Question

Question Central Texas College problem #56: Laffer Equation During the 1980s, the controversial economist Arthur Laffer promoted the idea that tax increases lead to a

Question

Central Texas College

problem #56: Laffer Equation

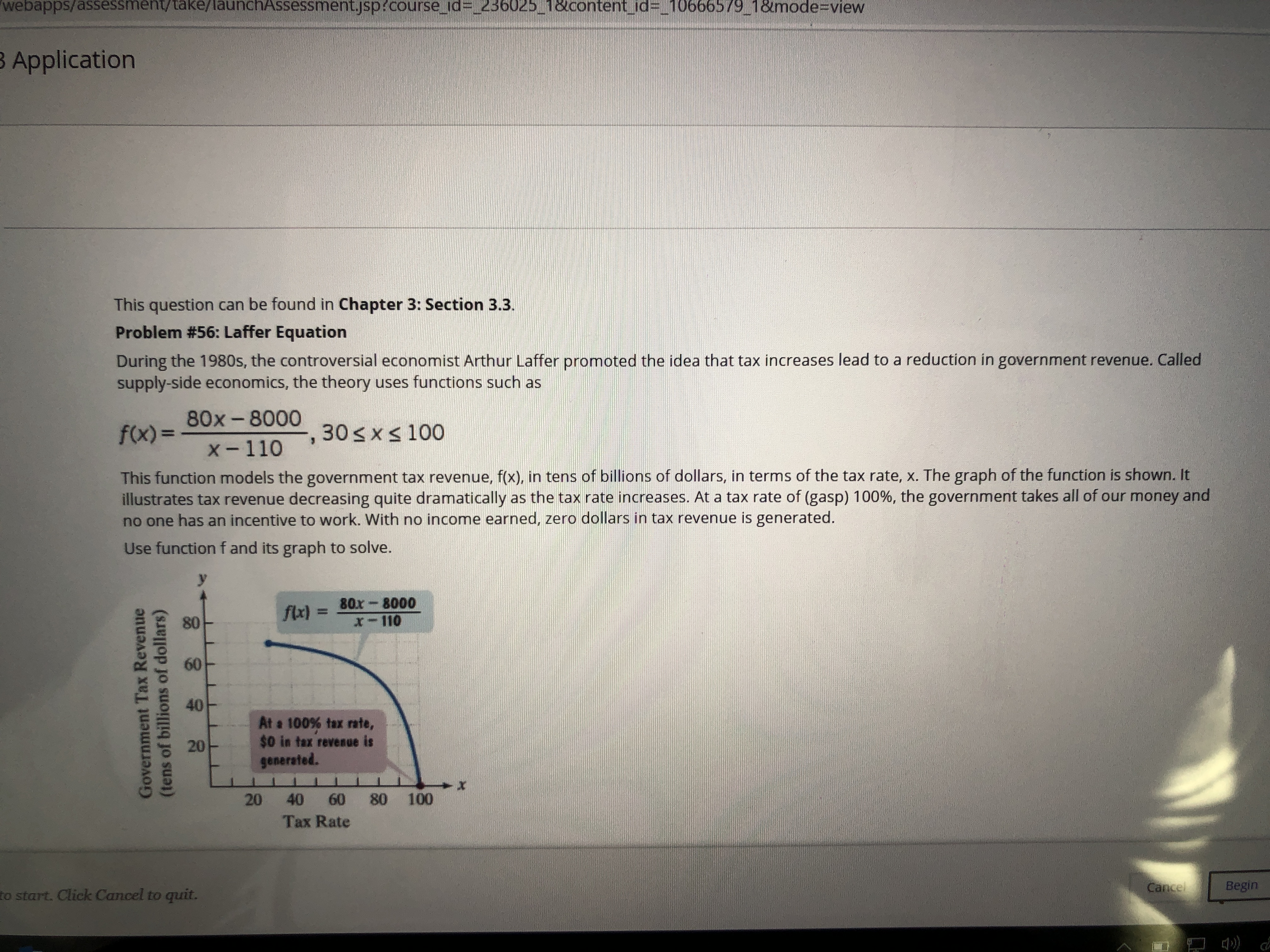

During the 1980s, the controversial economist Arthur Laffer promoted the idea that tax increases lead to a reduction in government revenue. Called supply-side economics, the theory uses functions such as

This function models the government tax revenue, f(x), in tens of billions of dollars, in terms of the tax rate, x. The graph of the function is shown. It illustrates tax revenue decreasing quite dramatically as the tax rate increases. At a tax rate of (gasp) 100%, the government takes all of our money and no one has an incentive to work. With no income earned, zero dollars in tax revenue is generated.

Use function f and its graph to solve.

- Find f(40).Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started