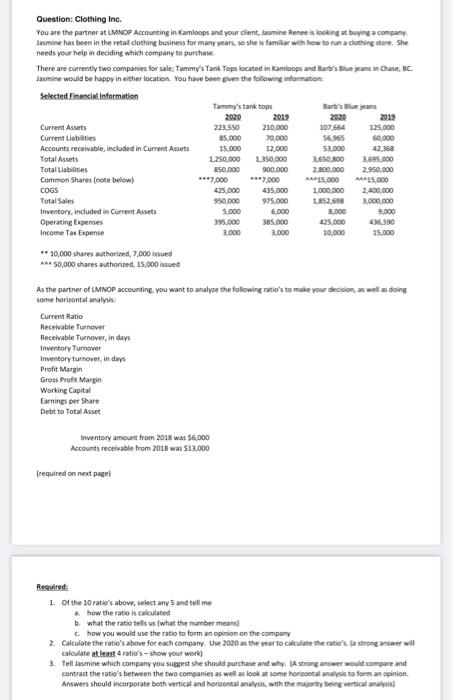

Question: Clothing Inc. You are the partner at UMNOP Accounting in Kamloops and your client, lasmine Rennes looking at buying a company Jasmine has been in the retail clothing business for many years, so she is familiar with how to run a clothing store. She needs your help in deciding which company to purchase There are currently two companies for sale: Tammy's Tank Tops located in Kamloops and Barbse jeans in Chase, 8C Jasmine would be happy in either location. You have been given the following information Selected Financial Information Tammy's tanktops 2020 2019 2020 2019 Current Assets 221.550 210,000 125.000 Current Liabilities 85,000 70,000 56.965 50.000 Accounts receivable, included in Current Assets 15,000 12.000 53,000 Total Assets 1.250,000 1,350,000 3.650.800 3.695.000 Total Liabilities 350.000 900.000 2.800.000 2.950.000 Common Shares (note below) AM35,000 COGS 425.000 435,000 1.000.000 2.400.000 Total Sales 950.000 975.000 3.000.000 Inventory, included in Current Assets 5.000 6,000 8.000 Operating Expenses 395.000 385,000 125.000 46.90 Income Tax Expense 3.000 3.000 10.000 15.000 3.000 ** 10,000 shares authorized, 7.000 issued ANA 50,000 shares authorised 15,000 issued As the partner of LMNOP accounting you want to analyze the following ratio's to make your decision, as wel doing some horizontal analysis Current Ratio Receivable Turnover Receivable Tumover, in days Inventory Turnover Inventory turnover, in der Profit Margin Gross Proft Margin Working Capital Earnings per Share Debt to Total Asset Inventory amount from 2018 $6,000 Accounts receivable from 2018 was $13,000 required on next page Required: 1 of the 10 ratio's above, select any 5 and tell me a how the ratio is calculated b. what the ratio tells us what the number means) how you would use the ratio to form an opinion on the company 2. Calculate the ratio's above for each company Use 2020 as the year to calculate the natie's a strong answer will calculate at least 4 ratio's -- show your work) 3. Tell Jasmine which company you suggest she should purchase and why. Astrong answer would compare and contrast the ratio's between the two companies as well as look at some horizontalnite forman pinion Answers should incorporate both vertical and horizontal analysis, with the majority being vertical) Question: Clothing Inc. You are the partner at UMNOP Accounting in Kamloops and your client, lasmine Rennes looking at buying a company Jasmine has been in the retail clothing business for many years, so she is familiar with how to run a clothing store. She needs your help in deciding which company to purchase There are currently two companies for sale: Tammy's Tank Tops located in Kamloops and Barbse jeans in Chase, 8C Jasmine would be happy in either location. You have been given the following information Selected Financial Information Tammy's tanktops 2020 2019 2020 2019 Current Assets 221.550 210,000 125.000 Current Liabilities 85,000 70,000 56.965 50.000 Accounts receivable, included in Current Assets 15,000 12.000 53,000 Total Assets 1.250,000 1,350,000 3.650.800 3.695.000 Total Liabilities 350.000 900.000 2.800.000 2.950.000 Common Shares (note below) AM35,000 COGS 425.000 435,000 1.000.000 2.400.000 Total Sales 950.000 975.000 3.000.000 Inventory, included in Current Assets 5.000 6,000 8.000 Operating Expenses 395.000 385,000 125.000 46.90 Income Tax Expense 3.000 3.000 10.000 15.000 3.000 ** 10,000 shares authorized, 7.000 issued ANA 50,000 shares authorised 15,000 issued As the partner of LMNOP accounting you want to analyze the following ratio's to make your decision, as wel doing some horizontal analysis Current Ratio Receivable Turnover Receivable Tumover, in days Inventory Turnover Inventory turnover, in der Profit Margin Gross Proft Margin Working Capital Earnings per Share Debt to Total Asset Inventory amount from 2018 $6,000 Accounts receivable from 2018 was $13,000 required on next page Required: 1 of the 10 ratio's above, select any 5 and tell me a how the ratio is calculated b. what the ratio tells us what the number means) how you would use the ratio to form an opinion on the company 2. Calculate the ratio's above for each company Use 2020 as the year to calculate the natie's a strong answer will calculate at least 4 ratio's -- show your work) 3. Tell Jasmine which company you suggest she should purchase and why. Astrong answer would compare and contrast the ratio's between the two companies as well as look at some horizontalnite forman pinion Answers should incorporate both vertical and horizontal analysis, with the majority being vertical)