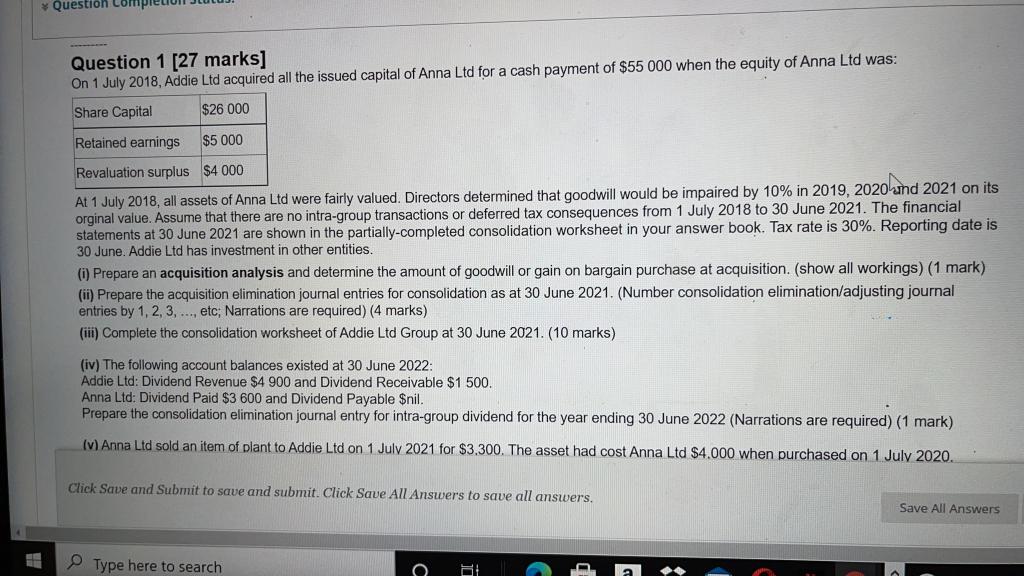

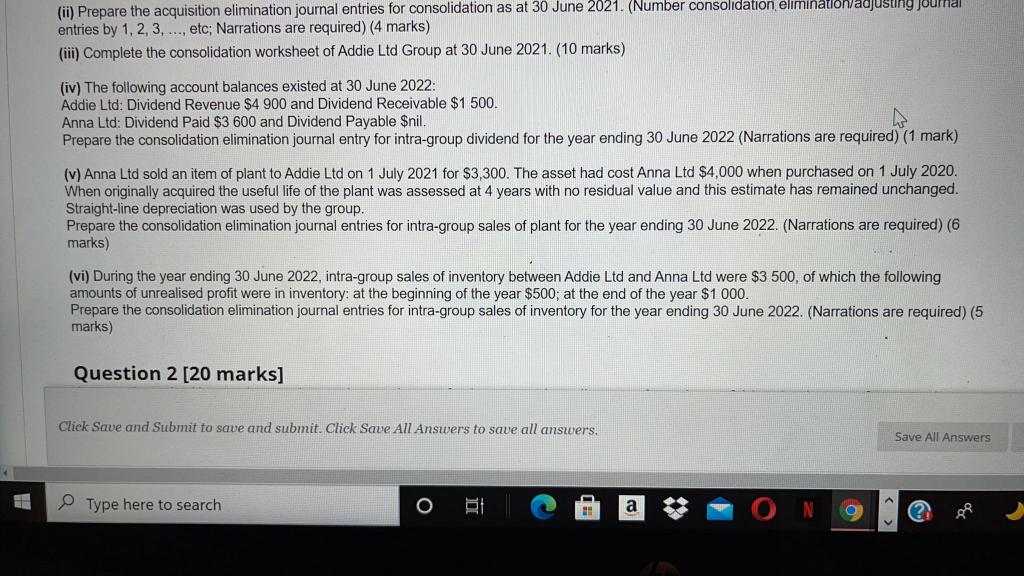

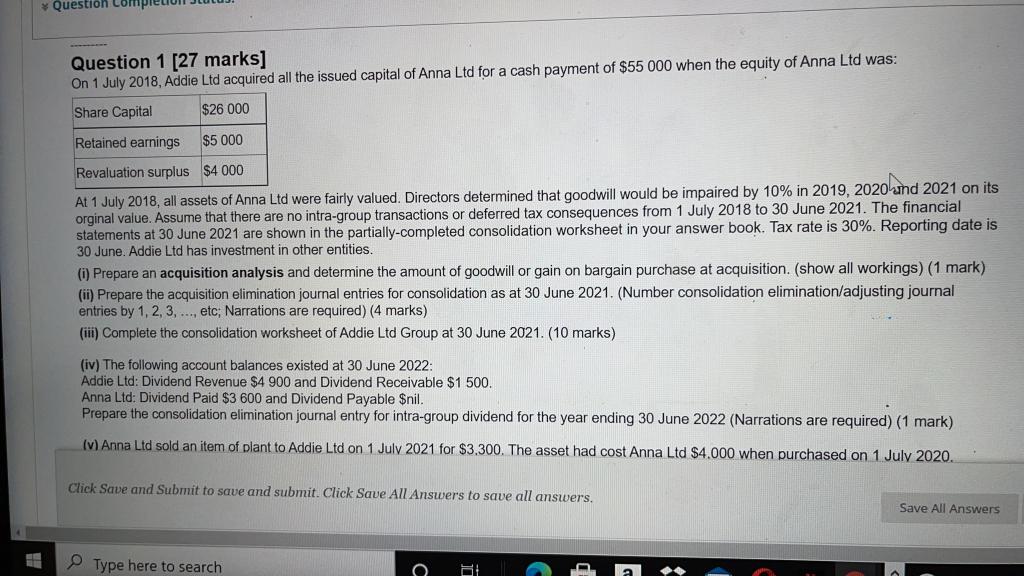

Question Comi Question 1 [27 marks] On 1 July 2018, Addie Ltd acquired all the issued capital of Anna Ltd for a cash payment of $55 000 when the equity of Anna Ltd was: Share Capital $26 000 Retained earnings $5 000 Revaluation surplus $4 000 At 1 July 2018, all assets of Anna Ltd were fairly valued. Directors determined that goodwill would be impaired by 10% in 2019, 2020 hind 2021 on its orginal value. Assume that there are no intra-group transactions or deferred tax consequences from 1 July 2018 to 30 June 2021. The financial statements at 30 June 2021 are shown in the partially-completed consolidation worksheet in your answer book. Tax rate is 30%. Reporting date is 30 June. Addie Ltd has investment in other entities. () Prepare an acquisition analysis and determine the amount of goodwill or gain on bargain purchase at acquisition. (show all workings) (1 mark) (ii) Prepare the acquisition elimination journal entries for consolidation as at 30 June 2021. (Number consolidation elimination/adjusting journal entries by 1,2,3,..., etc; Narrations are required) (4 marks) (ii) Complete the consolidation worksheet of Addie Ltd Group at 30 June 2021. (10 marks) (iv) The following account balances existed at 30 June 2022: Addie Ltd: Dividend Revenue $4 900 and Dividend Receivable $1 500. Anna Ltd: Dividend Paid $3 600 and Dividend Payable $nil. Prepare the consolidation elimination journal entry for intra-group dividend for the year ending 30 June 2022 (Narrations are required) (1 mark) (v) Anna Ltd sold an item of plant to Addie Ltd on 1 July 2021 for $3.300. The asset had cost Anna Ltd $4.000 when purchased on 1 July 2020. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers HE Type here to search i (ii) Prepare the acquisition elimination journal entries for consolidation as at 30 June 2021. (Number consolidation elimination/adjusung Journal entries by 1, 2, 3, ..., etc; Narrations are required) (4 marks) (iii) Complete the consolidation worksheet of Addie Ltd Group at 30 June 2021. (10 marks) (iv) The following account balances existed at 30 June 2022: Addie Ltd: Dividend Revenue $4 900 and Dividend Receivable $1 500. Anna