Answered step by step

Verified Expert Solution

Question

1 Approved Answer

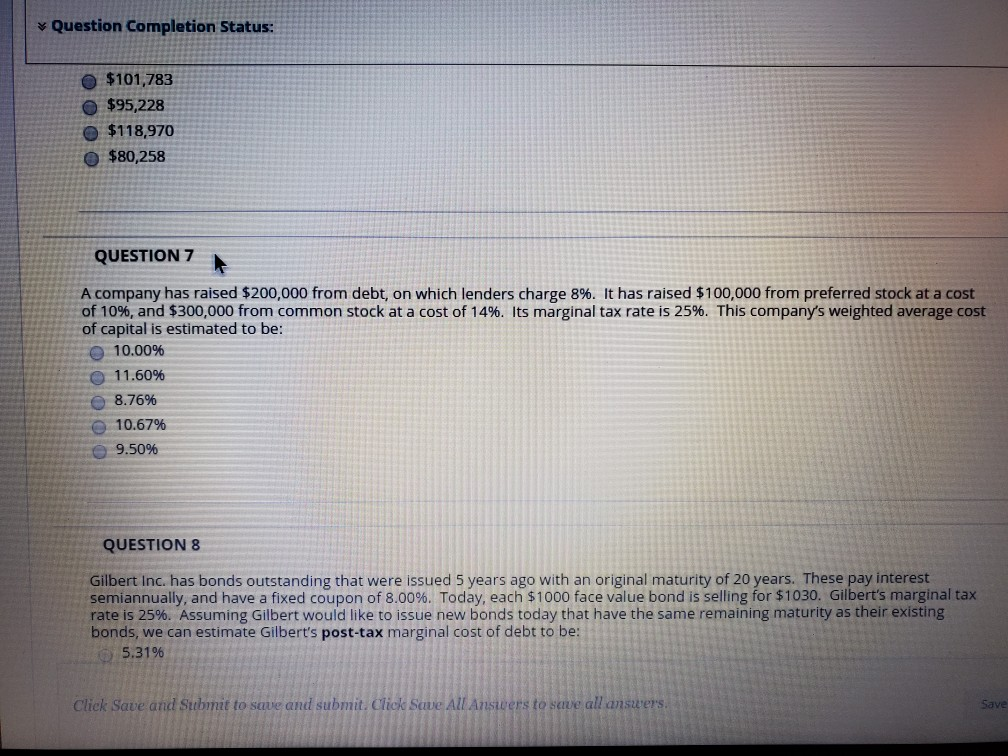

Question Completion Status: $101,783 $95,228 $118,970 $80,258 QUESTION 7 A company has raised $200,000 from debt, on which lenders charge 8%. It has raised $100,000

Question Completion Status: $101,783 $95,228 $118,970 $80,258 QUESTION 7 A company has raised $200,000 from debt, on which lenders charge 8%. It has raised $100,000 from preferred stock at a cost of 10%, and $300,000 from common stock at a cost of 14%. Its marginal tax rate is 25%. This company's weighted average cost of capital is estimated to be: 10.00% 11.60% 8.76% 10.67% 9.50% QUESTIONS Gilbert Inc. has bonds outstanding that were issued 5 years ago with an original maturity of 20 years. These pay interest semiannually, and have a fixed coupon of 8.00%. Today, each $1000 face value bond is selling for $1030. Gilbert's marginal tax rate is 25%. Assuming Gilbert would like to issue new bonds today that have the same remaining maturity as their existing bonds, we can estimate Gilbert's post-tax marginal cost of debt to be: 5.31% Click Save and Submit to save and submit. Click Save All Answers to save all answers Save

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started