Answered step by step

Verified Expert Solution

Question

1 Approved Answer

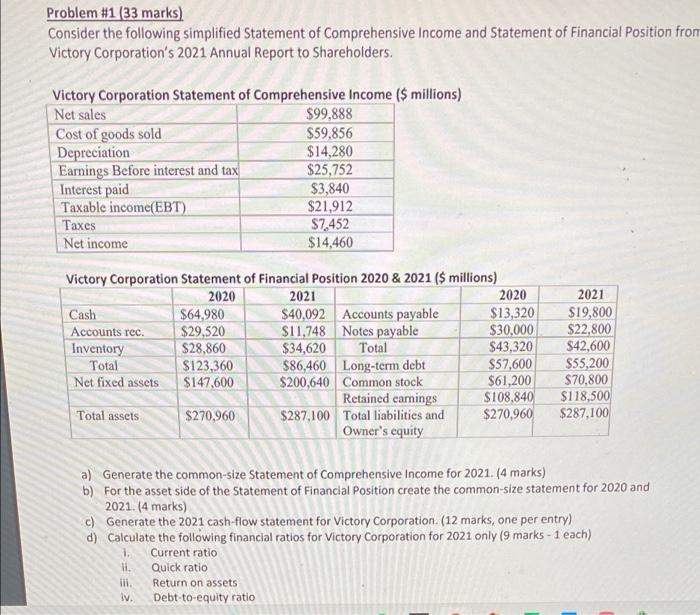

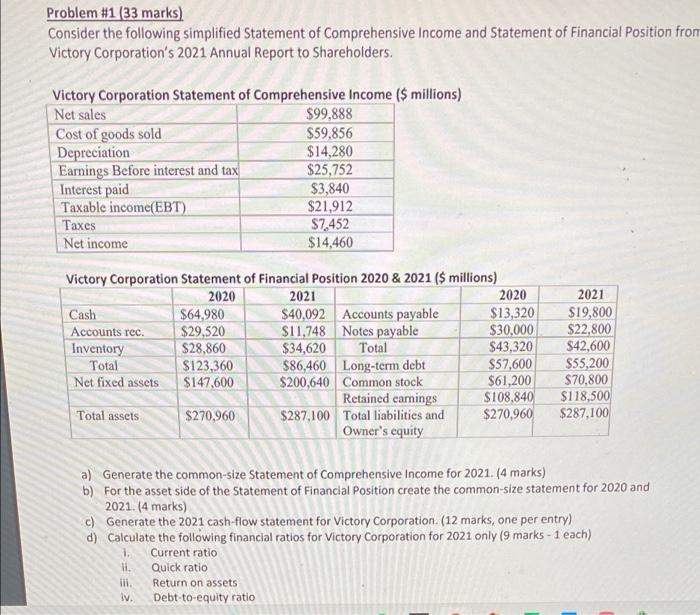

question c Problem #1 (33 marks) Consider the following simplified Statement of Comprehensive Income and Statement of Financial Position from Victory Corporation's 2021 Annual Report

question c

Problem #1 (33 marks) Consider the following simplified Statement of Comprehensive Income and Statement of Financial Position from Victory Corporation's 2021 Annual Report to Shareholders. Victory Corporation Statement of Comprehensive Income ($ millions) Net sales $99,888 Cost of goods sold $59,856 Depreciation $14,280 Earnings Before interest and tax $25,752 Interest paid $3,840 Taxable income(EBT) $21,912 Taxes $7,452 Net income $14,460 Victory Corporation Statement of Financial Position 2020 & 2021 ($ millions) 2020 2021 2020 Cash $64.980 $40,092 Accounts payable $13,320 Accounts rec. $29,520 $11,748 Notes payable $30,000 Inventory $28,860 $34,620 Total $43,320 Total $123,360 $86,460 Long-term debt $57,600 Net fixed assets $147,600 $200,640 Common stock $61,200 Retained earnings $108,840 Total assets $270,960 $287,100 Total liabilities and $270,960 Owner's equity 2021 $19,800 $22,800 $42,600 $55,200 $70,800 $118,500 $287,100 a) Generate the common-size Statement of Comprehensive Income for 2021. (4 marks) b) For the asset side of the Statement of Financial Position create the common-size statement for 2020 and 2021. (4 marks) c) Generate the 2021 cash-flow statement for Victory Corporation (12 marks, one per entry) d) Calculate the following financial ratios for Victory Corporation for 2021 only (9 marks - 1 each) 1. Current ratio H. Quick ratio Ili Return on assets iv. Debt-to-equity ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started