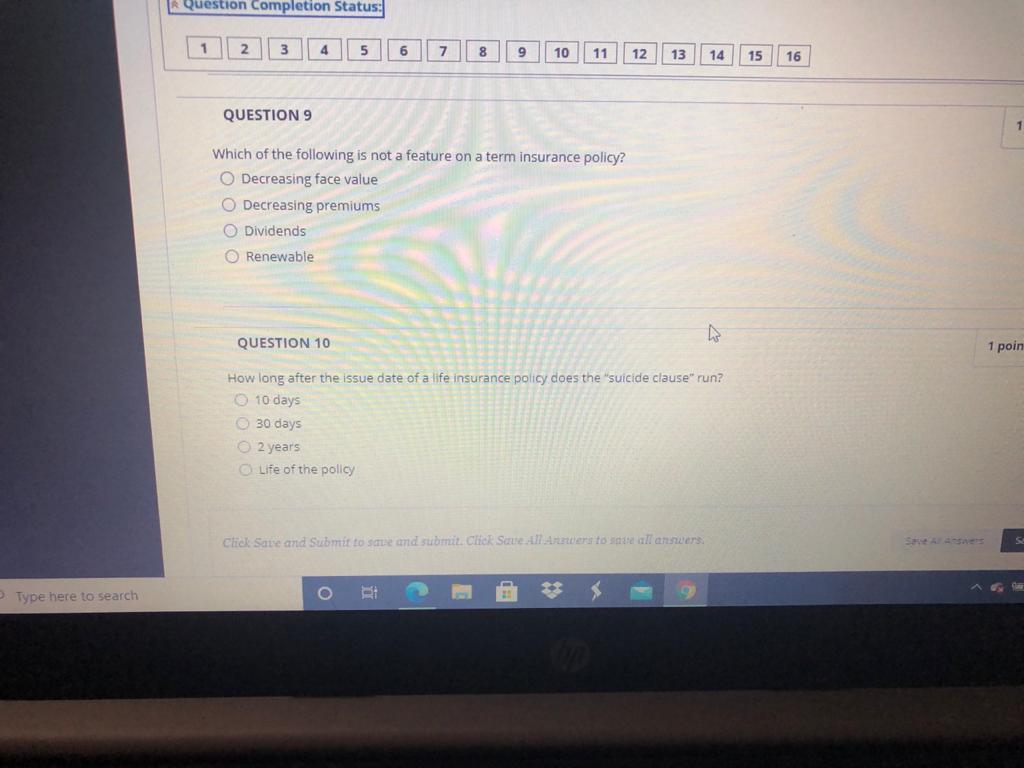

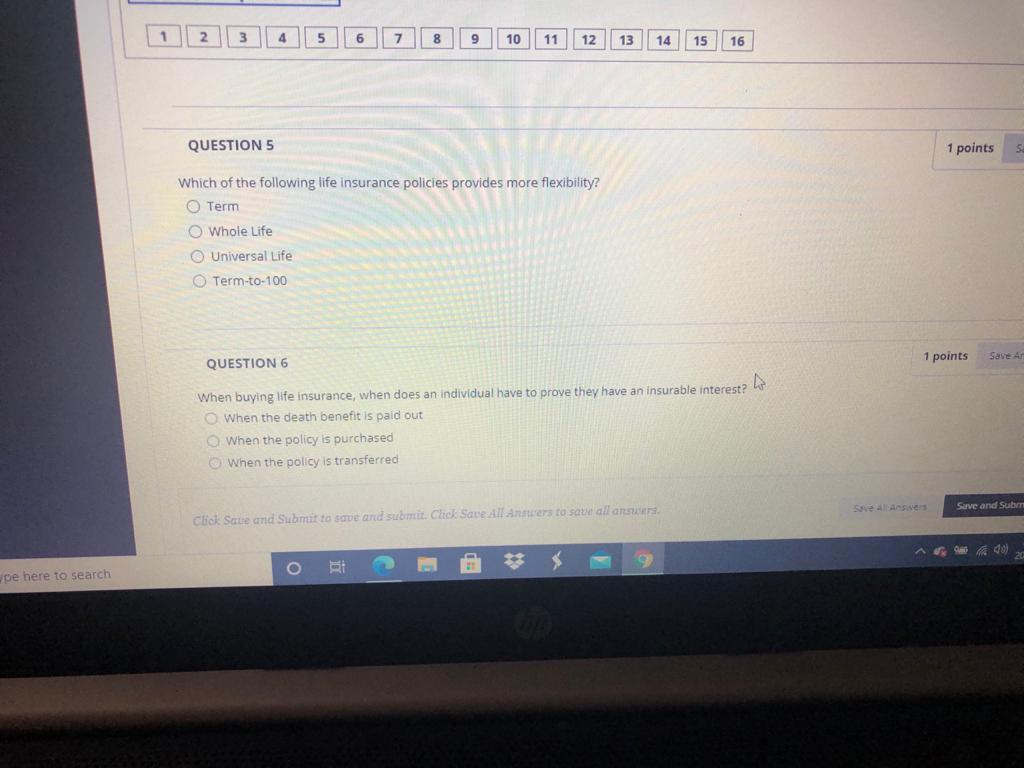

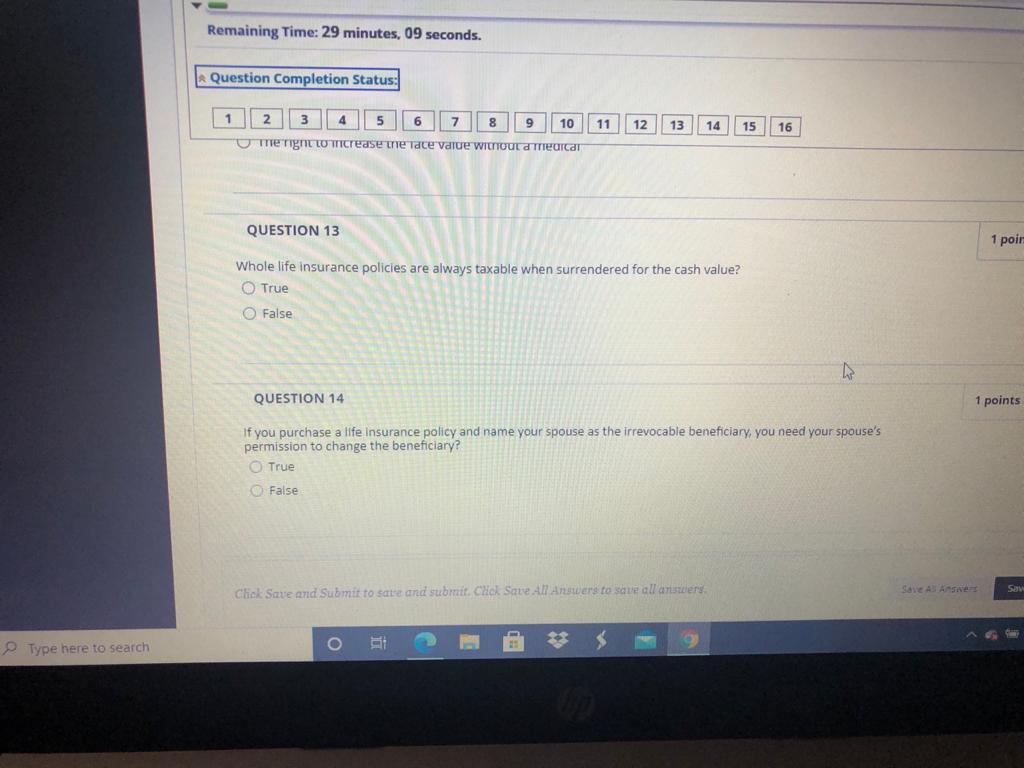

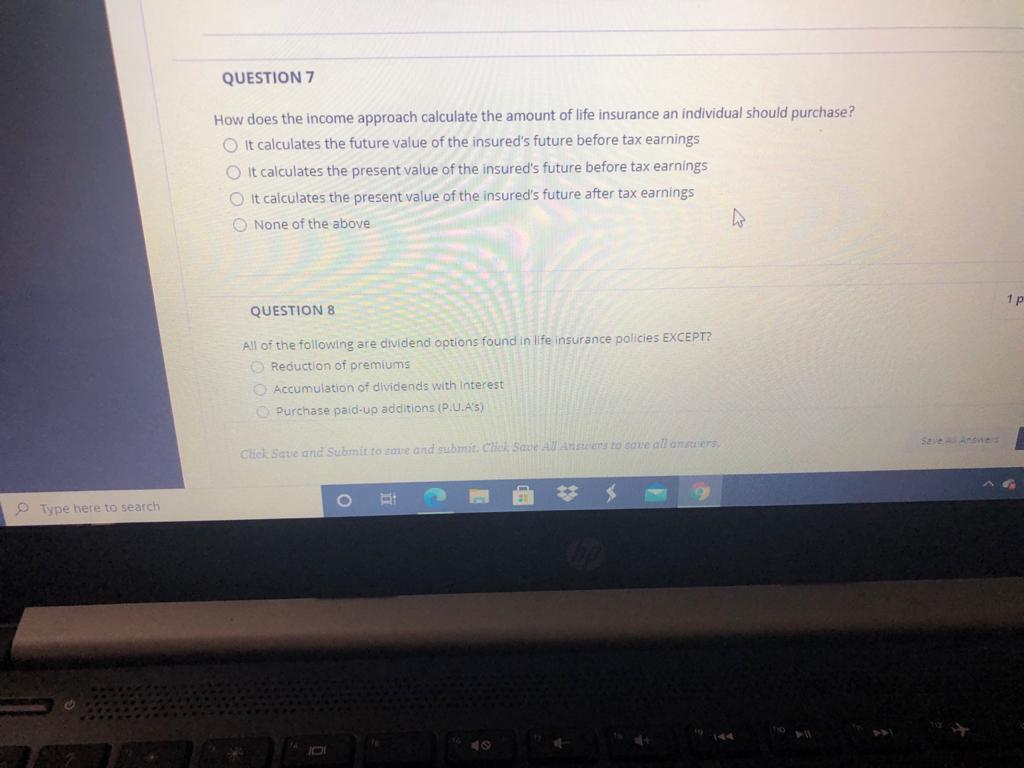

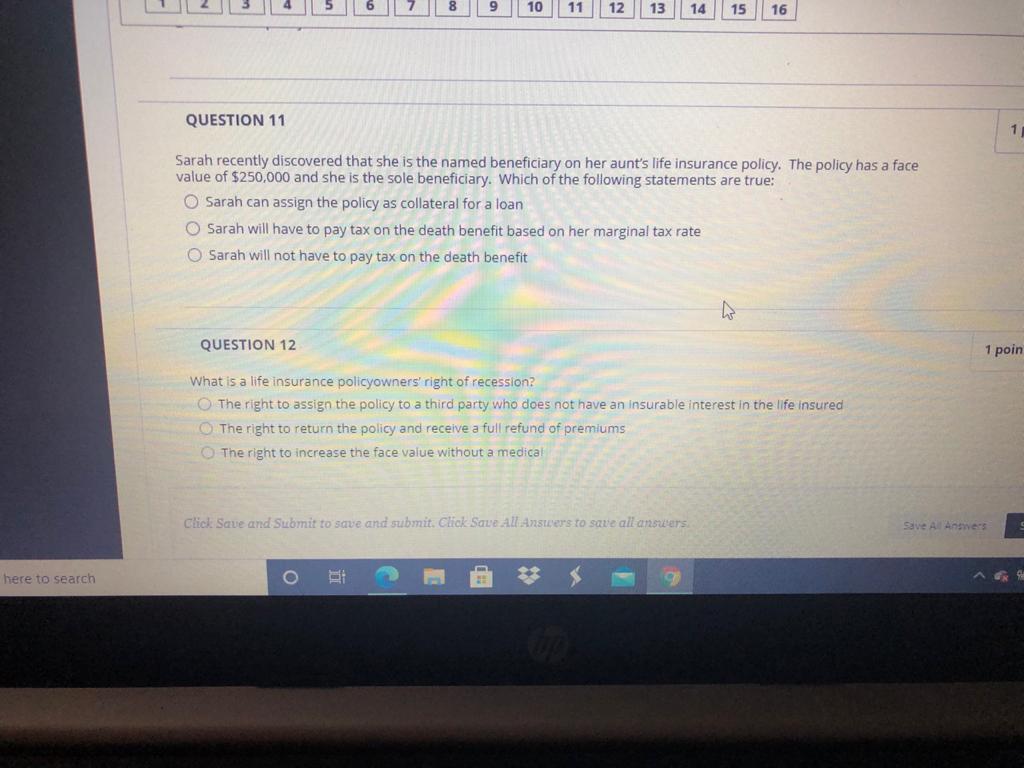

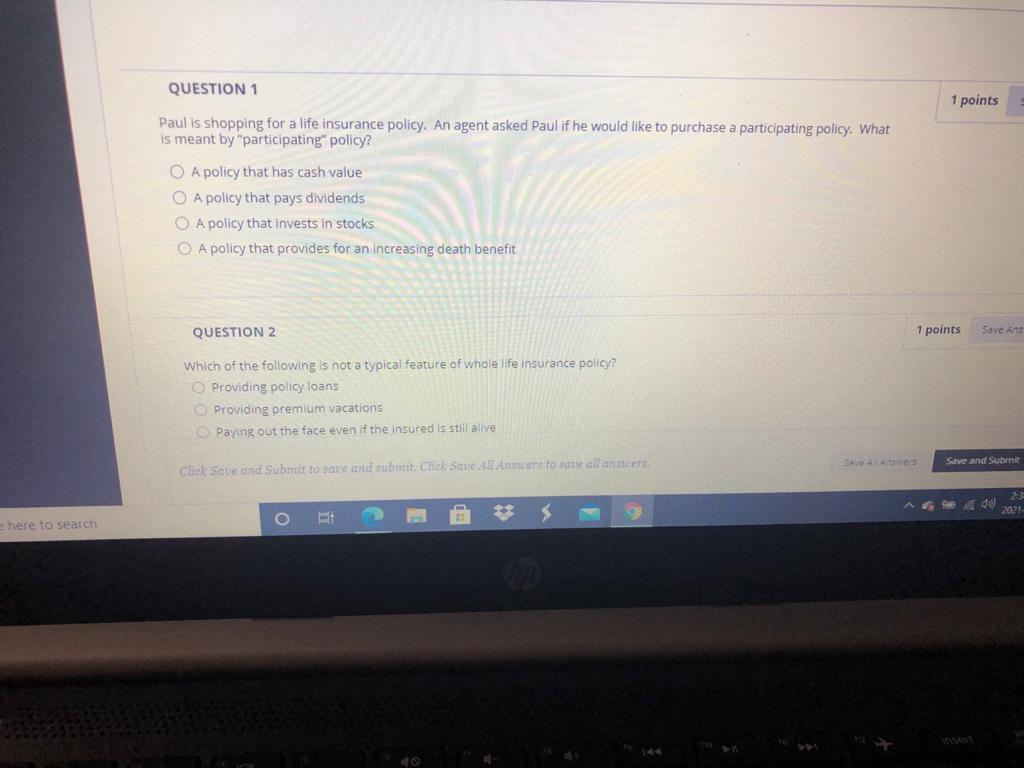

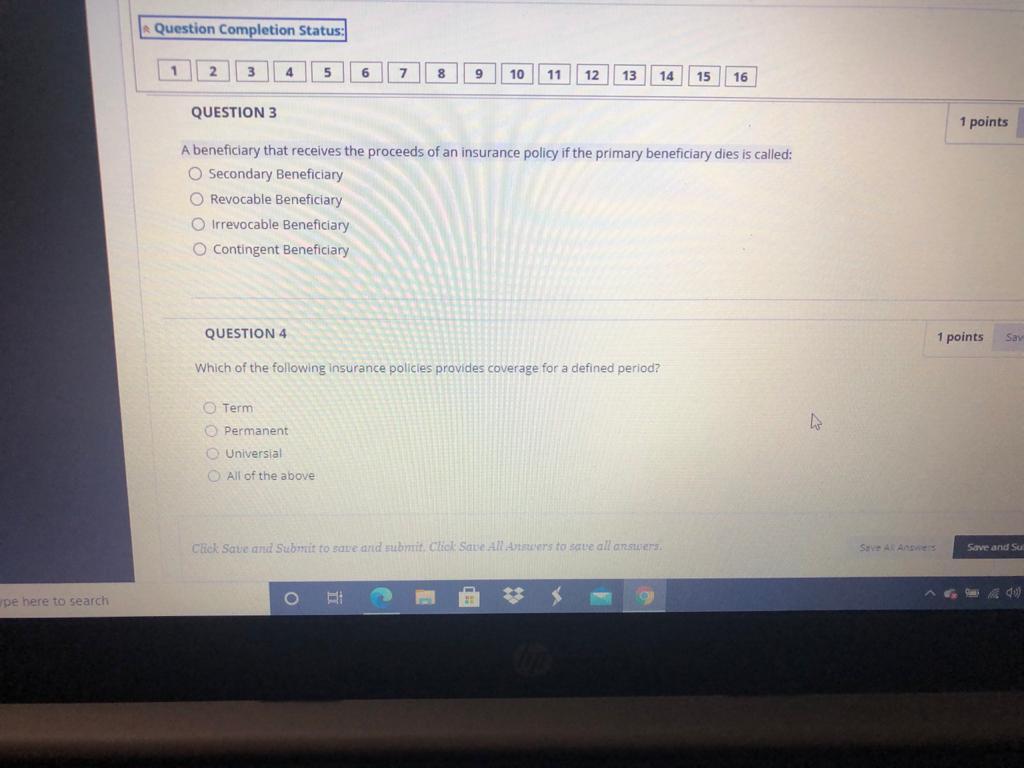

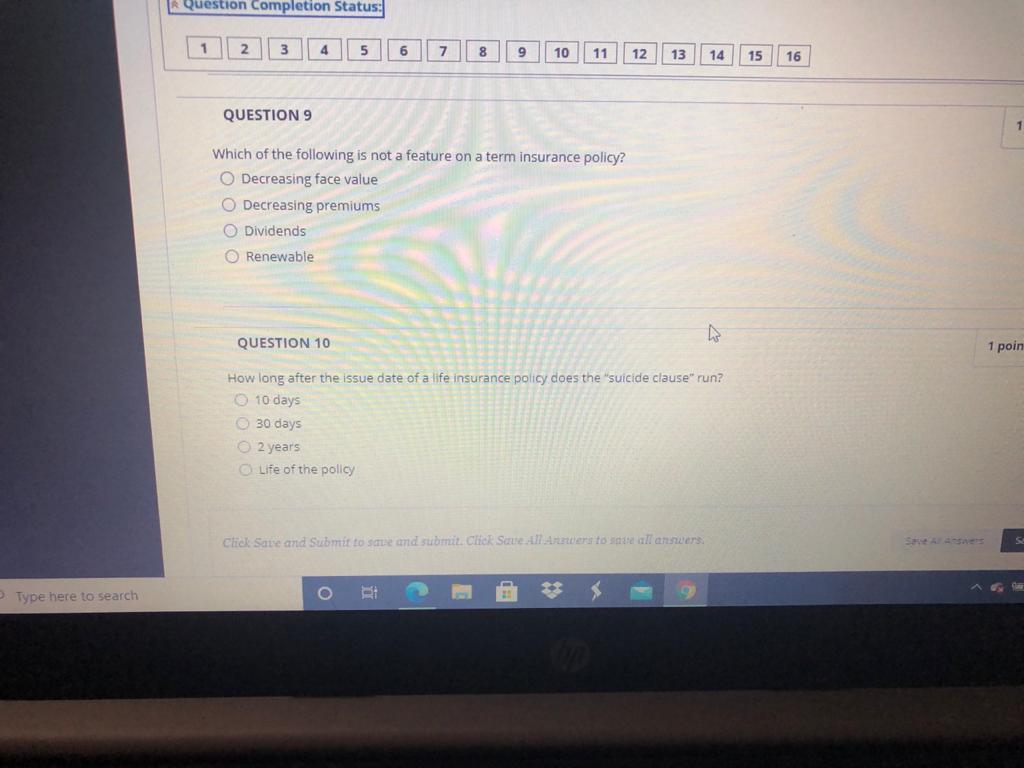

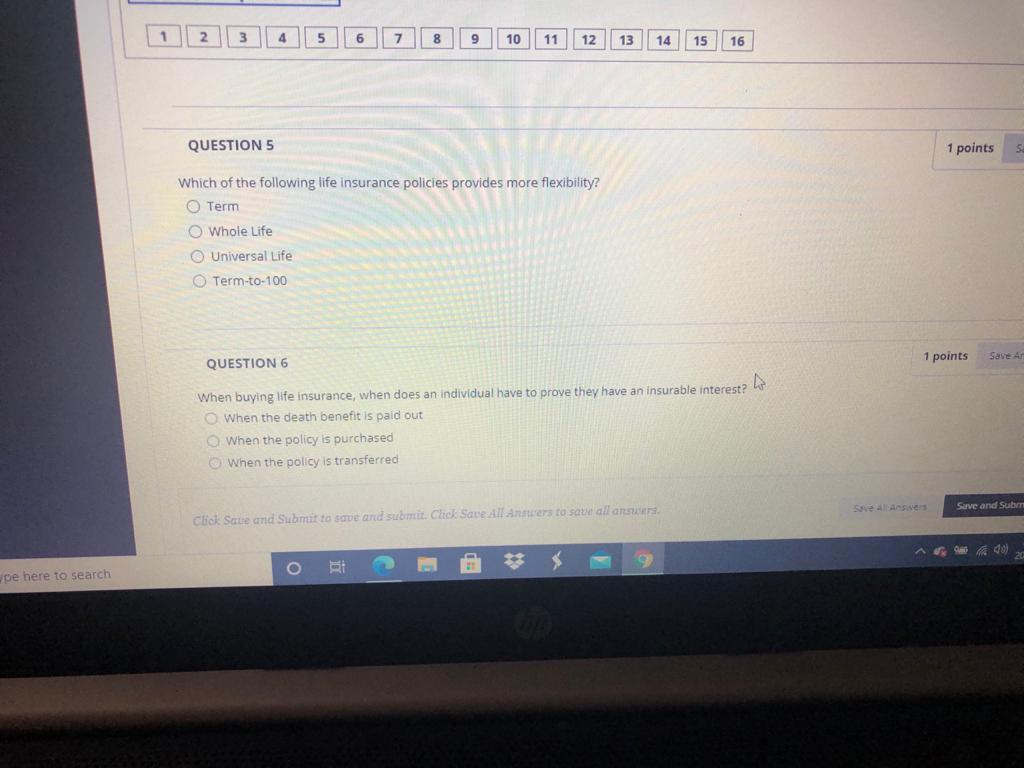

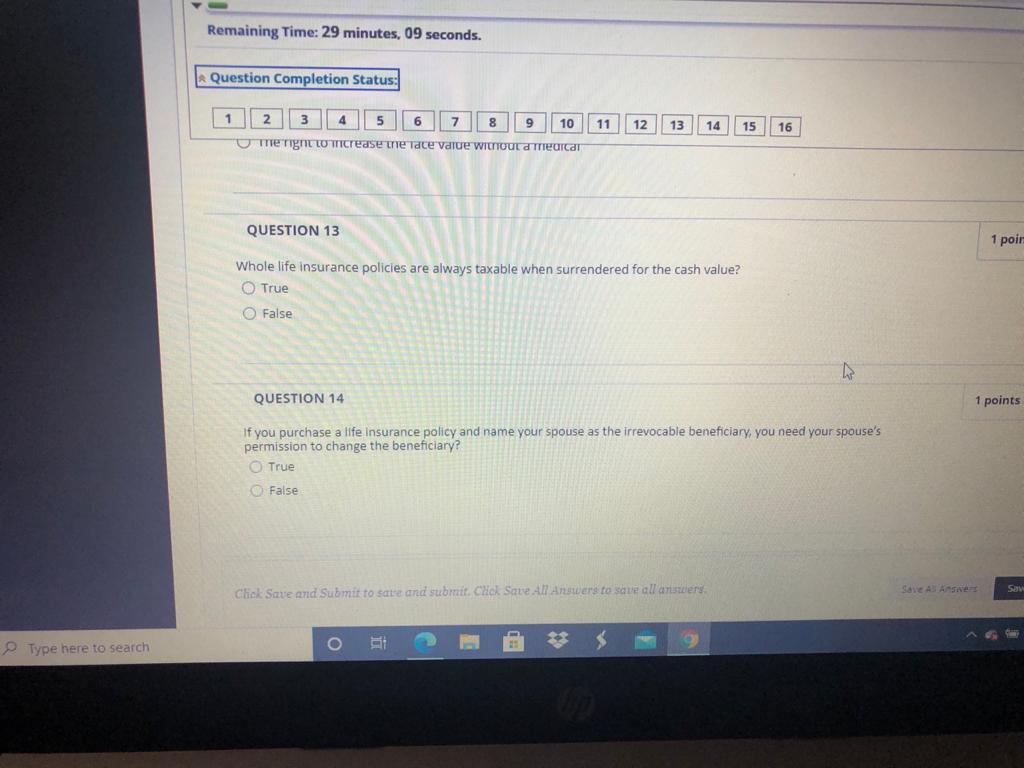

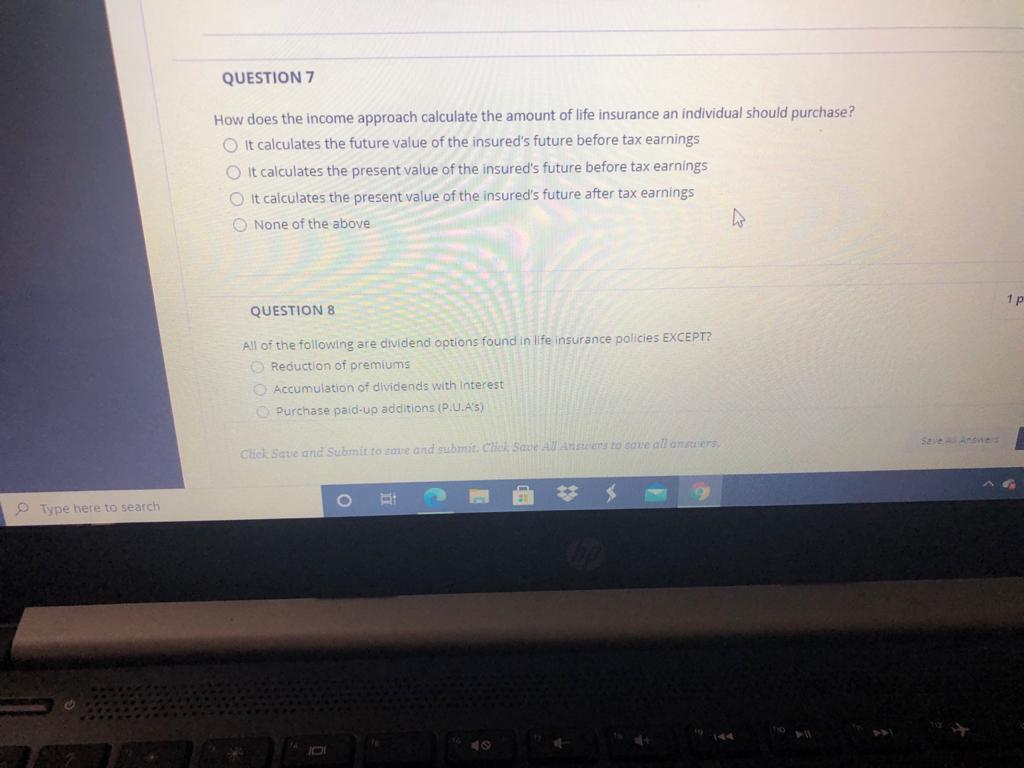

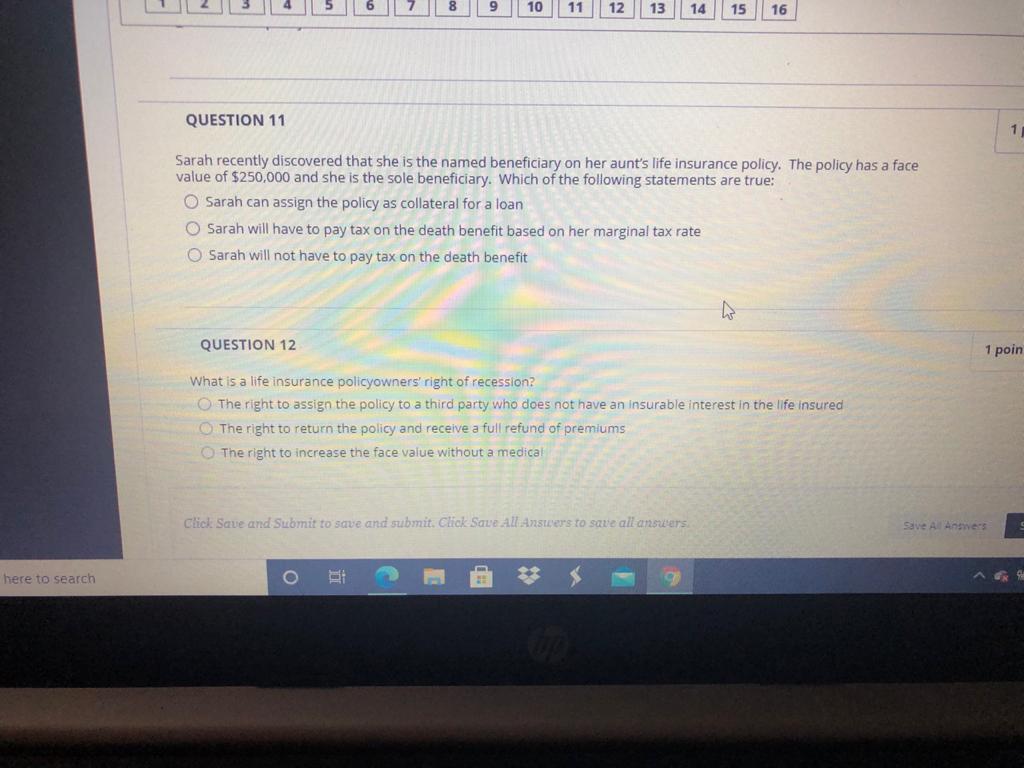

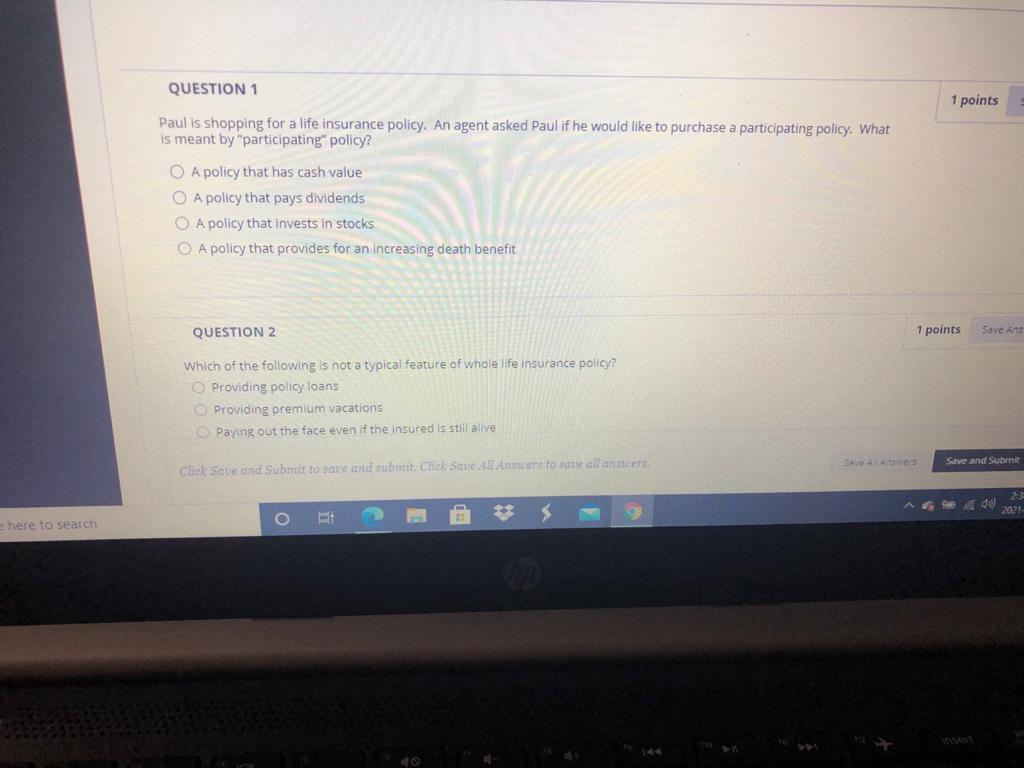

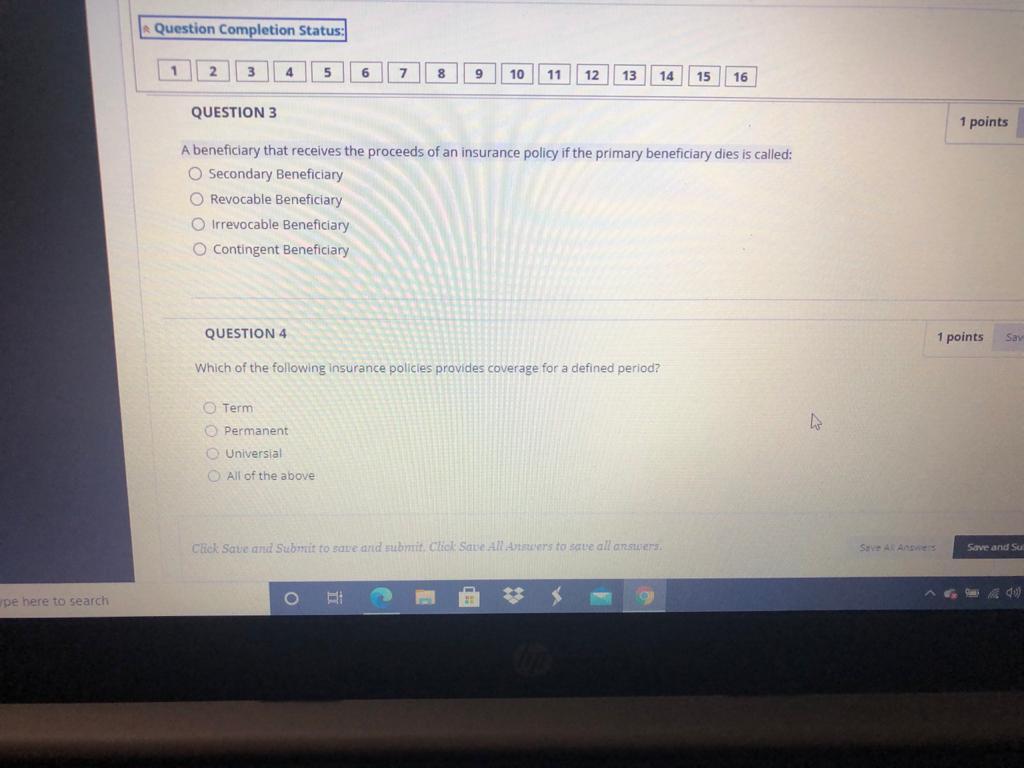

Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 QUESTION 9 1 Which of the following is not a feature on a term insurance policy? O Decreasing face value O Decreasing premiums O Dividends Renewable QUESTION 10 1 poin How long after the issue date of a life insurance policy does the "suicide clause" run? 10 days 30 days 2 years Life of the policy Chick Save and Submit to save and submit. Click Save-Arder to see all answers Type here to search 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 QUESTION 5 1 points Which of the following life insurance policies provides more flexibility? Term O Whole Life Universal Life Term-to-100 QUESTION 6 1 points Save 4 When buying life insurance, when does an individual have to prove they have an insurable interest? When the death benefit is paid out When the policy is purchased When the policy is transferred Save and Subm Click Sate and submit to save and submit Chek Save All Ansters to sare all ans. pe here to search Remaining Time: 29 minutes, 09 seconds. Question Completion Status: 11 12 13 14 15 16 1 2 3 4 5 6 7 8 9 10 Umre Tight to crease the race value without Tearcat QUESTION 13 1 poir Whole life insurance policies are always taxable when surrendered for the cash value? True False QUESTION 14 1 points If you purchase a life insurance policy and name your spouse as the irrevocable beneficiary, you need your spouse's permission to change the beneficiary? True False Save AS AN Sav Click Save and Submit to sate and submit Chok Save All Answers to save all answers Type here to search Eli QUESTION 7 How does the income approach calculate the amount of life insurance an individual should purchase? O It calculates the future value of the insured's future before tax earnings O It calculates the present value of the insured's future before tax earnings O It calculates