Question

Question (Cash Budget) Required: (a) Prepare a monthly cash budget for the period February to April inclusive. Include all the headings that you expect in

Question (Cash Budget)

Required:

(a) Prepare a monthly cash budget for the period February to April inclusive. Include all the headings that you expect in a formal cash budget. (24 marks)

(b) In order to avoid technical bankruptcy an actual negative bank balance may not exceed MLs overdraft limit at any time. Using the results of your cash budget, explain what Mr Patel could do to resolve any overdraft overruns (prevent spending more money than the business has including the overdraft arrangement that it has with the bank) that may arise. (8 marks)

(c) Mr Patel cannot understand why the cash budget looks different to his income statement. Explain, using four examples from the question or from your cash budget, why there are differences between items included in cash budget and those included in the income statement. (8 marks)

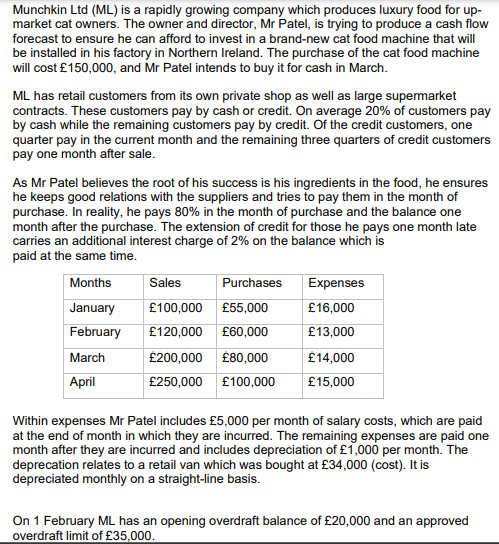

Munchkin Ltd (ML) is a rapidly growing company which produces luxury food for up- market cat owners. The owner and director, Mr Patel, is trying to produce a cash flow forecast to ensure he can afford to invest in a brand-new cat food machine that will be installed in his factory in Northern Ireland. The purchase of the cat food machine will cost 150,000, and Mr Patel intends to buy it for cash in March. ML has retail customers from its own private shop as well as large supermarket contracts. These customers pay by cash or credit . On average 20% of customers pay by cash while the remaining customers pay by credit. Of the credit customers, one quarter pay in the current month and the remaining three quarters of credit customers pay one month after sale. As Mr Patel believes the root of his success is his ingredients in the food, he ensures he keeps good relations with the suppliers and tries to pay them in the month of purchase. In reality, he pays 80% in the month of purchase and the balance one month after the purchase. The extension of credit for those he pays one month late carries an additional interest charge of 2% on the balance which is paid at the same time. Months Sales Purchases Expenses January 100,000 55,000 16,000 February 120,000 60,000 13,000 March 200,000 80,000 14,000 April 250,000 100,000 15,000 Within expenses Mr Patel includes 5,000 per month of salary costs, which are paid at the end of month in which they are incurred. The remaining expenses are paid one month after they are incurred and includes depreciation of 1,000 per month. The deprecation relates to a retail van which was bought at 34,000 (cost). It is depreciated monthly on a straight-line basis. On 1 February ML has an opening overdraft balance of 20,000 and an approved overdraft limit of 35,000. Munchkin Ltd (ML) is a rapidly growing company which produces luxury food for up- market cat owners. The owner and director, Mr Patel, is trying to produce a cash flow forecast to ensure he can afford to invest in a brand-new cat food machine that will be installed in his factory in Northern Ireland. The purchase of the cat food machine will cost 150,000, and Mr Patel intends to buy it for cash in March. ML has retail customers from its own private shop as well as large supermarket contracts. These customers pay by cash or credit . On average 20% of customers pay by cash while the remaining customers pay by credit. Of the credit customers, one quarter pay in the current month and the remaining three quarters of credit customers pay one month after sale. As Mr Patel believes the root of his success is his ingredients in the food, he ensures he keeps good relations with the suppliers and tries to pay them in the month of purchase. In reality, he pays 80% in the month of purchase and the balance one month after the purchase. The extension of credit for those he pays one month late carries an additional interest charge of 2% on the balance which is paid at the same time. Months Sales Purchases Expenses January 100,000 55,000 16,000 February 120,000 60,000 13,000 March 200,000 80,000 14,000 April 250,000 100,000 15,000 Within expenses Mr Patel includes 5,000 per month of salary costs, which are paid at the end of month in which they are incurred. The remaining expenses are paid one month after they are incurred and includes depreciation of 1,000 per month. The deprecation relates to a retail van which was bought at 34,000 (cost). It is depreciated monthly on a straight-line basis. On 1 February ML has an opening overdraft balance of 20,000 and an approved overdraft limit of 35,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started