Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: CALCULATE Sunil Kohli's Capital gains tax (CGT) liability for the tax year 2018/19 Sunil Kohli is 28 years old and is employed as a

Question: CALCULATE Sunil Kohli's Capital gains tax (CGT) liability for the tax year 2018/19

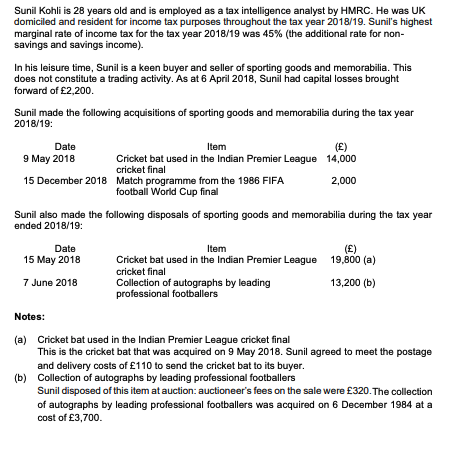

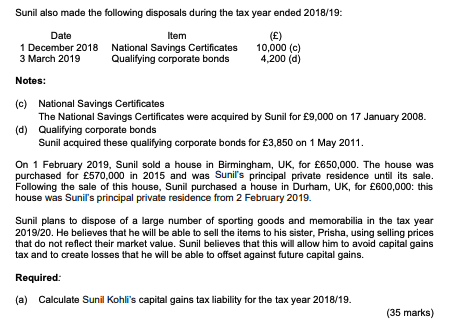

Sunil Kohli is 28 years old and is employed as a tax intelligence analyst by HMRC. He was UK domiciled and resident for income tax purposes throughout the tax year 2018/19. Sunil's highest marginal rate of income tax for the tax year 2018/19 was 45% (the additional rate for non- savings and savings income). In his leisure time, Sunil is a keen buyer and seller of sporting goods and memorabilia. This does not constitute a trading activity. As at 6 April 2018, Sunil had capital losses brought forward of 2,200. Sunil made the following acquisitions of sporting goods and memorabilia during the tax year 2018/19: Date Item (E) 9 May 2018 Cricket bat used in the Indian Premier League 14,000 cricket final 15 December 2018 Match programme from the 1986 FIFA 2,000 football World Cup final Sunil also made the following disposals of sporting goods and memorabilia during the tax year ended 2018/19 Date 15 May 2018 () 19,800 (a) Item Cricket bat used in the Indian Premier League cricket final Collection of autographs by leading professional footballers 7 June 2018 13,200 (b) Notes: (a) (b) Cricket bat used in the Indian Premier League cricket final This is the cricket bat that was acquired on 9 May 2018. Sunil agreed to meet the postage and delivery costs of 110 to send the cricket bat to its buyer. Collection of autographs by leading professional footballers Sunil disposed of this item at auction: auctioneer's fees on the sale were 320. The collection of autographs by leading professional footballers was acquired on 6 December 1984 at a cost of 3,700. Sunil also made the following disposals during the tax year ended 2018/19 () Date 1 December 2018 3 March 2019 Item National Savings Certificates Qualifying corporate bonds 10,000 (c) 4,200 (d) Notes: (c) National Savings Certificates The National Savings Certificates were acquired by Sunil for 9,000 on 17 January 2008. (d) Qualifying corporate bonds Sunil acquired these qualifying corporate bonds for 3,850 on 1 May 2011 On 1 February 2019, Sunil sold a house in Birmingham, UK, for 650,000. The house was purchased for 570,000 in 2015 and was Sunil's principal private residence until its sale. Following the sale of this house, Sunil purchased a house in Durham, UK, for 600,000: this house was Sunil's principal private residence from 2 February 2019. Sunil plans to dispose of a large number of sporting goods and memorabilia in the tax year 2019/20. He believes that he will be able to sell the items to his sister, Prisha, using selling prices that do not reflect their market value. Sunil believes that this will allow him to avoid capital gains tax and to create losses that he will be able to offset against future capital gains. Required: (a) Calculate Sunil Kohli's capital gains tax liability for the tax year 2018/19 (35 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started