Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Calculate and interpret all relevant ratios for Nyameye listed company for the year ended 31st December 2011 and 2010 (show all workings) Question 1

Question

Calculate and interpret all relevant ratios for Nyameye listed company for the year ended 31st December 2011 and 2010 (show all workings)

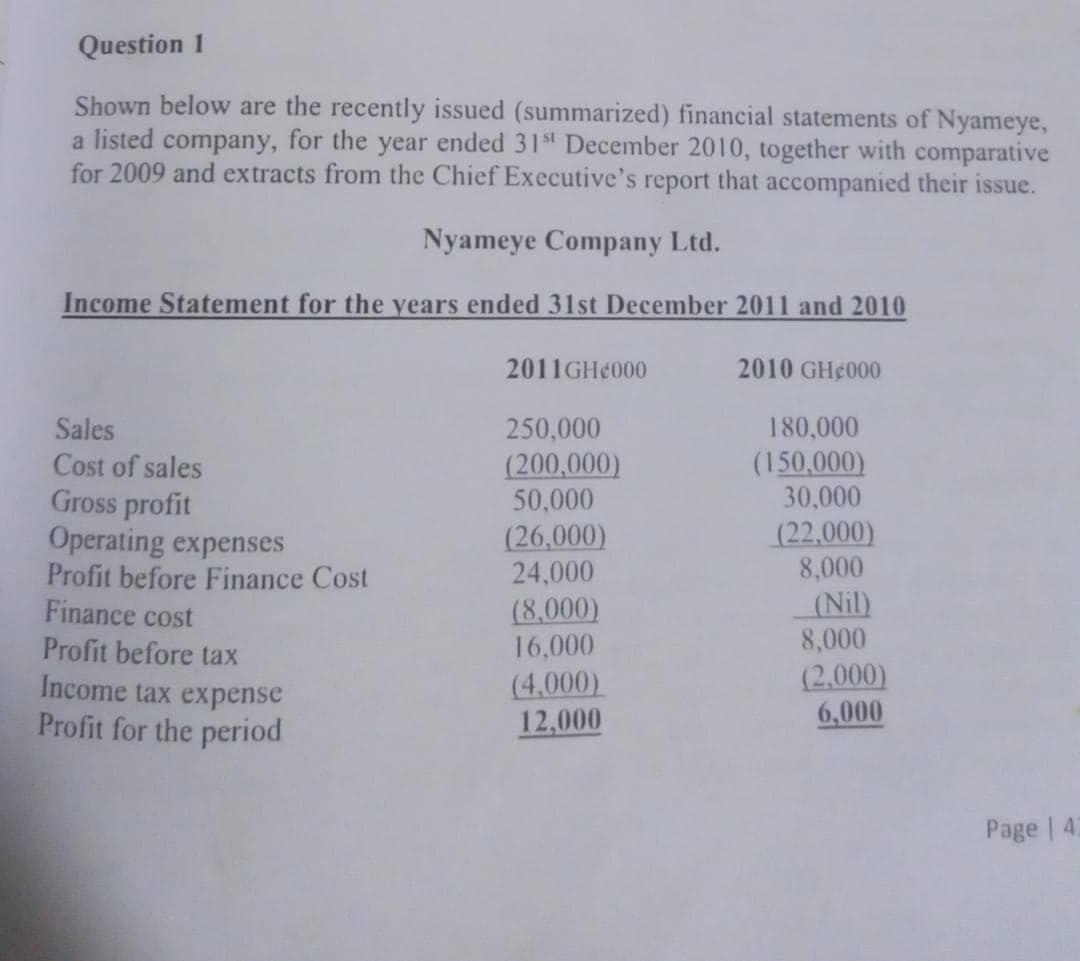

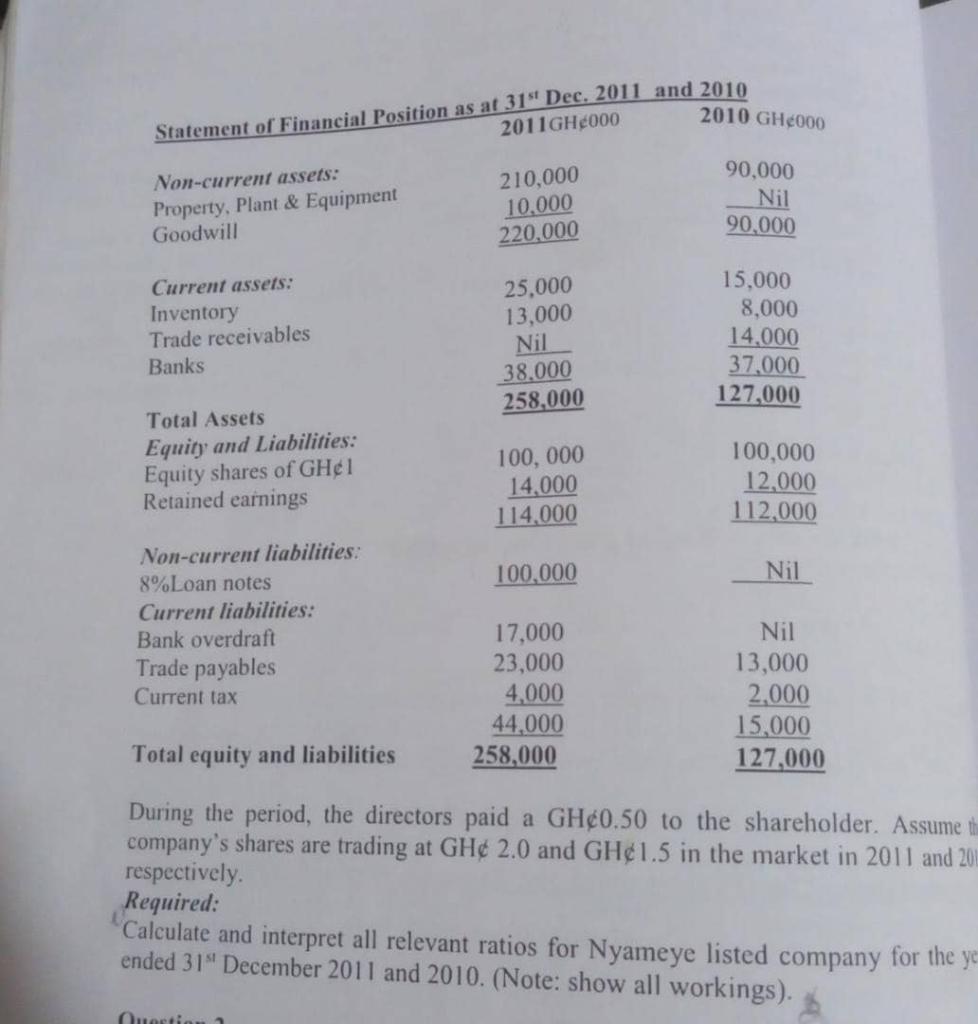

Question 1 Shown below are the recently issued (summarized) financial statements of Nyameye, a listed company, for the year ended 31" December 2010, together with comparative for 2009 and extracts from the Chief Executive's report that accompanied their issue. Nyameye Company Ltd. Income Statement for the years ended 31st December 2011 and 2010 2011GH000 2010 GH_000 Sales Cost of sales Gross profit Operating expenses Profit before Finance Cost Finance cost Profit before tax Income tax expense Profit for the period 250,000 (200,000) 50,000 (26,000) 24,000 (8,000) 16,000 (4,000) 12,000 180,000 (150,000) 30,000 (22,000) 8,000 (Nil) 8,000 (2.000) 6,000 Page 4 2010 GH000 Statement of Financial Position as at 31" Dec, 2011 and 2010 2011 GH000 Non-current assets: 210,000 90,000 Property, Plant & Equipment 10.000 Nil Goodwill 220,000 90,000 Current assets: 25,000 15,000 Inventory 13,000 8,000 Trade receivables Nil 14,000 Banks 38.000 37,000 258,000 127,000 Total Assets Equity and Liabilities: Equity shares of GH 1 100,000 100,000 Retained earnings 14,000 12,000 114.000 112,000 Non-current liabilities: 8%Loan notes 100,000 Nil Current liabilities: Bank overdraft 17,000 Nil Trade payables 23,000 13,000 Current tax 4,000 2,000 44,000 15,000 Total equity and liabilities 258,000 127,000 During the period, the directors paid a GH0.50 to the shareholder. Assume thi company's shares are trading at GH 2.0 and GH1.5 in the market