Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Build an Excel spreadsheet model to calculate SSIs foreign exchange exposure to each currency. Evaluate the outcomes of each hedging strategy for hedging the

Question:

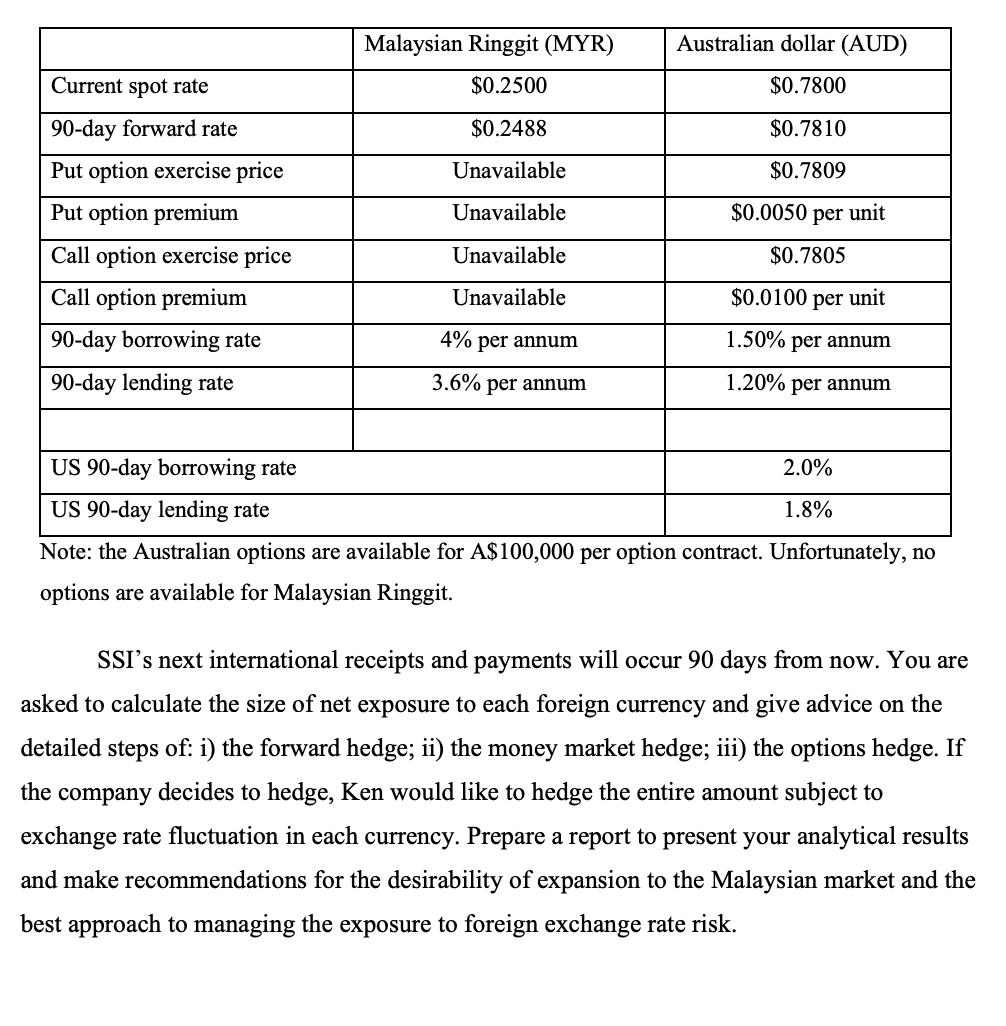

Build an Excel spreadsheet model to calculate SSI’s foreign exchange exposure to each currency. Evaluate the outcomes of each hedging strategy for hedging the exposure to Australian dollar. Then, compare the three hedging alternatives with a scenario under which SSI remains unhedged. Would you recommend a hedge or no hedge for the exposure to AUD? If you recommend a hedge, which hedge strategy is most appropriate?

