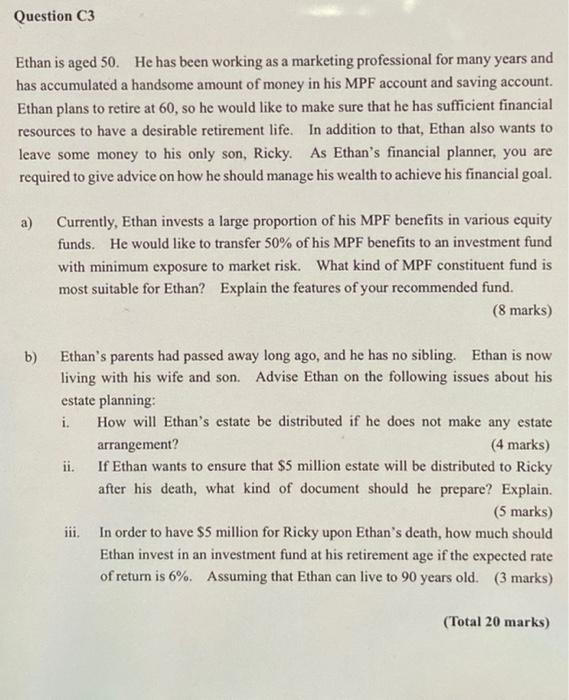

Question C3 Ethan is aged 50. He has been working as a marketing professional for many years and has accumulated a handsome amount of money in his MPF account and saving account. Ethan plans to retire at 60, so he would like to make sure that he has sufficient financial resources to have a desirable retirement life. In addition to that, Ethan also wants to leave some money to his only son, Ricky. As Ethan's financial planner, you are required to give advice on how he should manage his wealth to achieve his financial goal. a) Currently, Ethan invests a large proportion of his MPF benefits in various equity funds. He would like to transfer 50% of his MPF benefits to an investment fund with minimum exposure to market risk. What kind of MPF constituent fund is most suitable for Ethan? Explain the features of your recommended fund. (8 marks) b) Ethan's parents had passed away long ago, and he has no sibling. Ethan is now living with his wife and son. Advise Ethan on the following issues about his estate planning: i. How will Ethan's estate be distributed if he does not make any estate arrangement? (4 marks) ii. If Ethan wants to ensure that $5 million estate will be distributed to Ricky after his death, what kind of document should he prepare? Explain. (5 marks) iii. In order to have $5 million for Ricky upon Ethan's death, how much should Ethan invest in an investment fund at his retirement age if the expected rate of return is 6%. Assuming that Ethan can live to 90 years old. (3 marks) (Total 20 marks) Question C3 Ethan is aged 50. He has been working as a marketing professional for many years and has accumulated a handsome amount of money in his MPF account and saving account. Ethan plans to retire at 60, so he would like to make sure that he has sufficient financial resources to have a desirable retirement life. In addition to that, Ethan also wants to leave some money to his only son, Ricky. As Ethan's financial planner, you are required to give advice on how he should manage his wealth to achieve his financial goal. a) Currently, Ethan invests a large proportion of his MPF benefits in various equity funds. He would like to transfer 50% of his MPF benefits to an investment fund with minimum exposure to market risk. What kind of MPF constituent fund is most suitable for Ethan? Explain the features of your recommended fund. (8 marks) b) Ethan's parents had passed away long ago, and he has no sibling. Ethan is now living with his wife and son. Advise Ethan on the following issues about his estate planning: i. How will Ethan's estate be distributed if he does not make any estate arrangement? (4 marks) ii. If Ethan wants to ensure that $5 million estate will be distributed to Ricky after his death, what kind of document should he prepare? Explain. (5 marks) iii. In order to have $5 million for Ricky upon Ethan's death, how much should Ethan invest in an investment fund at his retirement age if the expected rate of return is 6%. Assuming that Ethan can live to 90 years old. (3 marks) (Total 20 marks)