Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* Question Completion Status: 16 27 31 105 116 12 13 14 151 16 175 18 19 206 C. TUNC UT UTC ODove is WTCTTITU.V

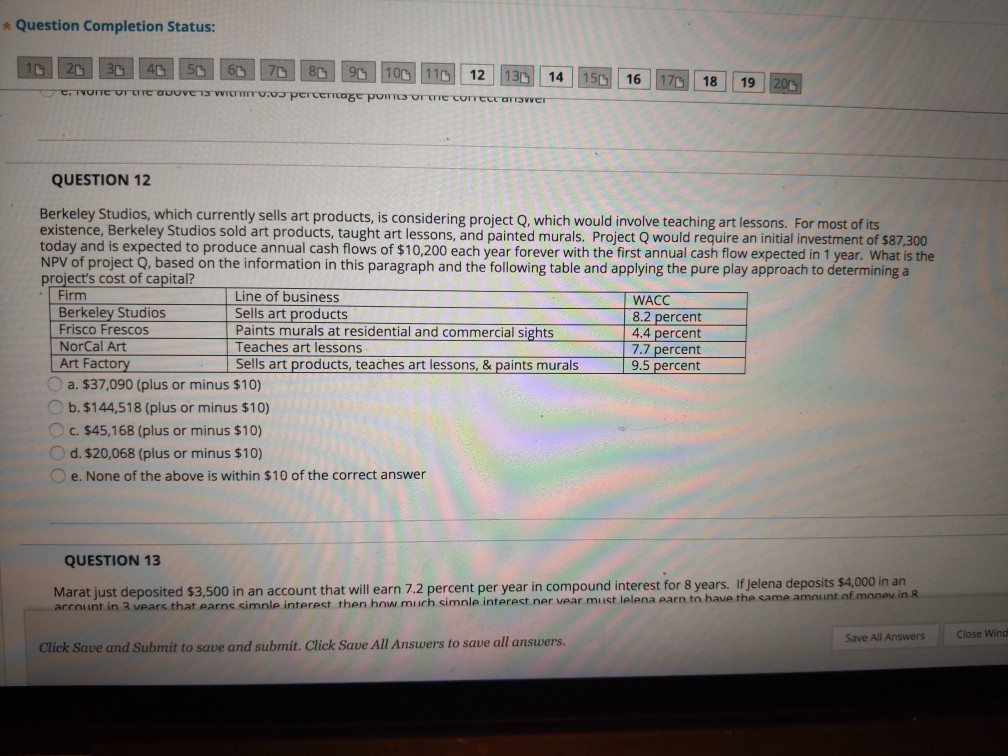

* Question Completion Status: 16 27 31 105 116 12 13 14 151 16 175 18 19 206 C. TUNC UT UTC ODove is WTCTTITU.V pertrag pom UITE CUITECT OFTSVET QUESTION 12 Berkeley Studios, which currently sells art products, is considering project Q, which would involve teaching art lessons. For most of its existence, Berkeley Studios sold art products, taught art lessons, and painted murals. Project Q would require an initial investment of $87,300 today and is expected to produce annual cash flows of $10,200 each year forever with the first annual cash flow expected in 1 year. What is the NPV of project Q, based on the information in this paragraph and the following table and applying the pure play approach to determining a project's cost of capital? Firm Line of business WACC Berkeley Studios Sells art products 8.2 percent Frisco Frescos Paints murals at residential and commercial sights 4.4 percent NorCal Art Teaches art lessons 7.7 percent Art Factory Sells art products, teaches art lessons, & paints murals 9.5 percent a. $37,090 (plus or minus $10) b. $144,518 (plus or minus $10) c. $45,168 (plus or minus $10) O d. $20,068 (plus or minus $10) e. None of the above is within $10 of the correct answer QUESTION 13 Marat just deposited $3,500 in an account that will earn 7.2 percent per year in compound interest for 8 years. If Jelena deposits $4,000 in an account in 2 vears that earns simple interest then how much simple interest ner vear must lelena earn to have the same amount of money in 8 Save All Answers Close Wind Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started