in 2011 and 201 respectively Required: Calculate and interpret all relevant ratios for Nyameye listed company for the ye ended 31" December 2011 and 2010. (Note: show all workings). Question Question 1 Shown below are the recently issued (summarized) financial statements of Nyameye, a listed company, for the year ended 31" December 2010, together with comparative for 2009 and extracts from the Chief Executive's report that accompanied their issue. Nyameye Company Ltd. Income Statement for the years ended 31st December 2011 and 2010 2011GH000 2010 GH_000 Sales Cost of sales Gross profit Operating expenses Profit before Finance Cost Finance cost Profit before tax Income tax expense Profit for the period 250,000 (200,000) 50,000 (26,000) 24,000 (8,000) 16,000 (4,000) 12,000 180,000 (150,000) 30,000 (22,000) 8,000 (Nil) 8,000 (2.000) 6,000 Page 4 2010 GH000 Statement of Financial Position as at 31" Dec, 2011 and 2010 2011 GH000 Non-current assets: 210,000 90,000 Property, Plant & Equipment 10.000 Nil Goodwill 220,000 90,000 Current assets: 25,000 15,000 Inventory 13,000 8,000 Trade receivables Nil 14,000 Banks 38.000 37,000 258,000 127,000 Total Assets Equity and Liabilities: Equity shares of GH 1 100,000 100,000 Retained earnings 14,000 12,000 114.000 112,000 Non-current liabilities: 8%Loan notes 100,000 Nil Current liabilities: Bank overdraft 17,000 Nil Trade payables 23,000 13,000 Current tax 4,000 2,000 44,000 15,000 Total equity and liabilities 258,000 127,000 During the period, the directors paid a GH0.50 to the shareholder. Assume thi company's shares are trading at GH 2.0 and GH1.5 in the market in 2011 and 201 respectively Required: Calculate and interpret all relevant ratios for Nyameye listed company for the ye ended 31" December 2011 and 2010. (Note: show all workings)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started