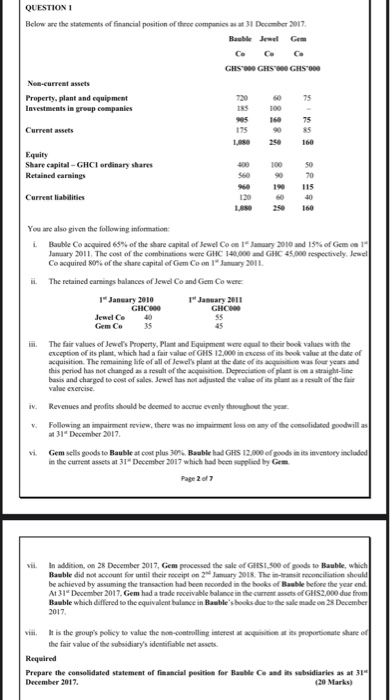

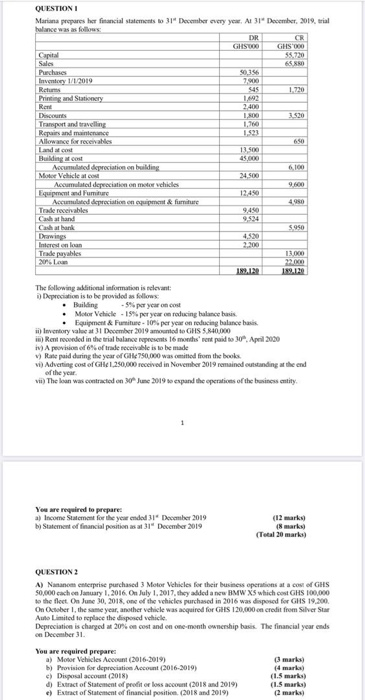

QUESTION Below are the statements of financial position of these companies as at 31 December 2017 Baublie Jewel Gem GHS000 GHS GHS000 Non-curreat assets Property, plant and equipment Investments in group companies 60 75 183 100 95 160 75 175 90 85 160 Current assets Equity Share capital - GHCI ordinary shares Retained carnings Current liabilities 960 190 115 i. You are also given the following information: Bauble Co acquired 65% of the share capital of Jewel Co on 19 January 2010 and 15% of Gemon 1 January 2011. The cost of the combinations were GHC 140,000 and GHC 45,000 respectively. Jewel Co acquired 80% of the share capital of Gem Co on 1 January 2011 ii. The retained carnings balances of Jewel Co and Gem Co were 1"January 2010 1"January 2011 GHC000 GHCO Jewel Co 35 Gem Co 35 45 ii. The fair values of Jewel's Property, Plant and Equipment were equal to their book values with the srception of its plant, which had a fair value of GHS 12,000 in excess of its book value at the date of acquisition. The remaining life of all of Jewel's plant at the date of its acquisition was four years and this period has not changed as a result of the acquisition. Depreciation of plant is on a straight-line basis and charged to cost of sales. Jewel has not adjusted the value of its plantas a result of the fair value exercise. iv. Revenues and profits should be deemed to accrue evenly throughout the year . Following an impairment review, there was no impairment loss on any of the consolidated goodwill as at 31 December 2017 Gem sells goods to Bauble at cost plus 30%. Bauble had GHS 12.000 of goods in its inventory included in the current assets at 31 December 2017 which had been supplied by Gem Page 2 of 7 In addition, on 28 December 2017, Gem processed the sale of GHS1.500 of goods to Bauble, which Bauble did not account for until their receipt on 29 January 2018. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Bauble before the year end. At 31 December 2017. Gem had a trade receivable balance in the current assets of GHS2,000 due from Bauble which differed to the equivalent balance in Bauble's books due to the sale made on 28 December 2017 i. It is the group's policy to value the non-controlling interest requisition at its proportionate shared the fair value of the subsidiary's identifiable net assets Required Prepare the consolidated statement of financial position for Bauble C and its subsidiaries as at 31" December 2017. (20 Marks) 66 1.10 QUESTION Mariana prepares her financial statements to 31" December every year. At 31 December, 2019. trial balance was follows DR CE GHSTOO GHS 000 Capital 58.220 Sales Purchases 90.356 Inventory 1/1/2019 7000 Returns 545 1.720 Printing and Stationery 1,492 Rew 2.400 Discounts 1.NO 3530 Transport and travelling Repairs and maintenance 1.521 Allowance for recebe 60 Land 13.500 Building 450 Accumulated depreciation on building 100 Motor Vehicles 24.500 Accumulated depreciation on motor vehicles 9.00 Equipment and Furniture 12.450 Accumulated depreciation on quipment & furniture 490 Teade receivables 9,450 Cash at hand 9.524 Cash at bank 5 950 4.520 Intered on loan 2200 Trinde payables 13 2016. 2000 189.12 159.120 The following additional information is relevant Depreciation is to be provided as follows Building - 5% per year on.co Motor Vehicle - 19% per year on reducing balance basis Equipment & Funiture -10% per year on reducing balance basis ii) Inventory value at 31 December 2019 amounted to GHS 5.840.000 Rent recorded in the trial balance represents 16 months rent paid to 30 April 2010 Rate paid during the year of G750,000 was comitiod from the books ve) Adverting cost of GHE 1.250,000 received in November 2019 remained outstanding at the end of the year vii) The loan was contracted on 30 June 2019 to expand the operations of the business entity You are required to prepare a) Income Statement for the year ended Itember 2019 by Statement of financial position as at 31 December 2019 (12 marks (8 marks) (Total 20 mark) QUESTION 2 A) Nananom enterprise purchased 3 Motor Vehicles for their business operations at a cost of GHS 50.000 cachon January 1, 2016. On July 1, 2017, they added a new BMW X5 which cost GHS 100.000 to the fleet. On June 30, 2018, one of the vehicles purchased in 2016 was disposed for GHS 19.300. On October 1, the same year, another vehicle was acquired for GHS 120,000 on credit from Silver Star Auto Limited to replace the disposed vehicle Depreciation is charged at 20% ce cost and one month ownership basis. The financial year ends on December 31 You are required prepared a) Motor Vehicles Account (2016-2019) mark b) Provision for depreciation Account (2016-2019) (4 mark c) Disposal account (2018) (1.5 marks) d) Extract of Statement of profit or loss account (2018 and 2019) (1.5 marks) c) Extract of Statement of financial positic (2018 and 2019) QUESTION Below are the statements of financial position of these companies as at 31 December 2017 Baublie Jewel Gem GHS000 GHS GHS000 Non-curreat assets Property, plant and equipment Investments in group companies 60 75 183 100 95 160 75 175 90 85 160 Current assets Equity Share capital - GHCI ordinary shares Retained carnings Current liabilities 960 190 115 i. You are also given the following information: Bauble Co acquired 65% of the share capital of Jewel Co on 19 January 2010 and 15% of Gemon 1 January 2011. The cost of the combinations were GHC 140,000 and GHC 45,000 respectively. Jewel Co acquired 80% of the share capital of Gem Co on 1 January 2011 ii. The retained carnings balances of Jewel Co and Gem Co were 1"January 2010 1"January 2011 GHC000 GHCO Jewel Co 35 Gem Co 35 45 ii. The fair values of Jewel's Property, Plant and Equipment were equal to their book values with the srception of its plant, which had a fair value of GHS 12,000 in excess of its book value at the date of acquisition. The remaining life of all of Jewel's plant at the date of its acquisition was four years and this period has not changed as a result of the acquisition. Depreciation of plant is on a straight-line basis and charged to cost of sales. Jewel has not adjusted the value of its plantas a result of the fair value exercise. iv. Revenues and profits should be deemed to accrue evenly throughout the year . Following an impairment review, there was no impairment loss on any of the consolidated goodwill as at 31 December 2017 Gem sells goods to Bauble at cost plus 30%. Bauble had GHS 12.000 of goods in its inventory included in the current assets at 31 December 2017 which had been supplied by Gem Page 2 of 7 In addition, on 28 December 2017, Gem processed the sale of GHS1.500 of goods to Bauble, which Bauble did not account for until their receipt on 29 January 2018. The in-transit reconciliation should be achieved by assuming the transaction had been recorded in the books of Bauble before the year end. At 31 December 2017. Gem had a trade receivable balance in the current assets of GHS2,000 due from Bauble which differed to the equivalent balance in Bauble's books due to the sale made on 28 December 2017 i. It is the group's policy to value the non-controlling interest requisition at its proportionate shared the fair value of the subsidiary's identifiable net assets Required Prepare the consolidated statement of financial position for Bauble C and its subsidiaries as at 31" December 2017. (20 Marks) 66 1.10 QUESTION Mariana prepares her financial statements to 31" December every year. At 31 December, 2019. trial balance was follows DR CE GHSTOO GHS 000 Capital 58.220 Sales Purchases 90.356 Inventory 1/1/2019 7000 Returns 545 1.720 Printing and Stationery 1,492 Rew 2.400 Discounts 1.NO 3530 Transport and travelling Repairs and maintenance 1.521 Allowance for recebe 60 Land 13.500 Building 450 Accumulated depreciation on building 100 Motor Vehicles 24.500 Accumulated depreciation on motor vehicles 9.00 Equipment and Furniture 12.450 Accumulated depreciation on quipment & furniture 490 Teade receivables 9,450 Cash at hand 9.524 Cash at bank 5 950 4.520 Intered on loan 2200 Trinde payables 13 2016. 2000 189.12 159.120 The following additional information is relevant Depreciation is to be provided as follows Building - 5% per year on.co Motor Vehicle - 19% per year on reducing balance basis Equipment & Funiture -10% per year on reducing balance basis ii) Inventory value at 31 December 2019 amounted to GHS 5.840.000 Rent recorded in the trial balance represents 16 months rent paid to 30 April 2010 Rate paid during the year of G750,000 was comitiod from the books ve) Adverting cost of GHE 1.250,000 received in November 2019 remained outstanding at the end of the year vii) The loan was contracted on 30 June 2019 to expand the operations of the business entity You are required to prepare a) Income Statement for the year ended Itember 2019 by Statement of financial position as at 31 December 2019 (12 marks (8 marks) (Total 20 mark) QUESTION 2 A) Nananom enterprise purchased 3 Motor Vehicles for their business operations at a cost of GHS 50.000 cachon January 1, 2016. On July 1, 2017, they added a new BMW X5 which cost GHS 100.000 to the fleet. On June 30, 2018, one of the vehicles purchased in 2016 was disposed for GHS 19.300. On October 1, the same year, another vehicle was acquired for GHS 120,000 on credit from Silver Star Auto Limited to replace the disposed vehicle Depreciation is charged at 20% ce cost and one month ownership basis. The financial year ends on December 31 You are required prepared a) Motor Vehicles Account (2016-2019) mark b) Provision for depreciation Account (2016-2019) (4 mark c) Disposal account (2018) (1.5 marks) d) Extract of Statement of profit or loss account (2018 and 2019) (1.5 marks) c) Extract of Statement of financial positic (2018 and 2019)