the present value of the insured's future after tax earnings None of the above 1 p QUESTION 8 All of the following are dividend options found in life insurance policies EXCEPT? Reduction of premiums Accumulation of dividends with interest Purchase paid-up additions (P.U.A's) Chek Save and submitto care and submit Chul Saue Alto cane all ansers $ Type here to search 10 11 12 13 14 15 16 QUESTION 11 1 Sarah recently discovered that she is the named beneficiary on her aunt's life insurance policy. The policy has a face value of $250,000 and she is the sole beneficiary. Which of the following statements are true: O Sarah can assign the policy as collateral for a loan Sarah will have to pay tax on the death benefit based on her marginal tax rate O Sarah will not have to pay tax on the death benefit QUESTION 12 1 poin What is a life insurance policyowners' right of recession? The right to assign the policy to a third party who does not have an insurable interest in the life insured The right to return the policy and receive a full refund of premiums The right to increase the face value without a medical Click Save and Submit to save and submit. Click Save Al Answers to save all ansuers. Save A Answers here to search QUESTION 1 1 points Paul is shopping for a life insurance policy. An agent asked Paul if he would like to purchase a participating policy. What is meant by "participating" policy? O A policy that has cash value O A policy that pays dividends O A policy that invests in stocks O A policy that provides for an increasing death benefit QUESTION 2 1 points Save Ans Which of the following is not a typical feature of whole life insurance policy? Providing policy loans Providing premium vacations Paying out the face even if the insured is still alive Save and Sub Click Save and submit to save and submit Click Save and to save all annars 00 2011 e here to search Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 QUESTION 3 1 points A beneficiary that receives the proceeds of an insurance policy if the primary beneficiary dies is called: O Secondary Beneficiary O Revocable Beneficiary Otrrevocable Beneficiary O Contingent Beneficiary QUESTION 4 1 points Sas Which of the following insurance policies provides coverage for a defined period? Term Permanent Universial All of the above Chek Save and Submit to save and submit Chet Save All Amers to save all answers SHAAs Save and su pe here to search