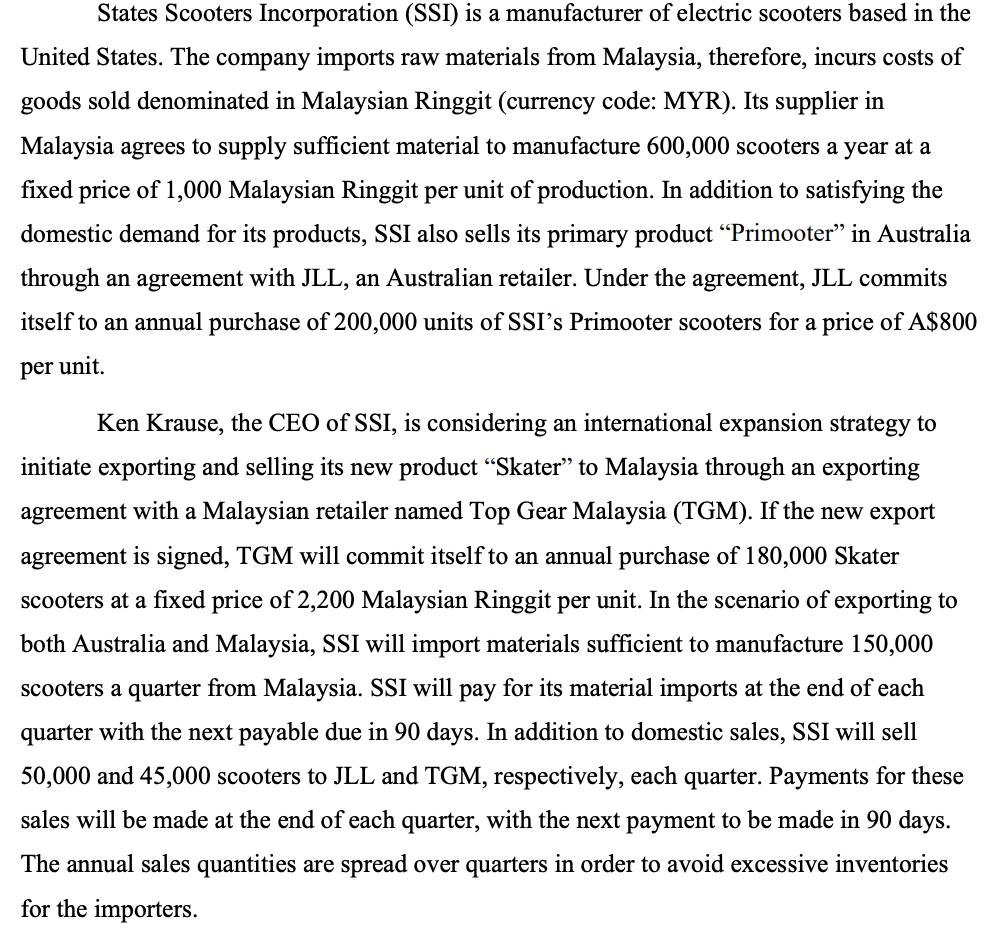

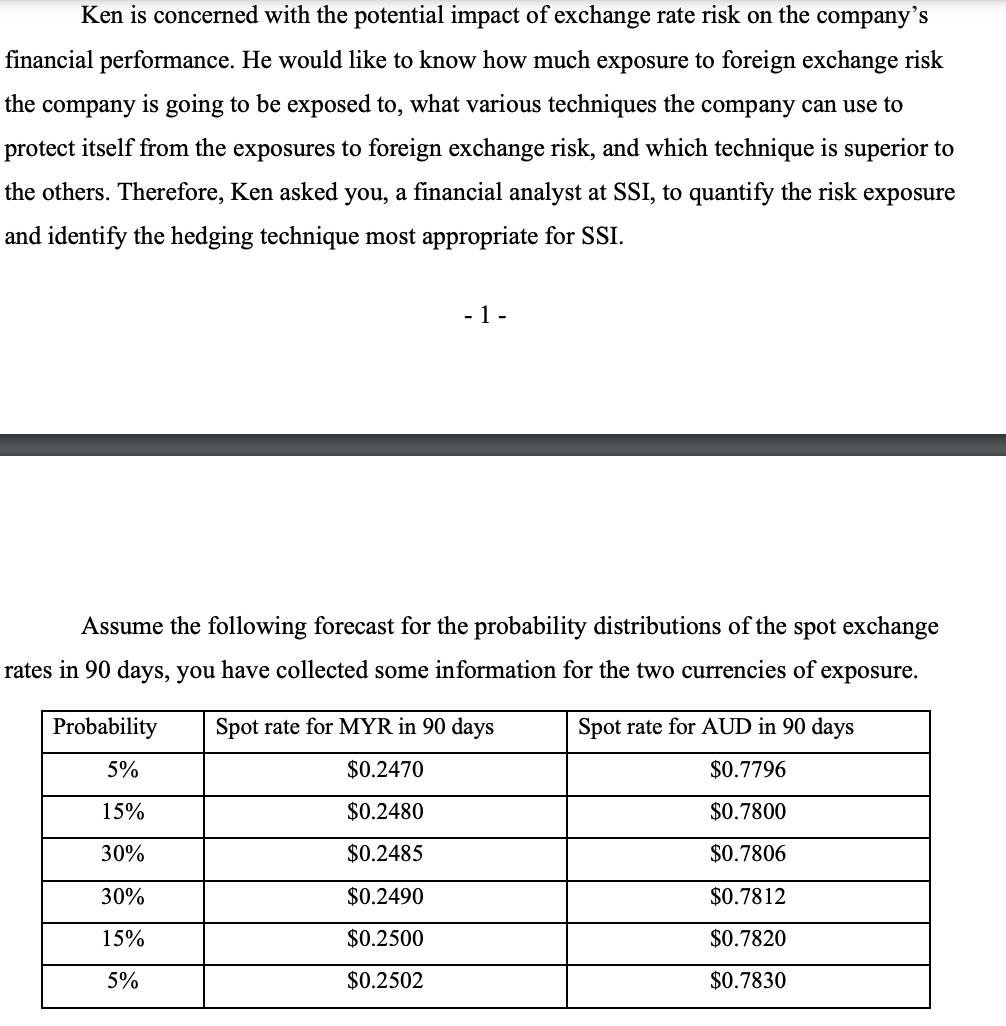

States Scooters Incorporation (SSI) is a manufacturer of electric scooters based in the United States. The company imports raw materials from Malaysia, therefore, incurs costs of goods sold denominated in Malaysian Ringgit (currency code: MYR). Its supplier in Malaysia agrees to supply sufficient material to manufacture 600,000 scooters a year at a fixed price of 1,000 Malaysian Ringgit per unit of production. In addition to satisfying the domestic demand for its products, SSI also sells its primary product "Primooter" in Australia through an agreement with JLL, an Australian retailer. Under the agreement, JLL commits itself to an annual purchase of 200,000 units of SSI's Primooter scooters for a price of A$800 per unit. Ken Krause, the CEO of SSI, is considering an international expansion strategy to initiate exporting and selling its new product "Skater" to Malaysia through an exporting agreement with a Malaysian retailer named Top Gear Malaysia (TGM). If the new export agreement is signed, TGM will commit itself to an annual purchase of 180,000 Skater scooters at a fixed price of 2,200 Malaysian Ringgit per unit. In the scenario of exporting to both Australia and Malaysia, SSI will import materials sufficient to manufacture 150,000 scooters a quarter from Malaysia. SSI will pay for its material imports at the end of each quarter with the next payable due in 90 days. In addition to domestic sales, SSI will sell 50,000 and 45,000 scooters to JLL and TGM, respectively, each quarter. Payments for these sales will be made at the end of each quarter, with the next payment to be made in 90 days. The annual sales quantities are spread over quarters in order to avoid excessive inventories for the importers.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Current Foreign Exchange Exposure without expansion to Malaysia market Malaysian Ringgit 600000 X 1000 X 02500 150000000 pa or 37500000 quarterly Aust...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started