Answered step by step

Verified Expert Solution

Question

1 Approved Answer

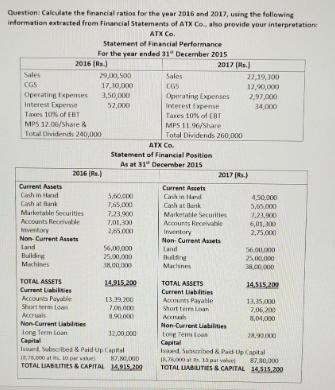

Question: Calculate the financial ratios for the year 2016 and 2017, using the following information extracted from Financial Statements of ATX Co., also provide

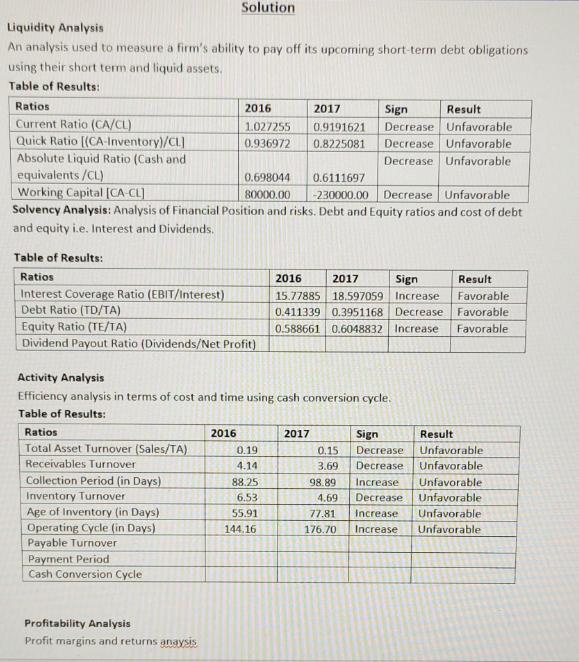

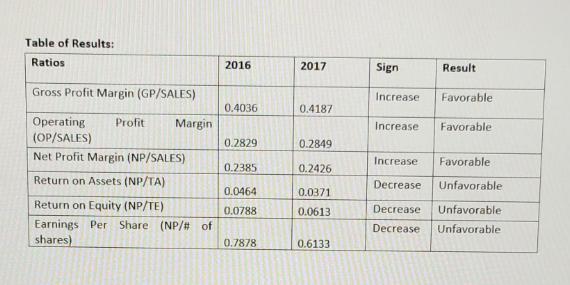

Question: Calculate the financial ratios for the year 2016 and 2017, using the following information extracted from Financial Statements of ATX Co., also provide your interpretation: ATX Co. Statement of Financial Performance For the year ended 31" December 2015 2016 (Rs.) 2017 (Rs.) Sales 29,00,500 Sales 22,19,300 CGS 17,10,000 12,90,000 Operating Expenses 3,50,000 Operating Expenses 2,97,000 Interest Expense 52,000 Interest Expense 34,000 Taxes 10% of EBT Taxes 10% of CBT MPS 12.06/Share & MPS 11.96/Share Total Dividends 260,000 Total Dividends 240,000 ATX Co. Statement of Financial Position As at 31 December 2015 2016(Rs.) 2017 (Rs.) Current Assets Current Assets Cash in Hand 5,60,000 Canin Hand 450.000 Cash Bank 7,65,000 Cash at Bank 5,50.000 Marketable Securities 7,23,900 Marketable Securities 1.23,900 Accounts Receivable 7,01,300 Accounts Receivable 6,011,300 Inventory 2,65.000 Inventory 2,75,000 Non Current Assets Non Current Assets Land 56,00,000 Land 560110001 Building 2500,000 25,00,000 Machines 300,000 Machines 38,00,000 TOTAL ASSETS 14,915,200 Current Liabilities TOTAL ASSETS Current Liabilities 14,515,200 Accounts Payable 13.39.200 Accounts Payable 13.35,000 Short term Low 7,00,000 Short term Loan 7,06,200 190000 Accra 8,04,000 Non-Current Liabilities Non-Current Liabilities Long Term Loan 12.00.000 Long Term 28.90.000 Capital and Subscribed & Paid Up Cl 87.80,000 78,000 at 10 para TOTAL LIABILITIES & CAPITAL 14,915,200 Capital Isad Suuribed & Paid Up Capital 18,78,000 at 13 par valve 87,80,000 TOTAL LIABILITIES & CAPITAL 14,515,200 Liquidity Analysis Solution An analysis used to measure a firm's ability to pay off its upcoming short-term debt obligations using their short term and liquid assets. Table of Results: Ratios: 2016 2017 Sign Result Current Ratio (CA/CL) 1.027255 0.9191621 Decrease Unfavorable Quick Ratio [(CA-Inventory)/CL] 0.936972 0.8225081 Decrease Unfavorable Absolute Liquid Ratio (Cash and Decrease Unfavorable equivalents/CL) 0.698044 0.6111697 Working Capital [CA-CL] 80000.00 -230000.00 Decrease Unfavorable Solvency Analysis: Analysis of Financial Position and risks. Debt and Equity ratios and cost of debt and equity i.e. Interest and Dividends. Table of Results: Ratios Interest Coverage Ratio (EBIT/Interest) Debt Ratio (TD/TA) Equity Ratio (TE/TA) Dividend Payout Ratio (Dividends/Net Profit) Activity Analysis 2016 2017 Sign Result 18.597059 Increase 15.77885 Favorable 0.411339 0.3951168 Decrease Favorable 0.588661 0.6048832 Increase Favorable Efficiency analysis in terms of cost and time using cash conversion cycle. Table of Results: Ratios 2016 2017 Sign Result Total Asset Turnover (Sales/TA) 0.19 0.15 Decrease Unfavorable Receivables Turnover 4.14 3.69 Decrease Unfavorable Collection Period (in Days) 88.25 98.89 Increase Unfavorable Inventory Turnover 6.53 4.69 Decrease Unfavorable Age of Inventory (in Days) 55.91 77.81 Operating Cycle (in Days) 144.16 176.70 Increase Increase Unfavorable Unfavorable Payable Turnover Payment Period Cash Conversion Cycle Profitability Analysis Profit margins and returns anaysis Table of Results: Ratios Gross Profit Margin (GP/SALES) 2016 2017 Sign Result Increase Favorable 0.4036 0.4187 Operating Profit Margin Increase Favorable (OP/SALES) 0.2829 0.2849 Net Profit Margin (NP/SALES) Increase Favorable 0.2385 0.2426 Return on Assets (NP/TA) Decrease Unfavorable 0.0464 0.0371 Return on Equity (NP/TE) 0.0788 0.0613 Decrease Unfavorable Earnings Per Share (NP/# of Decrease Unfavorable. shares) 0.7878 0.6133

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started