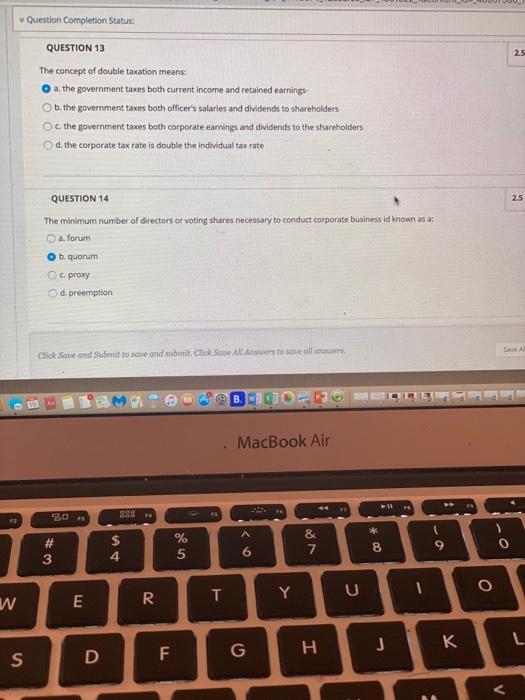

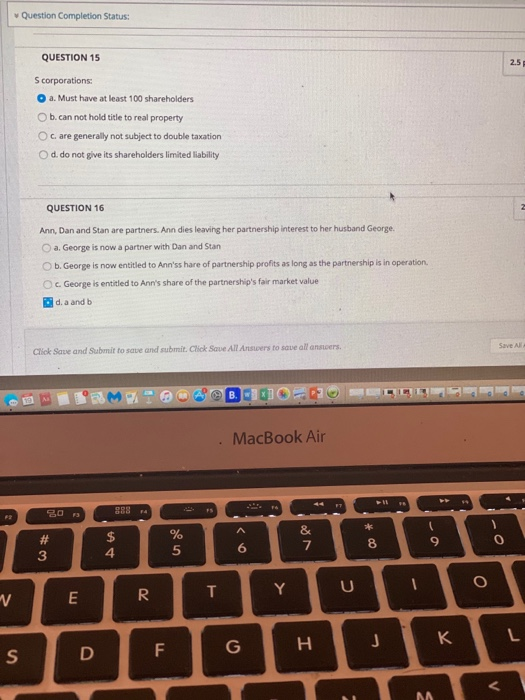

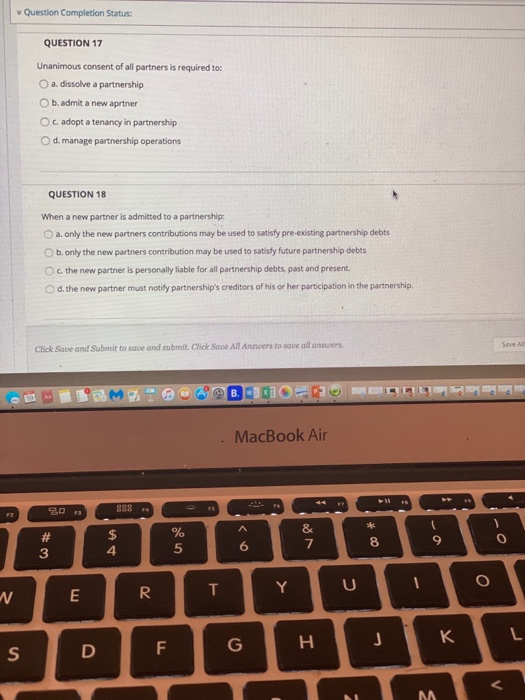

Question Completion Status: 25 QUESTION 13 The concept of double taxation means: a. the government taxes both current income and retained earnings b. the government taxes both officer's salaries and dividends to shareholders Oc the government taxes both corporate earnings and dividends to the shareholders d. the corporate tax rate is double the individual tax rate QUESTION 14 25 The minimum number of directors or voting shares necessary to conduct corporate business id known as a: a. forum b. quorum O proxy d. preemption Save Click Save and Submit to save and submit Chek Save All Answers to save all answers 09 B. MacBook Air 30 SK FS A $ 4 # 3 % 5 & 7 9 8 0 6 O T U Y R w E L. J H G S D F Question Completion Status: QUESTION 15 2.5 Scorporations: a. Must have at least 100 shareholders Ob.can not hold title to real property Oc are generally not subject to double taxation O d. do not give its shareholders limited liability QUESTION 16 Ann, Dan and Stan are partners. Ann dies leaving her partnership interest to her husband George. a. George is now a partner with Dan and Stan b. George is now entitled to Ann'ss hare of partnership profits as long as the partnership is in operation O c George is entitled to Ann's share of the partnership's fair market value d. a and be Save A Click Save and Submit to save and submit. Click Save All Answers to save all anstors . MacBook Air # 3 $ 4 % 5 & 7 8 9 Y U O E R T J H L F S D M. MA Question Completion Status: QUESTION 17 Unanimous consent of all partners is required to a. dissolve a partnership O b. admit a new aprtner O c adopt a tenancy in partnership O d. manage partnership operations QUESTION 18 When a new partner is admitted to a partnership: a. only the new partners contributions may be used to satisfy pre-existing partnership debts b. only the new partners contribution may be used to satisfy future partnership debts O c. the new partner is personally liable for all partnership debts, past and present, d. the new partner must notify partnership's creditors of his or her participation in the partnership, Save All Click Save and Submit to save and submit. Click Save All Answers to save all answers. B. MacBook Air 20 888 * # 3 $ 4 % 5 & 7 8 9 0 6 O Y R U T w E J L G H S D F MA M