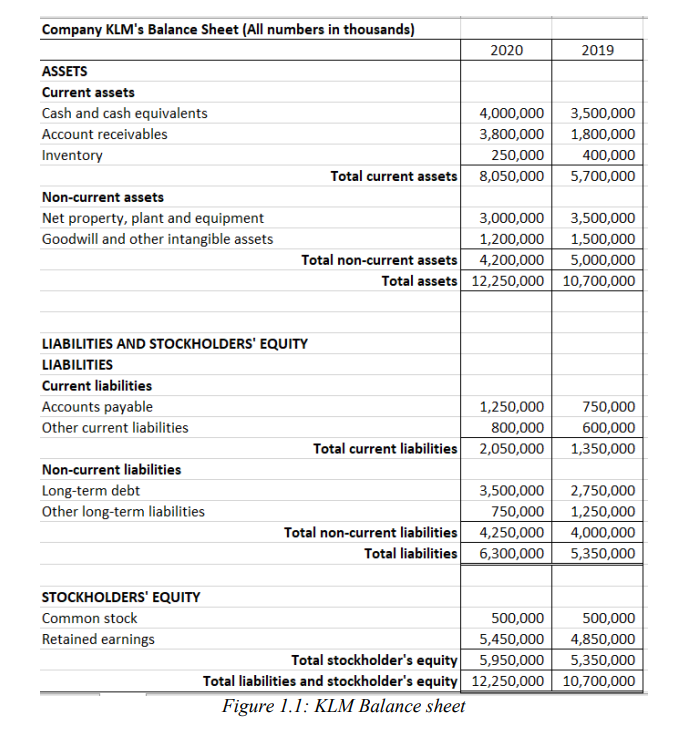

QUESTION : Based on the data for 2020 alone, you found that KLM has financed their operations through the issuance of fixed-rate bonds and common

QUESTION : Based on the data for 2020 alone, you found that KLM has financed their operations through the issuance of fixed-rate bonds and common stock. Given the corporate tax to be 25%, KLMs bond yield-to-maturity of 2.0% and a debt-equity ratio (D/E) of 25%, calculate the Weighted Average Cost of Capital (WACC). Round off to two (2) decimal places

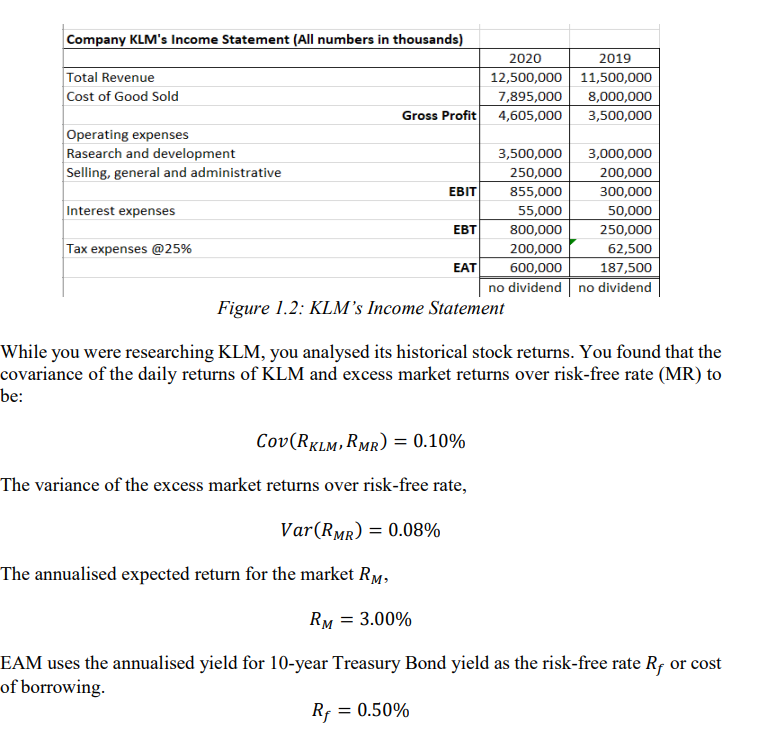

Company KLM's Balance Sheet (All numbers in thousands) 2020 2019 ASSETS Current assets Cash and cash equivalents Account receivables Inventory 4,000,000 3,800,000 250,000 8,050,000 3,500,000 1,800,000 400,000 5,700,000 Total current assets Non-current assets Net property, plant and equipment Goodwill and other intangible assets 3,000,000 3,500,000 1,200,000 1,500,000 Total non-current assets 4,200,000 5,000,000 Total assets 12,250,000 10,700,000 LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Current liabilities Accounts payable 1,250,000 Other current liabilities 800,000 Total current liabilities 2,050,000 Non-current liabilities Long-term debt 3,500,000 Other long-term liabilities 750,000 Total non-current liabilities 4,250,000 Total liabilities 6,300,000 750,000 600,000 1,350,000 2,750,000 1,250,000 4,000,000 5,350,000 STOCKHOLDERS' EQUITY Common stock 500,000 500,000 Retained earnings 5,450,000 4,850,000 Total stockholder's equity 5,950,000 5,350,000 Total liabilities and stockholder's equity 12,250,000 10,700,000 Figure 1.1: KLM Balance sheet Company KLM's Income Statement (All numbers in thousands) 2020 2019 Total Revenue 12,500,000 11,500,000 Cost of Good Sold 7,895,000 8,000,000 Gross Profit 4,605,000 3,500,000 Operating expenses Rasearch and development 3,500,000 3,000,000 Selling, general and administrative 250,000 200,000 EBIT 855,000 300,000 Interest expenses 55,000 50,000 EBT 800,000 250,000 Tax expenses @25% 200,000 62,500 EAT 600,000 187,500 no dividend no dividend Figure 1.2: KLM's Income Statement While you were researching KLM, you analysed its historical stock returns. You found that the covariance of the daily returns of KLM and excess market returns over risk-free rate (MR) to be: Cov(RKLM, RMR) = 0.10% = The variance of the excess market returns over risk-free rate, Var(RMR) = 0.08% The annualised expected return for the market RM, RM = 3.00% EAM uses the annualised yield for 10-year Treasury Bond yield as the risk-free rate R, or cost of borrowing Rj = 0.50%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started