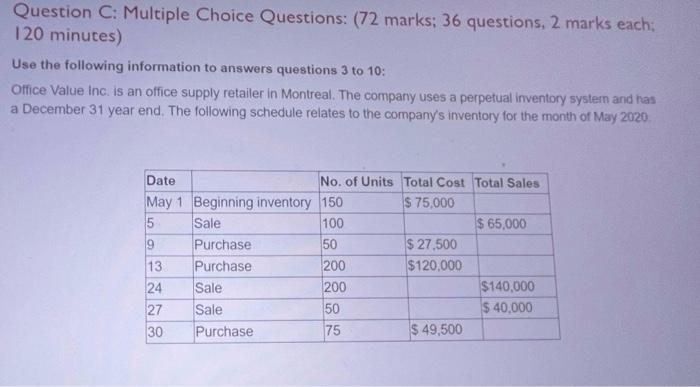

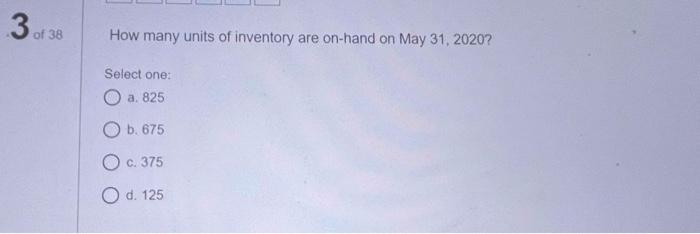

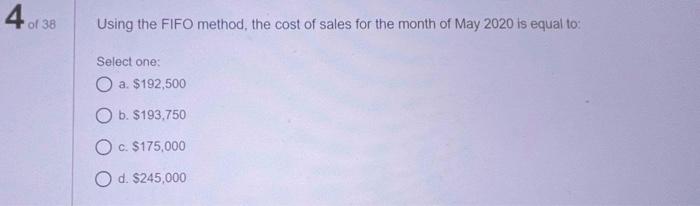

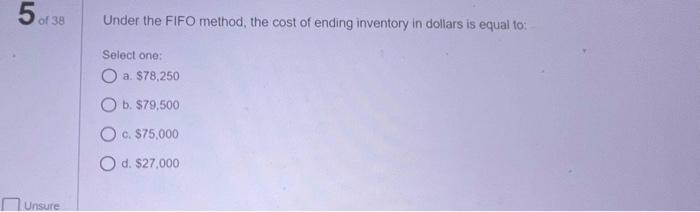

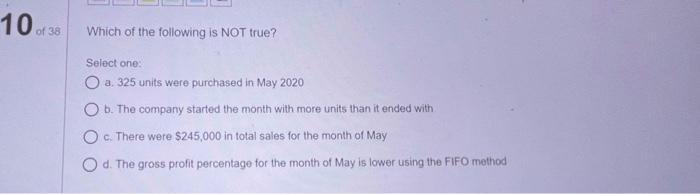

Question C: Multiple Choice Questions: (72 marks: 36 questions, 2 marks each; 120 minutes) Use the following information to answers questions 3 to 10: Office Value Inc. is an office supply retailer in Montreal. The company uses a perpetual inventory system and has a December 31 year end. The following schedule relates to the company's inventory for the month of May 2020 Date No. of Units Total Cost Total Sales May 1 Beginning inventory 150 $ 75,000 5 Sale 100 $ 65,000 9 Purchase 50 $ 27,500 13 Purchase 200 $120,000 24 Sale 200 $140,000 27 Sale 50 $ 40,000 30 Purchase 75 $ 49,500 3 of 36 of 38 How many units of inventory are on-hand on May 31, 2020? Select one: O a. 825 O b. 675 O c. 375 O d. 125 of 38 Using the FIFO method, the cost of sales for the month of May 2020 is equal to: Select one: a. $192,500 O b. $193.750 O c. $175,000 O d. $245,000 5138 Under the FIFO method, the cost of ending inventory in dollars is equal to: Select one: O a $78,250 O b: $79,500 O c. $75,000 O d. $27,000 unsure 6.13 of 38 Using the Weighted average-cost method, the cost of sales for the month of May 2020 is equal to: Select one: O a $193.750 O b. $192,500 O c. $200,421 O d. $245,000 7 of 38 Assume for this question only that the periodic inventory system is used and the weighted average cost method What would be the cost of ending inventory? Select one: O a 578,250 b. $79,500 O c. 568,750 O d. $71,579 8 of 38 The gross profit (loss) on the May 24 sale would be equal to Select one: O a $27,500 using the FIFO method: $25,000 using the weighted average cost method O b. $20,000 using the FIFO mothod: $20.000 using the Weighted-average cost method O c. $112,500 using the FIFO method, $115,000 using the weighted average cost method O d. $37,500 using the FIFO method: $36,250 using the Weighted average cost method 9.38 Office Value Inc's CEO has a meeting with its shareholders in the coming weeks who lavour higher asset MUES over higher net earnings. Which of the following would best serve the company's shareholder needs? Select one: O a. A periodic inventory system O b. The weighted average cost method O c. The FIFO cost method O d. A perpetual inventory system 100138 Which of the following is NOT true? Select one: O a 325 units were purchased in May 2020 O b. The company started the month with more units than it ended with O c. There were $245,000 in total sales for the month of May O d. The gross profit percentage for the month of May is lower using the FIFO method