Ltd: Dividend Paid $3 600 and Dividend Payable $nil. Prepare the consolidation elimination journal entry for intra-group dividend for the year ending 30 June 2022 (Narrations are required) (1 mark) (v) Anna Ltd sold an item of plant to Addie Ltd on 1 July 2021 for $3,300. The asset had cost Anna Ltd $4,000 when purchased on 1 July 2020. When originally acquired the useful life of the plant was assessed at 4 years with no residual value and this estimate has remained unchanged. Straight-line depreciation was used by the group. Prepare the consolidation elimination journal entries for intra-group sales of plant for the year ending 30 June 2022. (Narrations are required) (6 marks) (vi) During the year ending 30 June 2022, intra-group sales of inventory between Addie Ltd and Anna Ltd were $3 500, of which the following amounts of unrealised profit were in inventory: at the beginning of the year $500; at the end of the year $1 000. Prepare the consolidation elimination journal entries for intra-group sales of inventory for the year ending 30 June 2022. (Narrations are required) (5 marks) Question 2 [20 marks] Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Type here to search o BE a C? 8 Question Comi Question 1 [27 marks] On 1 July 2018, Addie Ltd acquired all the issued capital of Anna Ltd for a cash payment of $55 000 when the equity of Anna Ltd was: Share Capital $26 000 Retained earnings $5 000 Revaluation surplus $4 000 At 1 July 2018, all assets of Anna Ltd were fairly valued. Directors determined that goodwill would be impaired by 10% in 2019, 2020 hind 2021 on its orginal value. Assume that there are no intra-group transactions or deferred tax consequences from 1 July 2018 to 30 June 2021. The financial statements at 30 June 2021 are shown in the partially-completed consolidation worksheet in your answer book. Tax rate is 30%. Reporting date is 30 June. Addie Ltd has investment in other entities. () Prepare an acquisition analysis and determine the amount of goodwill or gain on bargain purchase at acquisition. (show all workings) (1 mark) (ii) Prepare the acquisition elimination journal entries for consolidation as at 30 June 2021. (Number consolidation elimination/adjusting journal entries by 1,2,3,..., etc; Narrations are required) (4 