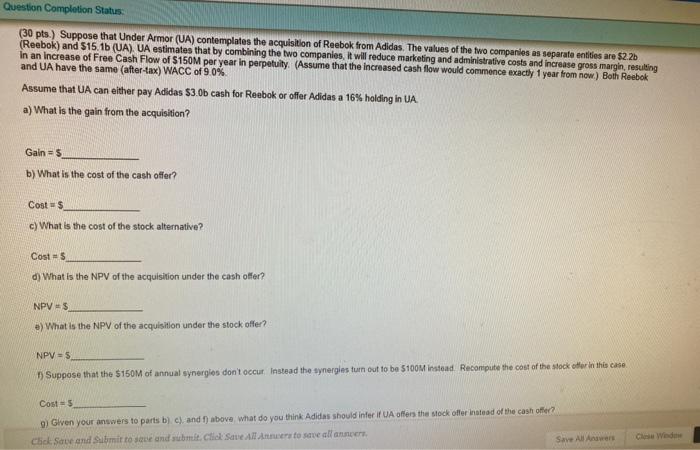

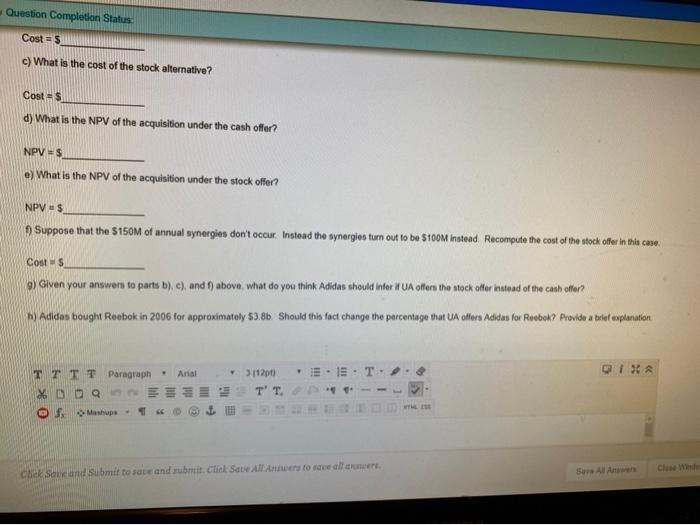

Question Completion Status (30 pts.) Suppose that Under Armor (UA) contemplates the acquisition of Reebok from Adidas. The values of the two companies as separate entities are $2.2b (Reebok) and 515. 1b (UA). UA estimates that by combining the two companies, twil reduce marketing and administrative costs and increase gross margin, resulting In an increase of Free Cash Flow of S150M per year in perpetuilty Assume that the increased cash flow would commence exactly 1 year from now) Both Reebok and UA have the same (after-tax) WACC of 90% Assume that UA can either pay Adidas $3.0b cash for Reebok or offer Adidas a 16% holding in UA a) What is the gain from the acquisition? Gain = 5 b) What is the cost of the cash offer? Costs c) What is the cost of the stock alternative? Costs d) What is the NPV of the acquisition under the cash offer? NPV 5 e) What is the NPV of the acquisition under the stock offer? NPV = 5 Suppose that the $150M of annual synergies don't occur Instead the synergies turn out to be $100M instead. Recompute the cost of the stock offer in this case Cost=5 g) Given your answers to parts b) c) and 1) above what do you think Adidas should Inter i UA offers the stock offer instead of the cash offer Chick Save and submit to see and submit.clo Save All Amers to save all annen Save All Anwar Che Wind Question Completion Status Costs c) What is the cost of the stock alternative? Costs d) What is the NPV of the acquisition under the cash offer? NPV = 5 .) What is the NPV of the acquisition under the stock offer? NPV $ Suppose that the $150M of annual synergies don't occur. Instead the synergies turn out to be St00m instead. Recompute the cost of the stock offer in this case. Costs 9) Given your answers to parts b), c), and 1) above, what do you think Adidas should inter UA offers the stock offer instead of the cash offer? Adidas bought Reebok in 2006 for approximately 53.86. Should this fact change the percentage that offers Adidas for Reebok? Provide a betul explanation QIX TTTT Paragraph Arial 31120 XDQE T' T. OS Che Wind Chek Save and submit to save and submit. Click Save Allerto save all are