Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question C and D please answer me all the highlighted part and *mark all the answers to make it clear.Thank you a, 1,179.00 b, 1,860.00

question C and D please answer me all the highlighted part and *mark all the answers to make it clear.Thank you

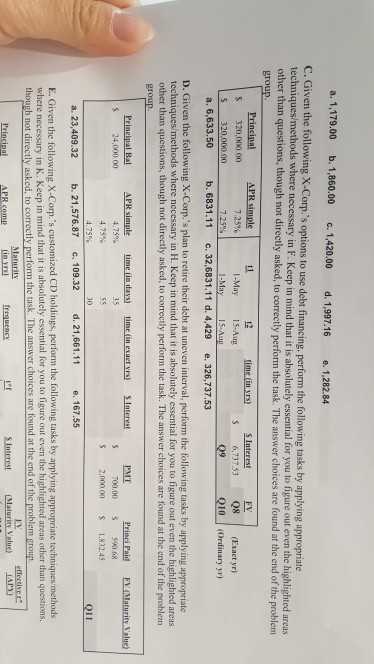

a, 1,179.00 b, 1,860.00 c. 1,420.00 d' 1997.16 e.1.28284 C. Given the following X-Corp.'s options to use debt financing, perform the following tasks by applying appropriate techniques/methods where necessary in F. Keep in mind that it is absolutely essential for you to figure out even the highlighted areas er than questions, though not directly asked, to correctly perform the task. The answer choices are found at the end of the problerm group 12 FV S 320,00000 S 320,000.00 a. 6,633.50 I-May 1s Aug 1-May 15 Aug 7.25% 6,737 53 Q8 (Exact yr) 010 (Ordinary yr) 725% b. 6831.11 c. 32,683 1.11 d. 4.429 e. 326,737.53 D. Given the following X-Corp.'s plan to retire their debt at uneven interval, perform the following tasks by applying appropriate techniques/methods where necessary in H. Keep in mind that it is absolutely essential for you to figure out even the highlighted areas other than questions, though not directly asked, to correctly perform the task. The answer choices are found at the end of the problem Principal Bal APR simple time (in days) time fin exact vrs) SInterestPMT 24,000.00 4.75% 4.75% $ 700.00 590.68 2,000o0 s 1,832.45 011 a. 23,409.32 b. 21,576.87 c. 109.32 d. 21,661.11 e. 167.55 n the following tasks by applying appropriate techniques et where necessary in K. Keep in mind that it is absolutely essential for you to figure out even the highlighted areas other than questions, though not directly asked to correctly perform the task. The answer choices are found at the end of the problem group. in yrs regency t*fStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started