marks) (ii) Complete the consolidation worksheet of Addie Ltd Group at 30 June 2021. (10 marks) (iv) The following account balances existed at 30 June 2022: Addie Ltd: Dividend Revenue $4 900 and Dividend Receivable $1 500. Anna Ltd: Dividend Paid $3 600 and Dividend Payable $nil. Prepare the consolidation elimination journal entry for intra-group dividend for the year ending 30 June 2022 (Narrations are required) (1 mark) (v) Anna Ltd sold an item of plant to Addie Ltd on 1 July 2021 for $3.300. The asset had cost Anna Ltd $4.000 when purchased on 1 July 2020. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers HE Type here to search i (ii) Prepare the acquisition elimination journal entries for consolidation as at 30 June 2021. (Number consolidation elimination/adjusung Journal entries by 1, 2, 3, ..., etc; Narrations are required) (4 marks) (iii) Complete the consolidation worksheet of Addie Ltd Group at 30 June 2021. (10 marks) (iv) The following account balances existed at 30 June 2022: Addie Ltd: Dividend Revenue $4 900 and Dividend Receivable $1 500. Anna Ltd: Dividend Paid $3 600 and Dividend Payable $nil. Prepare the consolidation elimination journal entry for intra-group dividend for the year ending 30 June 2022 (Narrations are required) (1 mark) (v) Anna Ltd sold an item of plant to Addie Ltd on 1 July 2021 for $3,300. The asset had cost Anna Ltd $4,000 when purchased on 1 July 2020. When originally acquired the useful life of the plant was assessed at 4 years with no residual value and this estimate has remained unchanged. Straight-line depreciation was used by the group. Prepare the consolidation elimination journal entries for intra-group sales of plant for the year ending 30 June 2022. (Narrations are required) (6 marks) (vi) During the year ending 30 June 2022, intra-group sales of inventory between Addie Ltd and Anna Ltd were $3 500, of which the following amounts of unrealised profit were in inventory: at the beginning of the year $500; at the end of the year $1 000. Prepare the consolidation elimination journal entries for intra-group sales of inventory for the year ending 30 June 2022. (Narrations are required) (5 marks) Question 2 [20 marks] Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Type here to search o BE a C? 8