Answered step by step

Verified Expert Solution

Question

1 Approved Answer

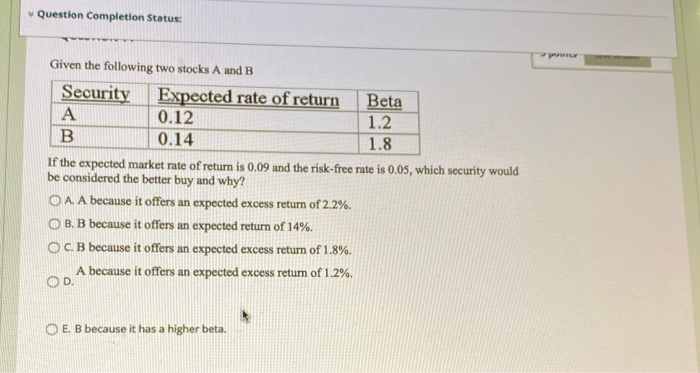

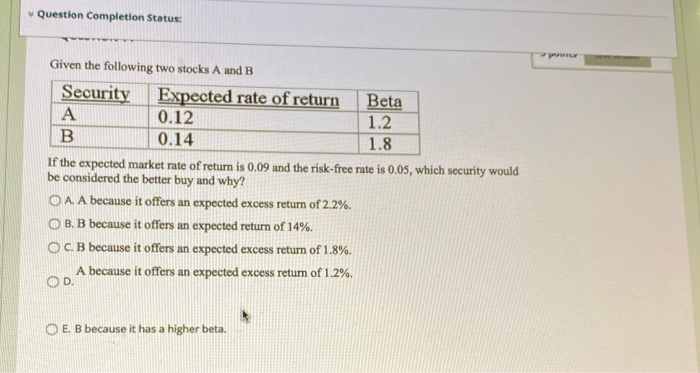

Question Completion Status: Given the following two stocks A and B Security Expected rate of return Beta 0.12 1.2 0.14 1.8 If the expected market

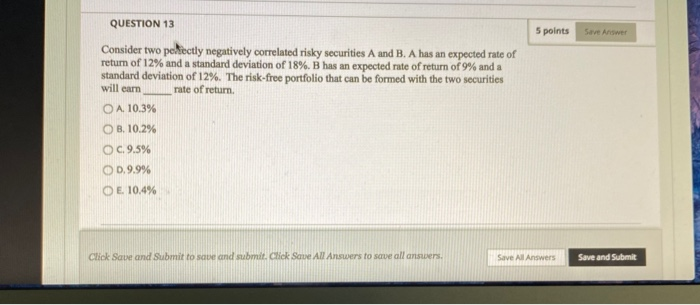

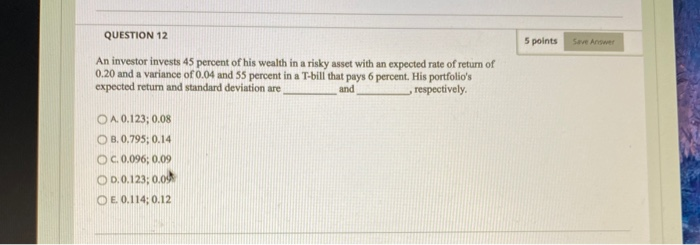

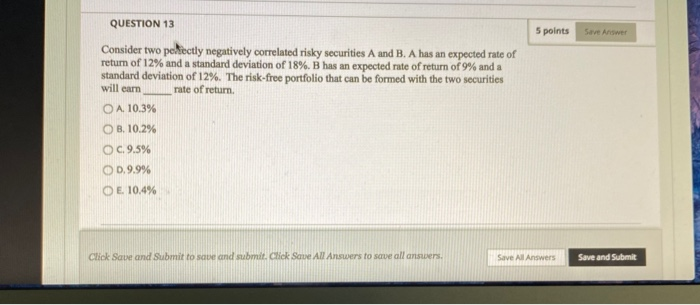

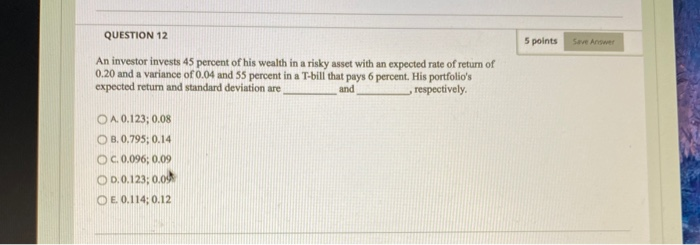

Question Completion Status: Given the following two stocks A and B Security Expected rate of return Beta 0.12 1.2 0.14 1.8 If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why? O A. A because it offers an expected excess return of 2.2%. O B. B because it offers an expected return of 14%. OCB because it offers an expected excess return of 1.8%. A because it offers an expected excess return of 1.2%. O E. B because it has a higher beta. QUESTION 13 5 points Save Answer Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 12% and a standard deviation of 18% Bhas an expected rate of return of 9% and a standard deviation of 12%. The risk-free portfolio that can be formed with the two securities will earn rate of return O A 10.3% OB 10.2% OC. 9.5% O 0.9.9% OE 10.4% Click Save and Submit to save and submit. Click Save All Answers to save all answers Save Al Answers Save and Submit QUESTION 12 5 points An investor invests 45 percent of his wealth in a risky asset with an expected rate of return of 0.20 and a variance of 0.04 and 55 percent in a T-bill that pays 6 percent. His portfolio's expected retum and standard deviation are and respectively. O A 0.123;0.08 OB. 0.795; 0.14 O c.0.096; 0.09 OD. 0.123;0.09 O E 0.114: 0.12

Question Completion Status: Given the following two stocks A and B Security Expected rate of return Beta 0.12 1.2 0.14 1.8 If the expected market rate of return is 0.09 and the risk-free rate is 0.05, which security would be considered the better buy and why? O A. A because it offers an expected excess return of 2.2%. O B. B because it offers an expected return of 14%. OCB because it offers an expected excess return of 1.8%. A because it offers an expected excess return of 1.2%. O E. B because it has a higher beta. QUESTION 13 5 points Save Answer Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 12% and a standard deviation of 18% Bhas an expected rate of return of 9% and a standard deviation of 12%. The risk-free portfolio that can be formed with the two securities will earn rate of return O A 10.3% OB 10.2% OC. 9.5% O 0.9.9% OE 10.4% Click Save and Submit to save and submit. Click Save All Answers to save all answers Save Al Answers Save and Submit QUESTION 12 5 points An investor invests 45 percent of his wealth in a risky asset with an expected rate of return of 0.20 and a variance of 0.04 and 55 percent in a T-bill that pays 6 percent. His portfolio's expected retum and standard deviation are and respectively. O A 0.123;0.08 OB. 0.795; 0.14 O c.0.096; 0.09 OD. 0.123;0.09 O E 0.114: 0.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started